- United States

- /

- Machinery

- /

- NYSE:WAB

Did Wabtec's (WAB) Record Kazakhstan Order Just Redefine Its Global Rail Ambitions?

Reviewed by Sasha Jovanovic

- Wabtec Corporation recently announced a regular quarterly dividend of US$0.25 per share, payable on November 26, 2025, to shareholders of record as of November 12, 2025.

- The company also secured a US$4.2 billion locomotive order from Kazakhstan, marking its largest contract to date and significantly expanding its presence in Central Asia’s rail sector.

- We'll examine how this historic Kazakhstan order could influence Wabtec’s long-term growth narrative and global market positioning.

Find companies with promising cash flow potential yet trading below their fair value.

Westinghouse Air Brake Technologies Investment Narrative Recap

For investors considering Westinghouse Air Brake Technologies (Wabtec), the core belief centers on long-term global rail expansion, digital and sustainable rail solutions, and consistent revenue streams from both developed and emerging markets. The recent US$4.2 billion Kazakhstan locomotive order could reinforce Wabtec’s long-term international growth narrative, yet it does not materially shift near-term risk from softened North American railcar demand, which remains a pressure point for future equipment sales and revenue visibility.

Among the newest announcements, the Kazakhstan contract is the most relevant; it highlights Wabtec’s momentum in expanding into international corridors that can help offset sluggish trends in North American freight markets. While such wins may provide partial relief to backlog concerns, they do not entirely resolve the volatility tied to domestic cyclical demand and order lumpiness.

However, if North American equipment demand stays weak while international opportunities like Kazakhstan prove unpredictable, the risk to future revenue...

Read the full narrative on Westinghouse Air Brake Technologies (it's free!)

Westinghouse Air Brake Technologies is projected to achieve $13.0 billion in revenue and $1.8 billion in earnings by 2028. This outlook is based on a forecast annual revenue growth rate of 7.1% and represents a $0.6 billion increase in earnings from the current level of $1.2 billion.

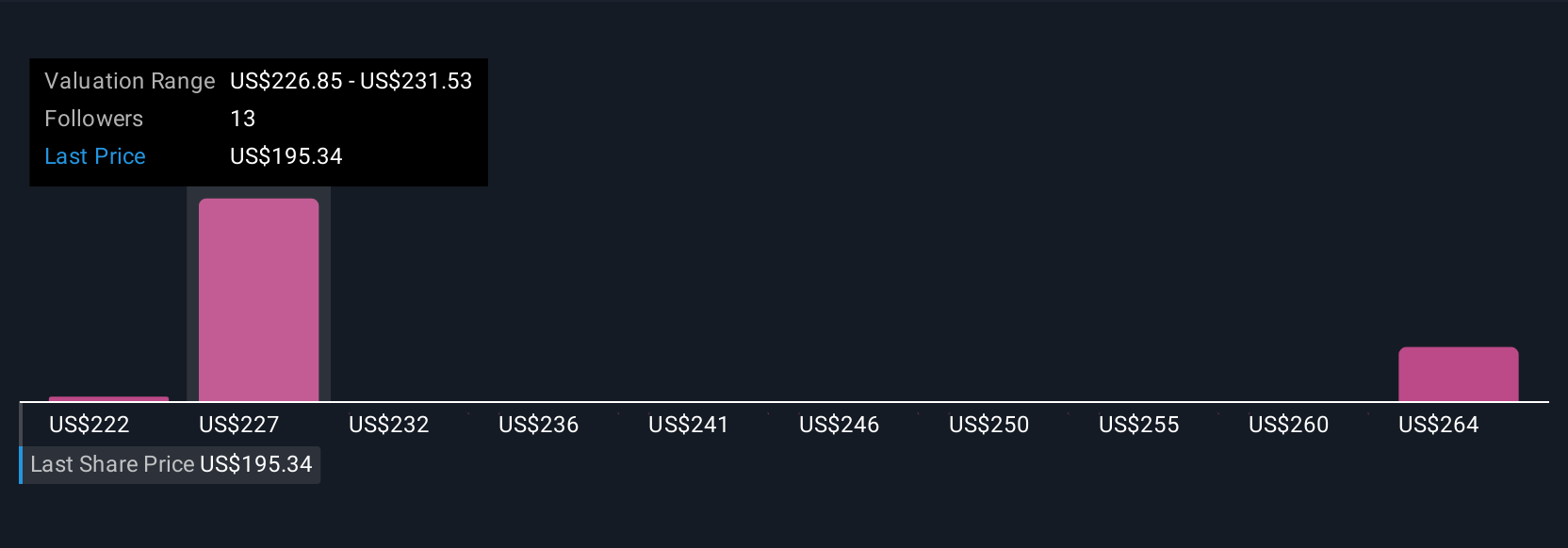

Uncover how Westinghouse Air Brake Technologies' forecasts yield a $226.12 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Three recent fair value estimates from the Simply Wall St Community span US$174.87 to US$226.13 per share. While some users expect international rail growth to counter domestic challenges, views differ widely on how much it will affect Wabtec’s performance.

Explore 3 other fair value estimates on Westinghouse Air Brake Technologies - why the stock might be worth as much as 16% more than the current price!

Build Your Own Westinghouse Air Brake Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westinghouse Air Brake Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Westinghouse Air Brake Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westinghouse Air Brake Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westinghouse Air Brake Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAB

Westinghouse Air Brake Technologies

Provides technology-based locomotives, equipment, systems, and services for the freight rail and passenger transit industries worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives