- United States

- /

- Electrical

- /

- NYSE:VRT

Does Appointment of Wei Shen as Greater China President Change the Bull Case for Vertiv (VRT)?

Reviewed by Simply Wall St

- Vertiv recently appointed Wei Shen as president of Greater China, effective July 22, 2025, succeeding Edward Cui who led the region since 2022 and is now leaving the company.

- Shen’s track record in digital infrastructure and prior leadership in APAC positions him to shape Vertiv’s presence in this vital growth market.

- We'll explore how Shen’s appointment could influence Vertiv’s overall outlook, particularly as Greater China remains central to its growth strategy.

Vertiv Holdings Co Investment Narrative Recap

To believe in Vertiv Holdings Co as a shareholder, you have to trust its focus on capturing AI data center demand and its ability to grow profitably across key global markets. The appointment of Wei Shen as president of Greater China is significant given the region’s importance to Vertiv’s growth, but the biggest immediate catalyst remains the company’s ongoing pipeline expansion amid strong AI infrastructure spending; the main risk continues to be potential changes in tariffs or supply chain disruptions, particularly with regard to China, and this news does not materially alter that risk in the short term. Of the many updates, Vertiv’s June launch of new cooling and power solutions for NVIDIA’s AI platforms stands out for its relevance to short-term growth. These types of product innovations are critical to both capturing the AI-driven wave and maintaining high margins, tying directly into the company's strategy for expanding in growth markets such as Greater China, where Shen's local expertise could prove complementary to these recent initiatives. In contrast, investors should also be aware that exposure to shifting tariff policies involving China remains a key factor, especially because...

Read the full narrative on Vertiv Holdings Co (it's free!)

Vertiv Holdings Co's outlook anticipates $12.5 billion in revenue and $1.9 billion in earnings by 2028. This implies a 14.0% annual revenue growth rate and a $1.23 billion increase in earnings from the current $666.2 million.

Exploring Other Perspectives

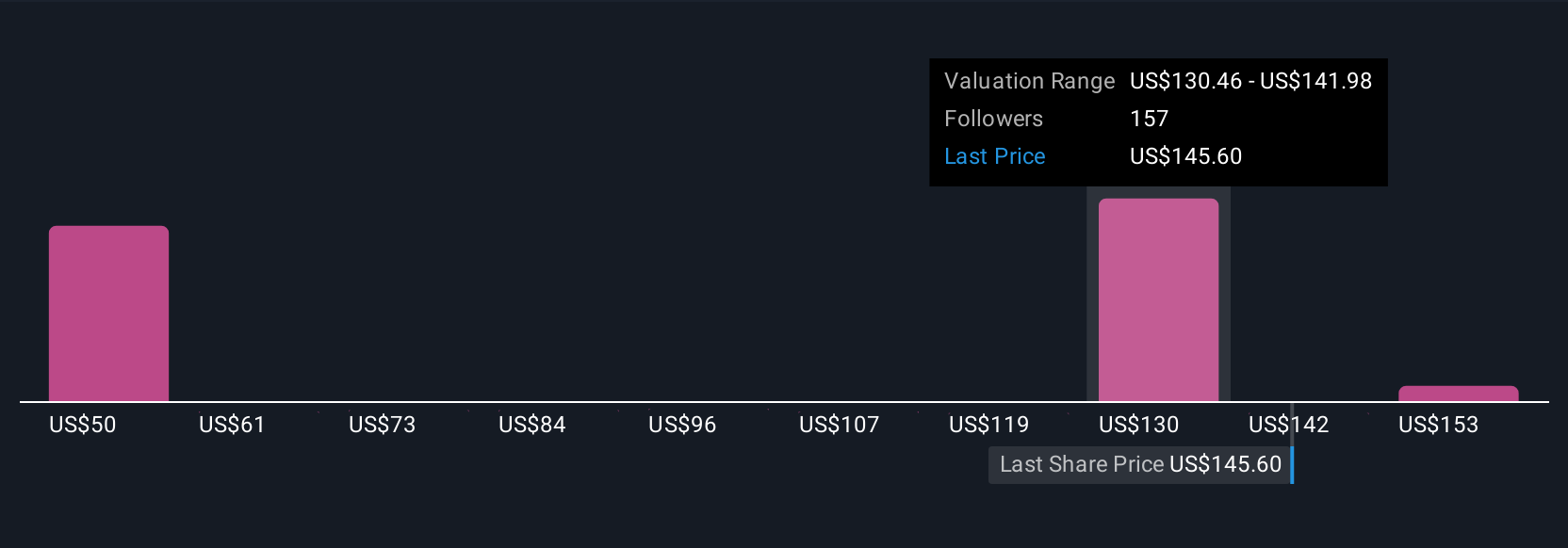

Simply Wall St Community members have placed Vertiv’s fair value between US$99.49 and US$165, with 10 unique estimates informing this spread. Opinions differ broadly, especially in light of ongoing risks tied to tariffs and global supply chains, consider exploring several perspectives before deciding on your view.

Build Your Own Vertiv Holdings Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertiv Holdings Co research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Vertiv Holdings Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertiv Holdings Co's overall financial health at a glance.

No Opportunity In Vertiv Holdings Co?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives