- United States

- /

- Building

- /

- NYSE:TT

Trane Technologies (TT): Evaluating Valuation After Recent Share Price Pause

Reviewed by Simply Wall St

This week’s move in Trane Technologies (TT) stock might have caught your eye. While there is no single big headline driving the action right now, some investors are taking the latest dip as a natural pause after a period of steady gains and are starting to weigh whether the market is signaling a change in how it values the company’s growth prospects.

Looking at the bigger picture, Trane Technologies has been on quite a ride over the past year, advancing 21% on a total return basis. Although the shares have cooled off a bit over the past month, the long-term trend still points higher, with a three-year return topping 183%. The latest move, following strong revenue and income growth over the last twelve months, adds an extra layer of intrigue as market momentum seems to be shifting.

After this year’s climb and a recent pullback, the question remains: is Trane Technologies positioned for further upside, or is the stock’s current price already factoring in all the future growth investors hope to see?

Most Popular Narrative: 7.3% Undervalued

According to community narrative, Trane Technologies is currently seen as trading below its calculated fair value, with analysts suggesting the stock price has not fully factored in its projected earnings growth and operational strength.

The strategic emphasis on innovation and a direct sales force enables Trane Technologies to consistently outgrow its end markets. This approach supports long-term revenue expansion and potential margin improvement due to enhanced market positioning and customer engagement.

What is the secret behind Trane’s “undervalued” label? A bold set of financial targets and a rare profit outlook underpin this narrative’s price target. Curious how ambitious revenue and margin projections shape this eye-catching valuation? Explore further, as this narrative’s hidden assumptions may be surprising.

Result: Fair Value of $457.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a slowdown in commercial HVAC demand or difficulties in passing on cost increases to customers could quickly challenge the company's "undervalued" outlook.

Find out about the key risks to this Trane Technologies narrative.Another View: A Different Take on Valuation

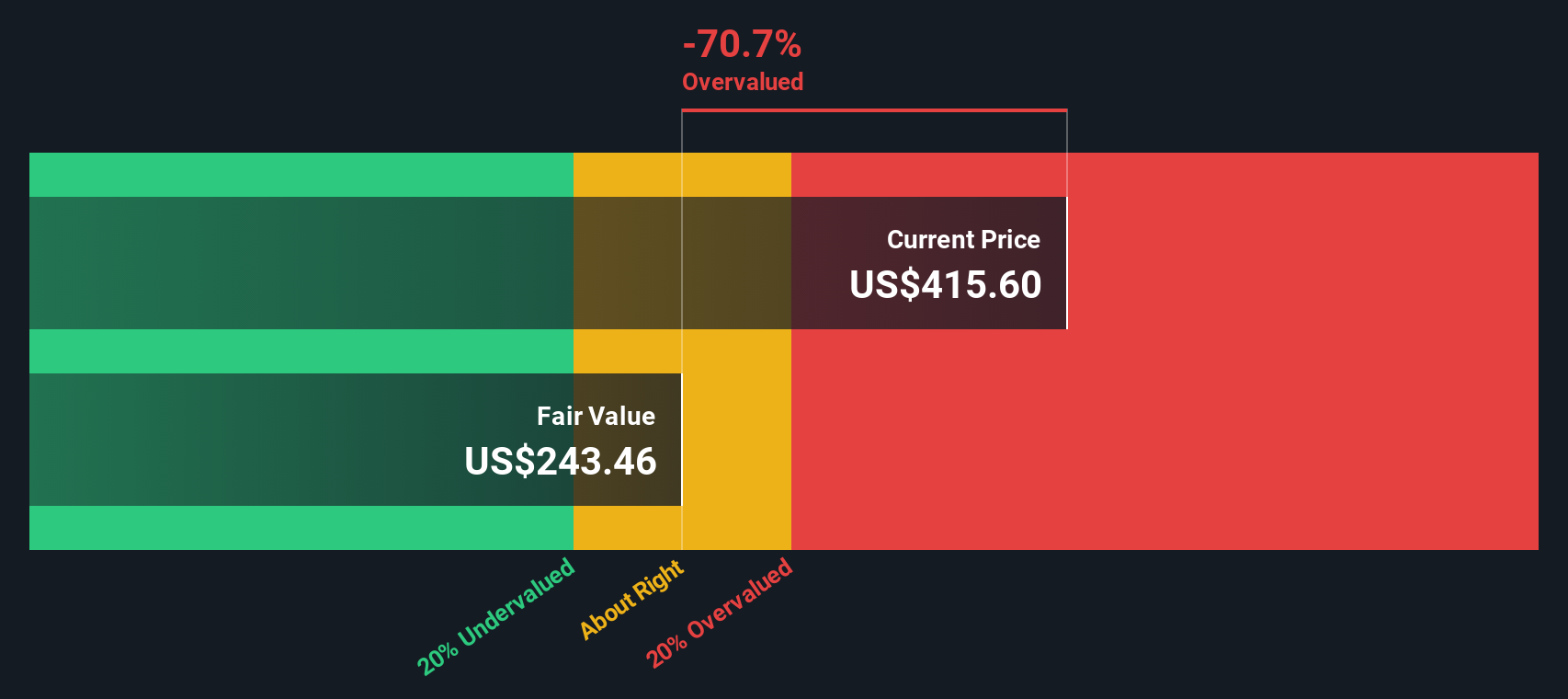

While the fair value estimate suggests opportunity, our DCF model points in the opposite direction. This indicates that Trane may actually be trading above its calculated value. Which approach really captures the business’s future?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Trane Technologies Narrative

If you’re not convinced by the prevailing viewpoints or want to chart your own course using the data, you can easily build your own narrative in just a few minutes. So why not do it your way?

A great starting point for your Trane Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Great investors stay open to fresh opportunities. Don’t let the next big winner slip past you. Let our handpicked stock lists inspire and inform your investing moves. Tap into the potential of these innovative businesses shaping tomorrow’s market trends.

- Unlock steady income and growth by exploring dividend stocks with yields > 3%. These options combine attractive yields with financial health.

- Capture the momentum of rapidly evolving technology by checking out AI penny stocks, which are transforming industries with artificial intelligence breakthroughs.

- Spot resilient value plays with undervalued stocks based on cash flows and get ahead of the crowd seeking stocks that may be poised for a re-rating.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trane Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TT

Trane Technologies

Designs, manufactures, sells, and services of solutions for heating, ventilation, air conditioning, and custom and transport refrigeration.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives