- United States

- /

- Aerospace & Defense

- /

- NYSE:VOYG

Voyager Technologies (VOYG): A Fresh Look at Valuation After Recent Share Price Swings

Reviewed by Kshitija Bhandaru

See our latest analysis for Voyager Technologies.

Voyager Technologies’ share price has had a roller-coaster ride lately, with a strong 12.86% gain over the last week and a 14.24% rally for the month. However, its year-to-date share price return remains deep in the red at -40.49%. The pickup in short-term momentum suggests that investors might be anticipating changes ahead. Still, recent volatility shows sentiment remains mixed over the company’s future direction.

If you’re watching the ups and downs here, now could be the perfect opportunity to branch out and discover fast growing stocks with high insider ownership

With shares still trading nearly 41% below the average analyst price target despite strong revenue growth, the question remains: is Voyager Technologies now a bargain with upside, or is the market already factoring in its next moves?

Price-to-Sales of 12.6x: Is it justified?

Voyager Technologies is currently trading at a price-to-sales ratio of 12.6x, which is far above peers and industry averages. At a last close of $33.61, this multiple suggests the stock is priced much higher relative to its sales than competitors in the Aerospace & Defense space.

The price-to-sales (P/S) ratio evaluates a company's market value compared to its revenue and is often used for unprofitable businesses, like Voyager Technologies. It is especially relevant here since the company is not currently generating profits, making earnings-based multiples unworkable.

With the US Aerospace & Defense industry averaging just 3.4x, Voyager’s 12.6x ratio stands out as expensive. Compared to its closest peers, which trade around 3.8x, Voyager’s valuation appears even steeper. This high multiple suggests the market is placing a significant premium on future revenue growth, but such optimism requires underlying business momentum to be sustained over time.

Without a fair ratio available to serve as a potential anchor for market reversion, scrutiny on this rich valuation is amplified. Investors should look closely at what justifies paying over three times as much per dollar of sales compared to industry norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 12.6x (OVERVALUED)

However, ongoing losses and sharp revenue expectations could challenge the market’s optimism, particularly if growth momentum slows or profit targets remain out of reach.

Find out about the key risks to this Voyager Technologies narrative.

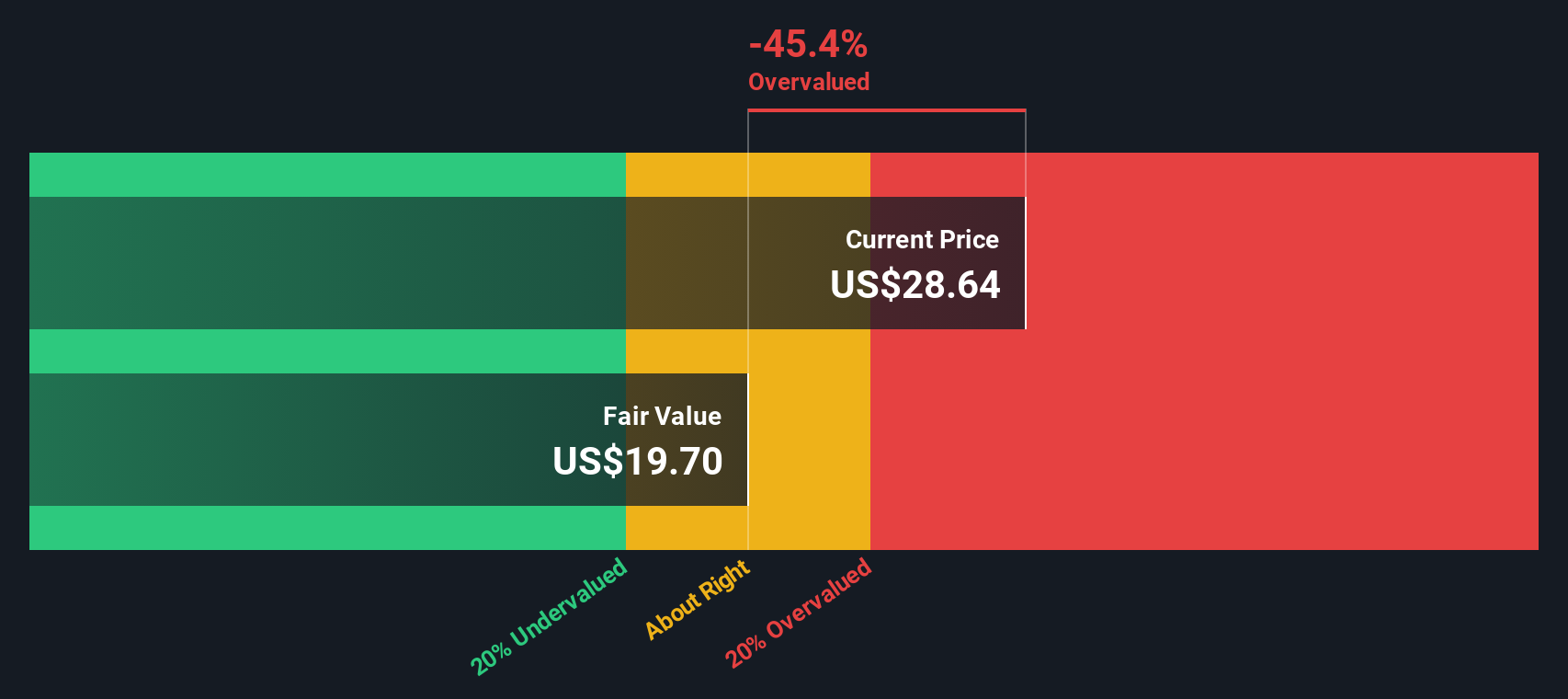

Another View: Discounted Cash Flow Model

While Voyager Technologies looks pricey based on its sales multiple, our SWS DCF model suggests a different story. The current share price of $33.61 is actually about 5.9% below our estimate of fair value at $35.72, which hints at potential undervaluation. Does this indicate the market is too pessimistic on the company’s future?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Voyager Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Voyager Technologies Narrative

If you want a different perspective or enjoy hands-on research, it's quick and easy to build your own case based on the numbers. Do it your way

A great starting point for your Voyager Technologies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let unique opportunities slip past you. The Simply Wall Street Screener uncovers high-potential stocks and trends you might have missed elsewhere. See which ideas fit your goals right now.

- Tap into the next wave of healthcare transformation, starting your search with these 32 healthcare AI stocks.

- Unlock fresh income streams for your portfolio by checking out these 19 dividend stocks with yields > 3%.

- Ride the momentum of technological innovation by evaluating these 25 AI penny stocks at the forefront of breakthrough developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VOYG

Voyager Technologies

Operates as a defense technology and space solutions company in the United States, Europe, the Middle East, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives