- United States

- /

- Electrical

- /

- NYSE:VRT

Vertiv (VRT): Is the Recent Pullback Creating a New Value Opportunity for Investors?

Reviewed by Simply Wall St

Vertiv Holdings Co (NYSE:VRT) is back in the spotlight after its shares logged a month-long slide that might leave some investors wondering what’s going on. In the absence of a clear event or catalyst, the recent dip could be seen as a routine breather for a stock that was setting new highs not long ago. However, any unexpected move in a name like Vertiv, which has captured attention for its data center and critical infrastructure exposure, tends to make investors pause, especially those watching for signals about valuation and future direction.

Stepping back, Vertiv’s recent performance has been anything but boring. While shares slipped 5% in the past week and lagged with a 3% drop over the past month, year-to-date gains remain in positive territory at 6%. Over the past year, Vertiv has surged by 61%, outpacing many peers and displaying little indication of long-term momentum fading. This comes as annual revenue and net income both posted double-digit growth, suggesting ongoing business execution even as the stock cools off in the short term.

The question, then, is whether this pullback is giving investors a real entry point, or if the market has already accounted for the company’s future growth story in its pricing.

Most Popular Narrative: 20.4% Undervalued

According to community narrative, Vertiv Holdings is currently viewed as significantly undervalued based on analysts' projections for future earnings, revenue growth, and profit margins.

Ongoing investments in R&D and engineering, highlighted by collaborations with industry leaders such as CoreWeave, Dell, and Oklo, position Vertiv to deliver next-generation solutions ahead of technology refresh cycles. This creates recurring upgrade opportunities and helps sustain top-line and earnings growth.

Ready to discover what is fueling this bullish outlook? The narrative is grounded in aggressive projections and ambitious financial targets. If you are curious about the full equation behind the double-digit valuation gap, see which assumptions give Vertiv its undervalued status and what could make headlines next month.

Result: Fair Value of $158.34 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent supply chain disruptions or aggressive competition from large cloud customers could quickly cast doubt on Vertiv's bullish case and growth trajectory.

Find out about the key risks to this Vertiv Holdings Co narrative.Another View: Is the DCF Model Telling a Different Story?

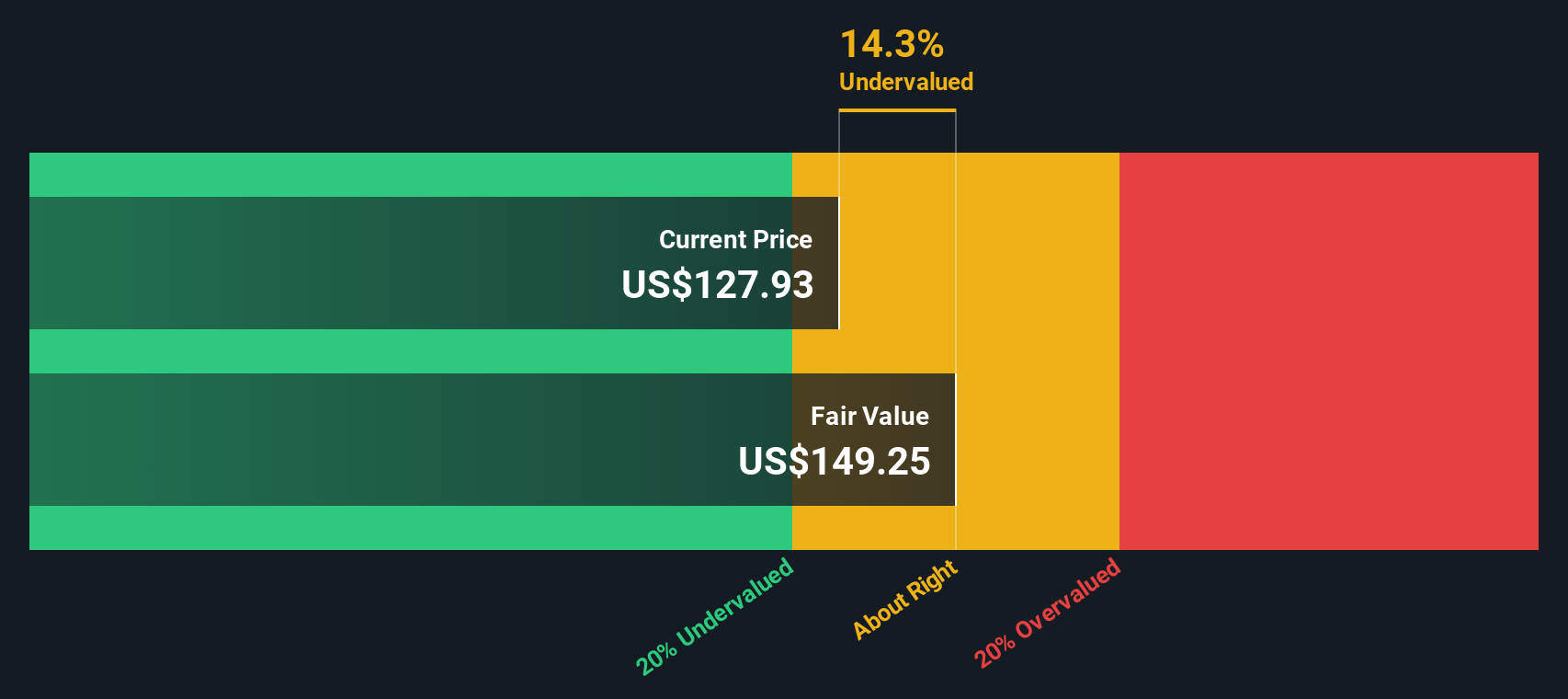

While analyst targets based on future earnings point to Vertiv being undervalued, our DCF model also considers cash flows and supports the idea that shares are trading below what they may truly be worth. However, can both methods be right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Vertiv Holdings Co Narrative

If you have a different perspective or want to draw your own conclusions, you can easily build a personalized Vertiv narrative in just a few minutes. do it your way.

A great starting point for your Vertiv Holdings Co research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunities pass you by when there are so many exciting stocks available. Use the Simply Wall Street Screener to find hidden gems, unique industry plays, or steady dividend performers that could enhance your portfolio and give you an edge.

- Discover companies at the forefront of AI innovation and healthcare technology growth by checking out healthcare AI stocks.

- Find powerful income opportunities by searching for dividend stocks with yields > 3% that deliver yields above 3%.

- Explore the momentum of technology transformation and consider quantum computing stocks for exposure to the next wave of computing advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives