- United States

- /

- Electrical

- /

- NYSE:VRT

Vertiv Holdings Co (NYSE:VRT) Sees 14% Weekly Dip Amid Dividend Affirmation

Reviewed by Simply Wall St

In the past week, Vertiv Holdings Co (NYSE:VRT) experienced a 14% decline in its share price. This occurred amidst key announcements including a quarterly dividend affirmation and the launch of innovative AI-oriented products. Despite these efforts to bolster long-term prospects, the broader stock market faced downward pressures due to inflation concerns and weak consumer sentiment, as indicated by the market performance where major indexes like the S&P 500 and Nasdaq fell 2% or more. Vertiv's stock movement reflects its interplay between strategic initiatives and the prevailing market conditions.

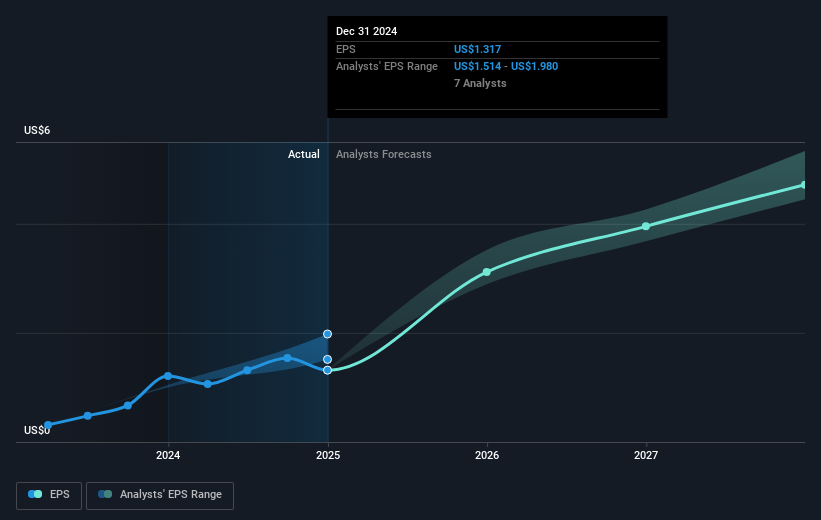

Over the past five years, Vertiv Holdings Co has delivered a very large total shareholder return of 842.37%, reflecting its robust growth and strategic maneuvers within a competitive market landscape. This remarkable performance contrasts with the past year's results, where Vertiv underperformed relative to the US Electrical industry. The company's aggressive product launches, such as the AI-oriented Vertiv Unify Software and CoolLoop RDHx, have cemented its position in high-demand sectors. Additionally, Vertiv's significant earnings growth, with a 70.2% annual increase over five years, reflects its focus on operational initiatives and expansion in emerging markets.

Vertiv has also benefited from initiatives like share buyback programs, successfully repurchasing US$599.84 million worth of shares, enhancing shareholder value. Furthermore, the collaboration with major tech players like NVIDIA underscores Vertiv's adaptation to burgeoning markets. These efforts, along with its substantial increase in annual revenue, illustrate Vertiv’s ability to capitalize on evolving industry needs and continuously drive long-term shareholder returns.

Assess Vertiv Holdings Co's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives