- United States

- /

- Electrical

- /

- NYSE:VRT

Vertiv Holdings Co (NYSE:VRT) Reaffirms 2025 Guidance And Announces CFO Retirement Plan

Reviewed by Simply Wall St

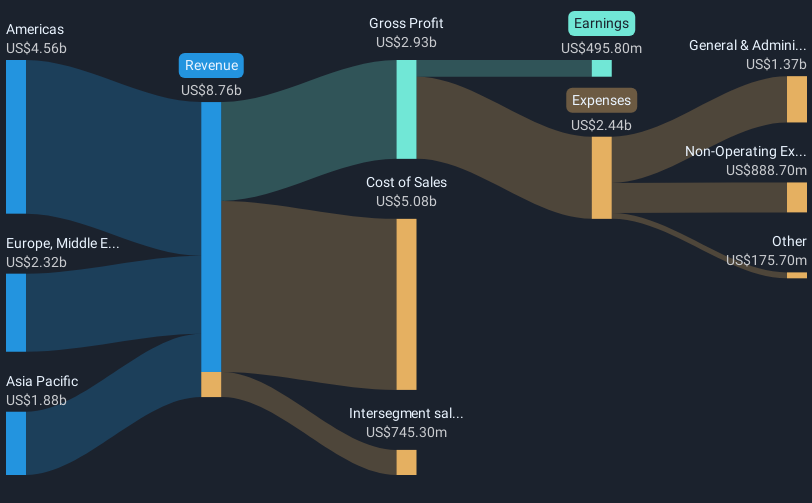

Vertiv Holdings Co (NYSE:VRT) experienced a significant price increase of 26% last month, drawing attention as it aligns with several recent corporate developments. The company reaffirmed its earnings guidance for 2025, emphasizing the solid trajectory of the data center market, driven by AI demand and strategic investments in R&D and capacity expansion. Additionally, the announced retirement of long-serving CFO David Fallon and new product initiatives with NVIDIA may have added momentum. As broader markets remained relatively flat, Vertiv's focused corporate actions and market-relevant advancements likely underscored investor confidence amid a generally stable economic backdrop.

Be aware that Vertiv Holdings Co is showing 2 risks in our investment analysis.

With Vertiv Holdings Co's recent 26% price surge driven by new product initiatives with NVIDIA and corporate developments, the company's strategic focus strongly aligns with the narrative of substantial long-term growth. The collaboration on AI infrastructure positions Vertiv to capitalize on increasing demand, potentially bolstering revenue and earnings forecasts. This could further enhance profitability through advanced data center solutions despite existing tariff and supply chain challenges. The share price movement, while impressive, remains slightly below the consensus price target of US$115.60, suggesting room for potential upside if these initiatives yield expected results.

Over a three-year period, Vertiv's total shareholder return was very large, indicating significant appreciation beyond short-term fluctuations. This performance underscores the company's capacity to generate substantial returns, a stark contrast to its underperformance relative to the US Electrical industry over the past year. The industry returned 16.1% while Vertiv's annual growth trailed behind, showing that while short-term growth faces some challenges, the long-term strategic investments may deliver more robust outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives