- United States

- /

- Electrical

- /

- NYSE:VRT

Vertiv Holdings Co (NYSE:VRT) Shares Fall 11% As Market Reacts To Positive Earnings Forecast

Reviewed by Simply Wall St

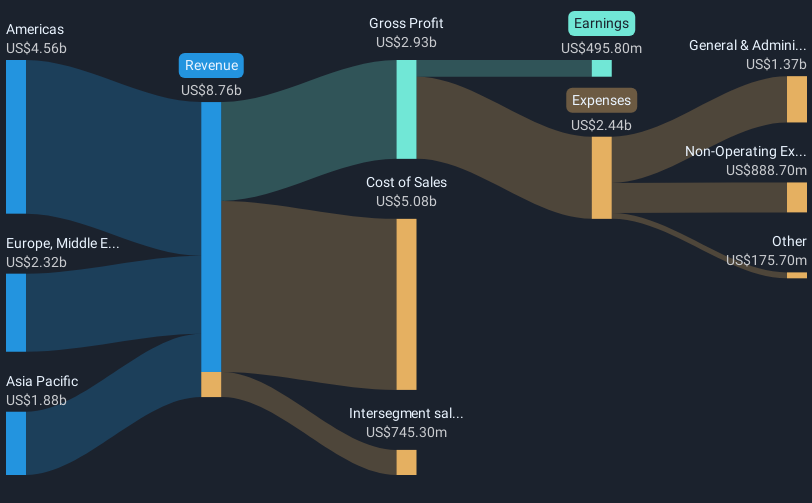

Vertiv Holdings Co (NYSE:VRT) recently launched its Vertiv™ Liquid Cooling Services and discussed M&A activity. Despite the positive earnings for 2024 and optimistic guidance for 2025, the company's stock saw a 11% decline over the past week. This decline occurred amid broader market unease from tariff concerns, which impacted tech stocks, leading to a 1.9% market drop. The tech-heavy Nasdaq, in particular, faced pressure as global economic uncertainty persisted. Vertiv's movement coincides with this broader market sentiment, indicating that external economic factors and investor sentiment weighed on the share price. While Vertiv’s earnings showed growth, the lack of share repurchases and recent executive changes might also influence investor perspectives. Overall, while Vertiv's internal developments were mainly positive, the market's external pressures likely played a key role in the share price decline.

Dig deeper into the specifics of Vertiv Holdings Co here with our thorough analysis report.

Over the past five years, Vertiv Holdings Co has delivered a very large total shareholder return of 728.09%, reflecting significant growth despite short-term volatilities. This growth trajectory was bolstered by accelerated earnings expansion, with profits growing by an average of 70.2% annually, and the company turning profitable during this period. Vertiv also outperformed its peers in the US Electrical industry over the past year, which marked a decline of 3.6%, and surpassed the broader US market's 13.1% return. Analysts maintain an optimistic outlook, projecting faster-than-market revenue and earnings growth in the coming years.

Key developments contributing to Vertiv's performance include the introduction of innovative products like the Vertiv™ PowerUPS 9000 in December 2024 and successful partnerships, such as the collaboration with NVIDIA in October 2024. A 50% dividend increase announced in November 2024 also points toward robust cash flow management. Additionally, effective debt management through a $2.1 billion Term Loan repricing in December 2024 helped in reducing interest expenses, further fortifying their financial position.

- Understand the fair market value of Vertiv Holdings Co with insights from our valuation analysis—click here to learn more.

- Analyze the downside risks for Vertiv Holdings Co and understand their potential impact—click to learn more.

- Have a stake in Vertiv Holdings Co? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with excellent balance sheet.