- United States

- /

- Electrical

- /

- NYSE:VRT

Vertiv Holdings Co (NYSE:VRT) Sees US$496 Million Net Income Despite Stock Sliding 12%

Reviewed by Simply Wall St

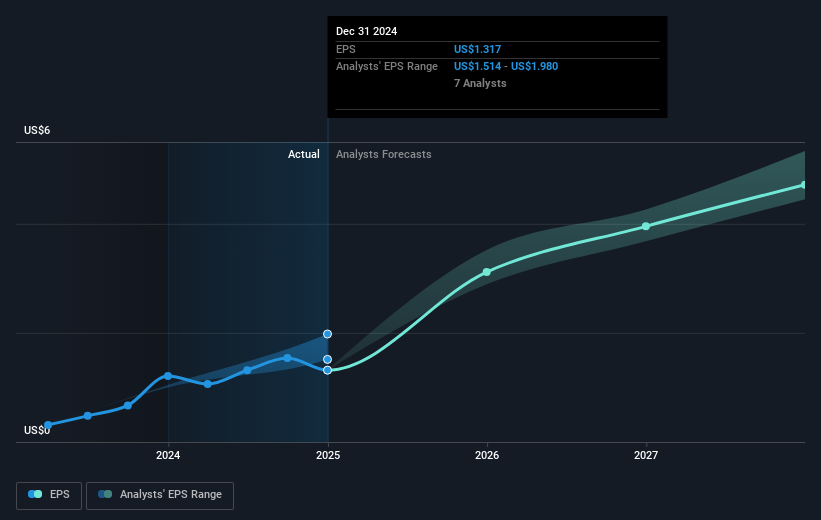

Vertiv Holdings Co (NYSE:VRT) recently reported solid earnings for the year ending December 31, 2024, with revenue growing to $8 billion and net income rising to $496 million. Despite these positive results, the company's stock faced an 11.85% decline over the last week. Concurrently, Vertiv announced new earnings guidance and strategic goals, including ongoing mergers and acquisitions initiatives. These announcements came amidst broader market volatility, where the Dow and Nasdaq are experiencing significant fluctuations, particularly in technology sectors. The market's overall drop of 4.8% last week, influenced by economic concerns and geopolitical factors, likely contributed to the pressure on Vertiv’s share price. Market sentiment was also affected by inflation news and trade policy uncertainties from the U.S. administration, which could influence industrial stocks like Vertiv. Thus, while Vertiv's operational performance remains robust, external market conditions appear to have had a more pronounced impact on its stock performance in recent days.

Navigate through the intricacies of Vertiv Holdings Co with our comprehensive report here.

Over the past five years, Vertiv Holdings Co has achieved a very large total return of 783.96%, reflecting robust operational performance. Several key developments have influenced this success. The company's focus on innovative product launches, such as the Vertiv™ Liquid Cooling Services and Vertiv™ PowerUPS 9000, has enhanced its market offerings. Moreover, strategic expansions in the M&A landscape indicate Vertiv's commitment to growth, as highlighted by CEO Giordano Albertazzi's emphasis on aligning acquisitions with the company’s value model.

In the most recent year, Vertiv's earnings growth notably exceeded the Electrical industry's decline and significantly outperformed the U.S. market's return. Additionally, a recent annual dividend increase by 50% underscores solid financial health, offering value to shareholders. However, although the company has a high level of debt, this leverage has supported impressive earnings growth, averaging 70.2% annually over the past five years, positioning Vertiv as a standout in its field.

- Understand the fair market value of Vertiv Holdings Co with insights from our valuation analysis—click here to learn more.

- Assess the potential risks impacting Vertiv Holdings Co's growth trajectory—explore our risk evaluation report.

- Already own Vertiv Holdings Co? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives