- United States

- /

- Aerospace & Defense

- /

- NYSE:TXT

Can Textron’s (TXT) Defense Push Reveal Its Long-Term Edge in Military Innovation?

Reviewed by Sasha Jovanovic

- In recent weeks, Textron Aviation, a Textron Inc. company, announced the delivery of the XM204 Top Attack Munition to the U.S. Army and new integrations in its military aviation programs, underscoring expanded participation in U.S. defense modernization initiatives.

- Textron’s selection in major defense programs and adoption of advanced technology highlights the company's growing alignment with next-generation military innovation and operational support.

- We'll explore how Textron's expanded presence in U.S. defense initiatives could impact the company's overall investment narrative and future prospects.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Textron Investment Narrative Recap

To own Textron stock, you need to believe in the company’s ability to capitalize on U.S. defense modernization and advanced aviation solutions, despite recent pressure on overall segment profit margins. While Textron's new contracts and technology integrations strengthen its long-term story, these updates have not altered the immediate critical risk: ongoing challenges in cost management and product mix, which continue to constrain profitability in the short term.

Among the most recent headlines, Textron Aviation's integration of Sensos Smart Labels for real-time parts tracking stands out, reflecting a commitment to operational efficiency and aftermarket support. Although this isn't a direct catalyst for margin recovery, it speaks to longer-term efforts to enhance service profitability and reliability for its aviation clients.

Yet, in contrast, investors should also pay close attention to the risk that segment profits could remain under pressure if Textron cannot...

Read the full narrative on Textron (it's free!)

Textron's outlook anticipates $16.2 billion in revenue and $1.1 billion in earnings by 2028. This is based on a projected 4.8% annual revenue growth and a $284 million increase in earnings from the current $816.0 million.

Uncover how Textron's forecasts yield a $92.57 fair value, a 14% upside to its current price.

Exploring Other Perspectives

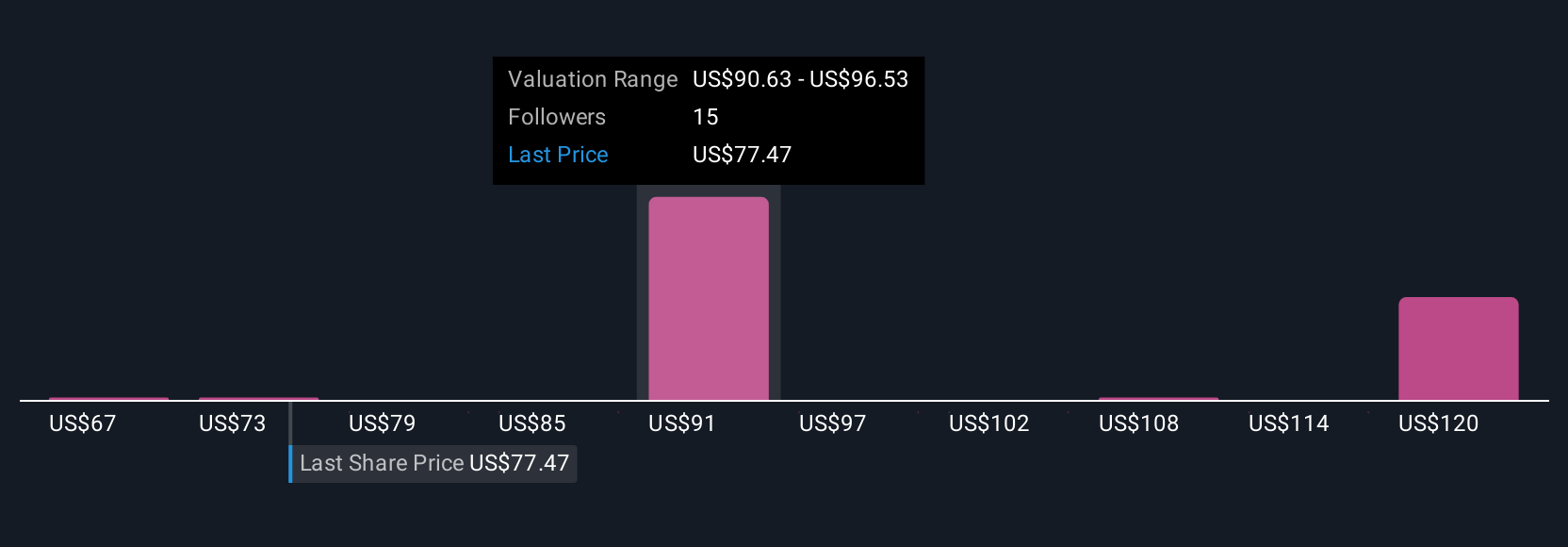

Simply Wall St Community members provide seven fair value opinions for Textron, ranging from US$67.04 to US$124.18. While views vary widely, many focus on Textron’s weaker profit margins as a key factor that could influence performance going forward, readers can explore multiple viewpoints to inform their own analysis.

Explore 7 other fair value estimates on Textron - why the stock might be worth as much as 52% more than the current price!

Build Your Own Textron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Textron research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Textron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Textron's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Textron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TXT

Textron

Operates in the aircraft, defense, industrial, and finance businesses worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives