- United States

- /

- Electrical

- /

- NYSE:VRT

Vertiv Holdings Co (NYSE:VRT) Expands Thermal Management With Innovative CoolLoop Trim Cooler For AI and HPC

Reviewed by Simply Wall St

Vertiv Holdings Co (NYSE:VRT) has recently experienced an 8.65% decrease in its share price over the last week. Despite the company's launch of the Vertiv™ CoolLoop Trim Cooler, which enhances their thermal management capabilities for AI and high-performance computing, external economic factors appear to have influenced its stock performance. The announcement of U.S. tariffs on Canadian steel and aluminum by the Trump administration contributed to overall market negativity, with major indexes like the Dow Jones and S&P 500 declining by 1.2% and 0.8%, respectively. Vertiv's dividend declaration on March 7, 2025, also took place within this period, aligning with heightened market volatility driven by tariff concerns. These broader economic pressures likely overshadowed Vertiv’s recent innovations, reflecting widespread investor caution as the market grappled with potential recession fears and the impact of protectionist measures.

Unlock comprehensive insights into our analysis of Vertiv Holdings Co stock here.

Over the past five years, Vertiv Holdings Co has enjoyed a very large total shareholder return of 912.78%, reflecting a period of substantial growth. Several factors have contributed to this impressive performance, including the launch of significant products like the Vertiv™ PowerUPS 9000, which offers enhanced efficiency for IT applications, and CoolChip CDU systems improving data center cooling. Additionally, Vertiv's revenue has notably increased, with 2024 revenue reaching US$8.01 billion, up from US$6.86 billion in 2023, bolstering investor confidence.

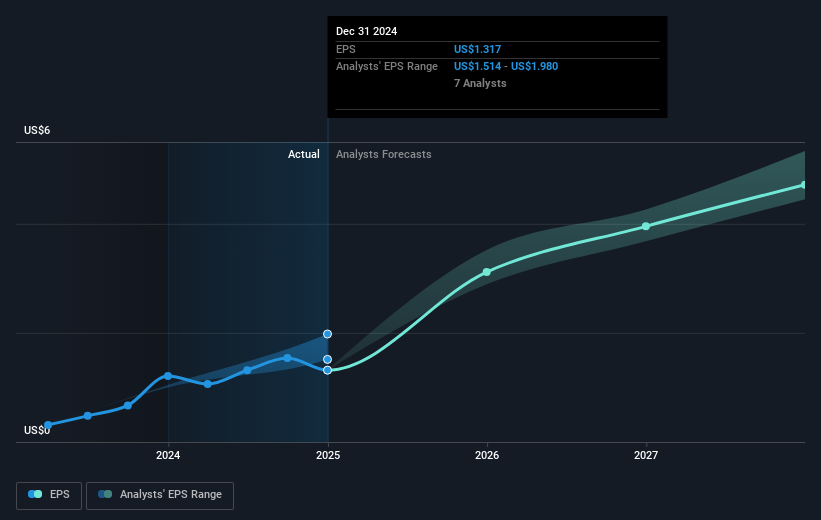

Further affirming Vertiv's growth trajectory is the forecast that its earnings are expected to outpace the US market over the next few years. Although Vertiv's Price-to-Earnings Ratio is high compared to peers, analysts agree on a positive outlook, with the stock trading below their price targets. Noteworthy is Vertiv's one-year return, which surpassed both the US electrical industry and the broader market, standing out as a firm with exemplary growth amidst market challenges.

- See how Vertiv Holdings Co measures up with our analysis of its intrinsic value versus market price.

- Assess the downside scenarios for Vertiv Holdings Co with our risk evaluation.

- Already own Vertiv Holdings Co? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives