- United States

- /

- Building

- /

- NYSE:TT

Should Investors Reassess Trane After Strong 24.5% Return and Latest Market Momentum?

Reviewed by Simply Wall St

If you have been watching Trane Technologies lately and wondering whether now might be the right time to buy, sell, or hold, you are not alone. This stock has certainly given investors a lot to talk about. Over the past year, Trane has delivered a total return of nearly 24.5%, handily outpacing many in its sector. Even its year-to-date performance is impressive, at about 14.7%, despite some recent short-term dips over the last month. In fact, the last three and five years tell an even more compelling story, with returns of 182% and 288% respectively, rewarding patient shareholders.

Of course, such strong gains often bring fresh questions about valuation. Is the share price running ahead of the company's true worth, or is there still room to grow? This is a big question, especially given that Trane Technologies currently trades at a slight discount to the average analyst price target. However, none of the six standard undervaluation checks indicate that the stock is undervalued. Trane’s valuation score stands at 0 out of 6.

Before you make your next move, it is crucial to dig into what those valuation checks mean and whether they are telling the whole story. Up next, we will break down Trane’s valuation through different common approaches. Later in the article, I will share a smarter way to think about what the company is really worth.

Trane Technologies delivered 24.5% returns over the last year. See how this stacks up to the rest of the Building industry.Approach 1: Trane Technologies Cash Flows

The Discounted Cash Flow (DCF) model offers a straightforward way to estimate what a business is worth by forecasting its future cash flows and discounting them back to their value today. Essentially, it answers the question: how much are all the dollars Trane Technologies is expected to generate worth in current terms?

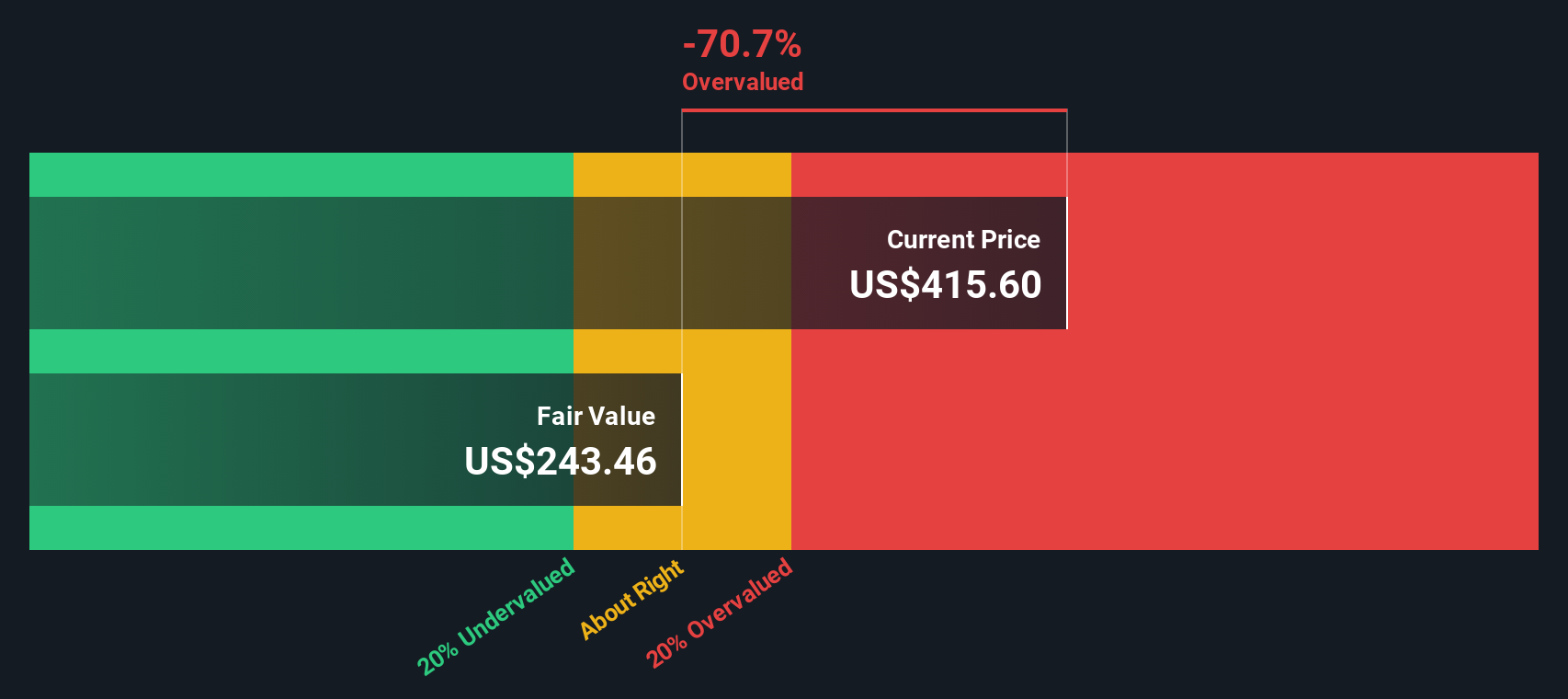

For Trane Technologies, the latest twelve months’ Free Cash Flow sits at $2.86 billion. Analysts forecast steady growth, with Free Cash Flow projected to climb to $3.62 billion by 2029 and continue higher over the next decade. The DCF valuation, which uses all these future figures and discounts them appropriately, results in an intrinsic value of $243.80 per share.

Comparing this intrinsic value to Trane Technologies’ current share price shows the stock is trading at a 75.9% premium. This means it is 75.9% overvalued when judged by the DCF model. In other words, investors are currently paying significantly more than what this model suggests is a fair value based on cash flows.

Result: OVERVALUED

Approach 2: Trane Technologies Price vs Earnings

For companies with steady profits, the Price-to-Earnings (PE) ratio is often the go-to metric for investors. This ratio allows you to quickly gauge how much you are paying for each dollar of the company’s earnings. Essentially, it sets expectations around growth and risk. Higher growth prospects often justify higher PE ratios, while added risks or industry pressures can weigh them down.

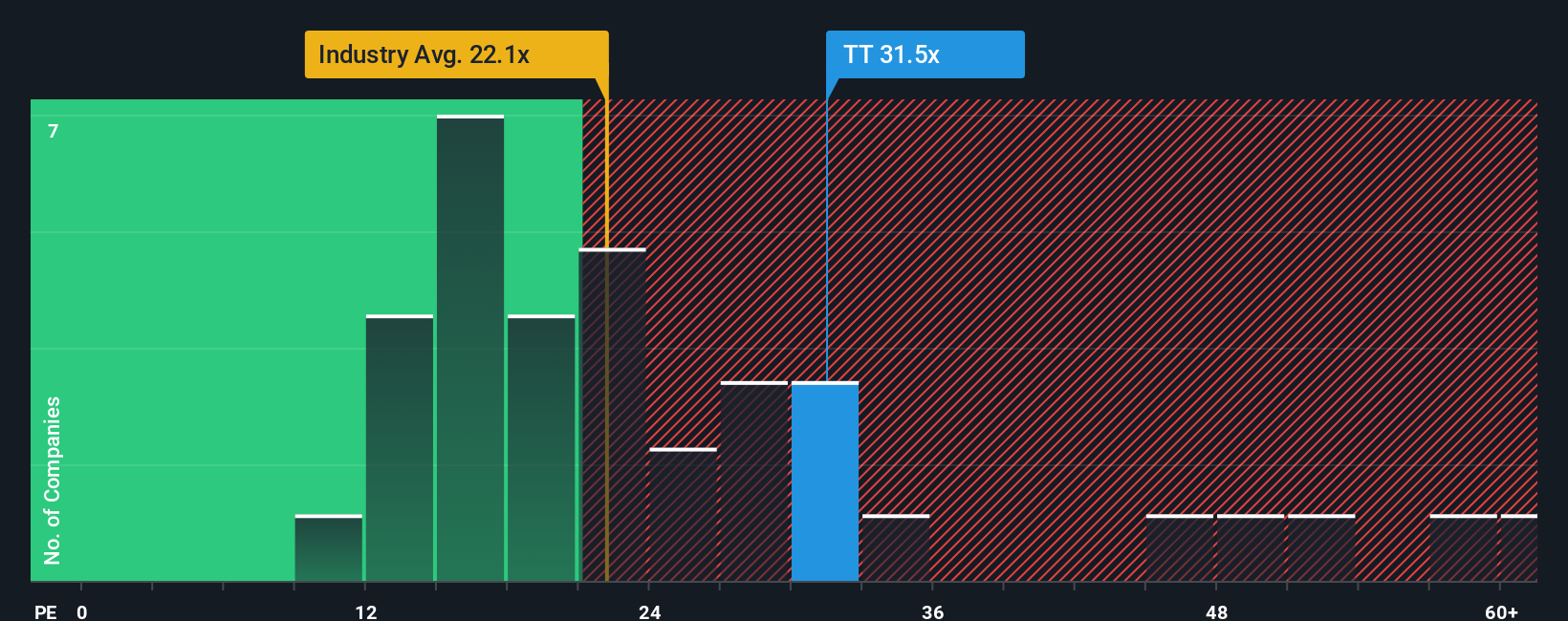

Currently, Trane Technologies trades at a PE ratio of 33.2x. To put this in perspective, the average PE among its industry peers is 23.1x and its closest comparables sit at 30.1x. By comparison, Trane’s shares appear relatively expensive. However, not all companies merit the same multiple; factors like robust earnings growth, industry standing, and profit quality come into play.

This is where the Fair Ratio comes in. Simply Wall St’s Fair Ratio for Trane is 28.3x, reflecting a comprehensive look at the company’s prospects and risks. Trane’s actual PE ratio of 33.2x is only moderately above this proprietary benchmark. While it trades at a premium, the difference is not extreme and is largely in line with what you might expect for a leader in the sector with strong growth.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Trane Technologies Narrative

Beyond just crunching numbers, a Narrative is your personal story about Trane Technologies that connects your understanding of its business, the estimates you make about future revenue, earnings, and margins, and the fair value you believe is justified.

Instead of focusing only on past performance or a single valuation model, Narratives link the real business drivers and prospects you see to a clear forecast. From there, you can determine a logical fair value, making your investment case both transparent and evidence-based.

On the Simply Wall St platform, Narratives are an easy, practical tool, used by millions of investors to clarify their thinking and compare with the wider community. You can quickly see how your view stacks up and track how perceptions shift over time.

Narratives also help you make better buy or sell decisions by matching your own fair value estimate to Trane’s current price. This gives you a straightforward summary of whether a stock looks attractive or expensive based on your logic, not someone else’s.

The best part is that Narratives dynamically update when fresh data, news, or earnings results come in, instantly refreshing the story and the valuation. This helps ensure your thesis is always current.

For example, some investors see Trane Technologies as worth as much as $544.00 per share while others think it is only worth $265.00, all depending on their assumptions about future growth, margins, and risks.

Do you think there's more to the story for Trane Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trane Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TT

Trane Technologies

Designs, manufactures, sells, and services of solutions for heating, ventilation, air conditioning, and custom and transport refrigeration.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives