- United States

- /

- Electrical

- /

- NYSE:VRT

Will Vertiv (VRT) Gain an Edge as Product and Technology Leadership Unite Under One Executive?

Reviewed by Sasha Jovanovic

- Vertiv Holdings Co. recently announced that Chief Technology Officer Stephen Liang will retire after more than thirty years, with Scott Armul assuming an expanded executive role on January 1, 2026 to oversee both product and technology strategy.

- This leadership transition consolidates product innovation and engineering under a single executive, aiming to better align technology development with Vertiv's broader business objectives and evolving customer needs.

- We'll explore how Vertiv's leadership realignment, focused on integrating technology and business strategy, could impact its future growth narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Vertiv Holdings Co Investment Narrative Recap

Vertiv Holdings Co. shareholders are typically aligned with the long-term belief that accelerating demand for AI-driven data centers will create ongoing opportunities for growth, provided Vertiv can maintain technological leadership and execution. The recent CTO transition does not appear to materially affect the most important short-term catalyst, robust data center infrastructure demand, or the key risk of operational and supply chain challenges impacting margins and earnings in the near term.

The August launch of Vertiv™ OneCore, a scalable prefabricated data center solution, is especially relevant as it strengthens Vertiv’s offering amid increasing complexity and scale in high-density deployments, directly supporting the current growth catalysts driven by AI expansion.

Yet, in contrast, investors should also keep in mind the persistent supply chain and execution risks which...

Read the full narrative on Vertiv Holdings Co (it's free!)

Vertiv Holdings Co is projected to reach $13.9 billion in revenue and $2.3 billion in earnings by 2028. This outlook assumes a 15.2% annual revenue growth rate and an increase in earnings of about $1.5 billion from the current $812.3 million.

Uncover how Vertiv Holdings Co's forecasts yield a $159.11 fair value, a 6% downside to its current price.

Exploring Other Perspectives

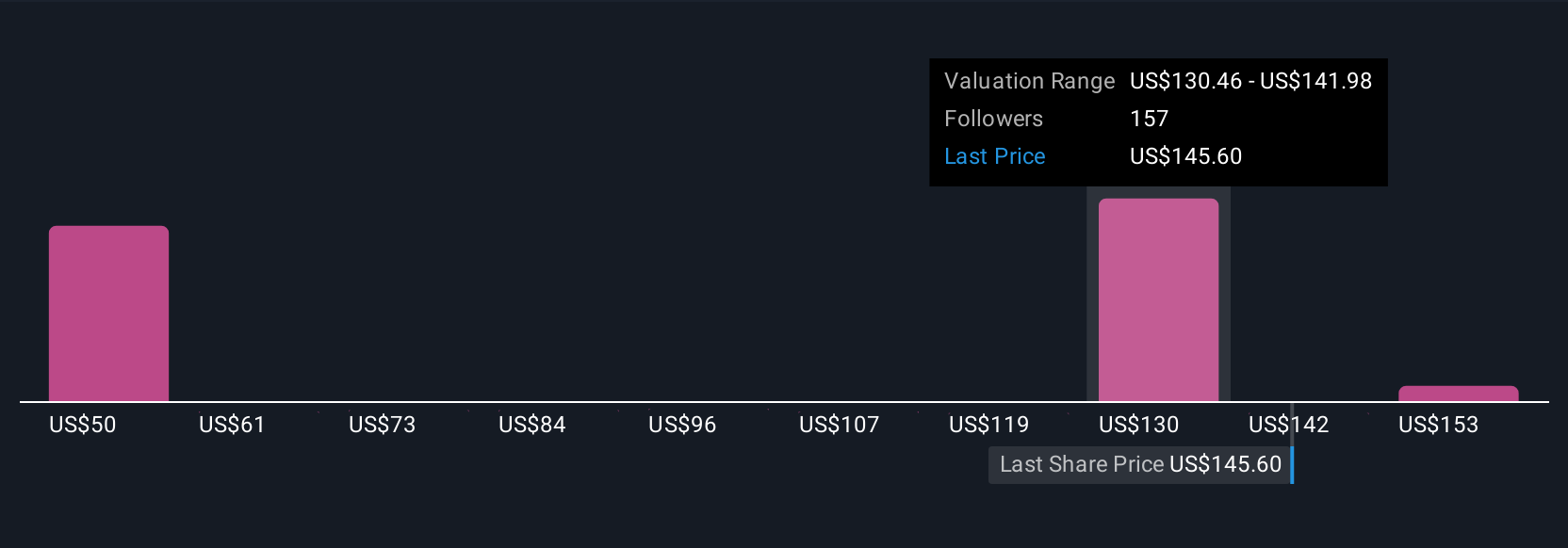

Thirteen members of the Simply Wall St Community estimate Vertiv's fair value between US$100.42 and US$165. As market participants weigh these views, persistent supply chain risks remain a key consideration for Vertiv's future performance.

Explore 13 other fair value estimates on Vertiv Holdings Co - why the stock might be worth as much as $165.00!

Build Your Own Vertiv Holdings Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertiv Holdings Co research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vertiv Holdings Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertiv Holdings Co's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives