- United States

- /

- Construction

- /

- NYSE:VMI

The Bull Case For Valmont Industries (VMI) Could Change Following Record Backlogs and AI-Driven Growth Investments

Reviewed by Sasha Jovanovic

- In the past month, Valmont Industries has seen strong investor interest following a surge in demand from infrastructure investment and the accelerating energy transition, leading to record customer backlogs and capacity constraints across the industry.

- The company’s investments in capacity, automation, and AI are poised to unlock between US$350 million and US$400 million in additional annual revenue while supporting higher earnings and margins as this multi-year growth cycle continues.

- We will examine how Valmont’s advanced automation and AI investments could shape its broader investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Valmont Industries Investment Narrative Recap

To be a Valmont Industries shareholder today, you need conviction in global infrastructure upgrades and the energy transition, which are fueling strong utility and transmission demand. While the recent surge in customer backlogs and capacity constraints reinforces the most important near-term catalyst, continued growth in infrastructure investment, economic cyclicality remains the company's biggest risk, and the recent news does not materially shift this risk profile in the short term.

Among recent announcements, the opening of a sustainable concrete utility pole facility in Indiana stands out, directly linking to current demand themes and reinforcing Valmont’s focus on decarbonization and expanding its utility product offering as capacity and backlog pressures mount. This move complements the short-term catalysts by supporting Valmont’s positioning in green infrastructure ahead of the 2025 earnings cycle.

Yet, contrary to recent optimism, investors should also be aware of...

Read the full narrative on Valmont Industries (it's free!)

Valmont Industries' outlook anticipates $4.5 billion in revenue and $462.5 million in earnings by 2028. This projection assumes a 3.5% annual revenue growth rate and an earnings increase of $244.8 million from the current $217.7 million.

Uncover how Valmont Industries' forecasts yield a $415.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

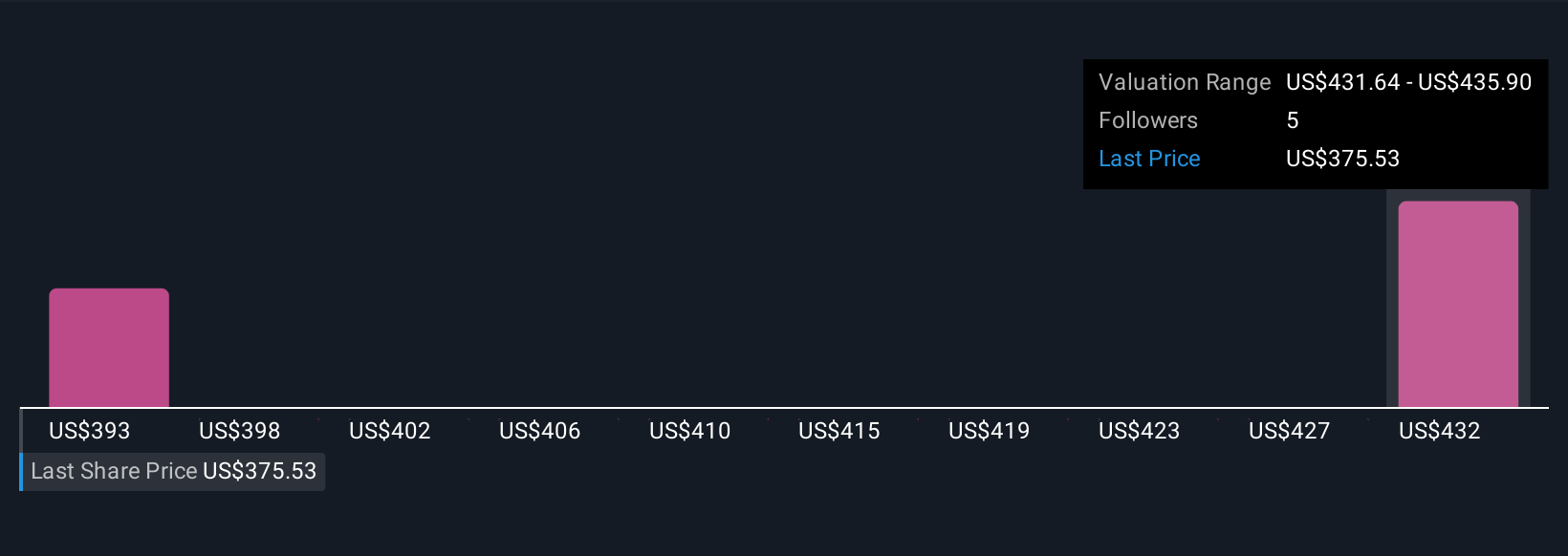

Simply Wall St Community members' fair value estimates for Valmont Industries range from US$415 to US$435, based on two unique analyses. With such perspectives, consider how exposure to cyclical infrastructure spending could impact the sustainability of recent backlog-driven momentum.

Explore 2 other fair value estimates on Valmont Industries - why the stock might be worth as much as 12% more than the current price!

Build Your Own Valmont Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valmont Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Valmont Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valmont Industries' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VMI

Valmont Industries

Operates as a manufacturer of products and services for infrastructure and agriculture markets in the United States, Australia, Brazil, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives