- United States

- /

- Aerospace & Defense

- /

- NYSE:TXT

It's A Story Of Risk Vs Reward With Textron Inc. (NYSE:TXT)

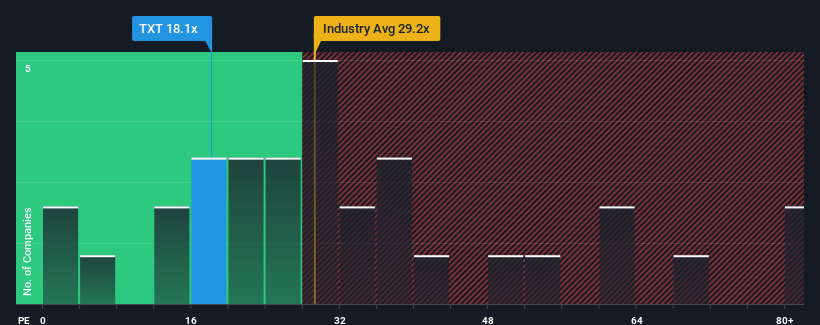

With a median price-to-earnings (or "P/E") ratio of close to 16x in the United States, you could be forgiven for feeling indifferent about Textron Inc.'s (NYSE:TXT) P/E ratio of 18.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Textron certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Textron

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Textron's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a decent 13% gain to the company's bottom line. The latest three year period has also seen an excellent 248% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 15% per year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 10% per year, which is noticeably less attractive.

With this information, we find it interesting that Textron is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Textron's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Textron with six simple checks.

If these risks are making you reconsider your opinion on Textron, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Textron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TXT

Textron

Operates in the aircraft, defense, industrial, and finance businesses worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives