- United States

- /

- Machinery

- /

- NYSE:TRN

Trinity Industries (TRN) Valuation Check After Its Latest Dividend Increase and Ongoing Shareholder Payout Streak

Reviewed by Simply Wall St

Trinity Industries (TRN) just nudged its quarterly dividend up to 31 cents per share, marking a seventh straight year of raises and extending a 247 quarter payment streak that income focused investors watch closely.

See our latest analysis for Trinity Industries.

The latest dividend bump comes as Trinity’s share price sits around $27.63, with a recent 1 month share price return of 5.22 percent but a much weaker year to date share price return of negative 21.24 percent. Its 5 year total shareholder return of 28.93 percent suggests that, despite current pressure, long term holders have still come out ahead and may be betting this consistent income stream can help rebuild momentum.

If Trinity’s mix of steady payouts and choppy performance has you rethinking your watchlist, it could be worth exploring fast growing stocks with high insider ownership as potential next wave opportunities.

Yet with the stock trading below analyst targets despite modest revenue and earnings growth, the key question is whether Trinity is quietly undervalued or whether the market is already pricing in all of its future upside.

Most Popular Narrative: 8.4% Overvalued

Compared with Trinity Industries last close at $27.63, the most widely followed narrative pins fair value closer to $25.50, implying modest downside from here.

A structurally tight railcar market, coupled with elevated scrapping rates outpacing new builds, has led to a contracting railcar fleet; eventual replacement demand and normalized delivery growth should boost order backlog, core segment revenues, and future earnings. Secondary railcar market strength is allowing Trinity to both grow its lease fleet with higher-yielding assets and realize higher gains on portfolio sales, supporting stronger near-term cash flows and enhancing return on equity.

Want to see how steady but unspectacular revenue growth, rising margins, and a lower future earnings multiple still add up to today’s fair value call? The answer is in the projections.

Result: Fair Value of $25.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that outlook could unravel if cyclical end markets weaken or if persistent customer delays keep railcar orders and utilization below expectations.

Find out about the key risks to this Trinity Industries narrative.

Another View: Market Ratios Tell a Different Story

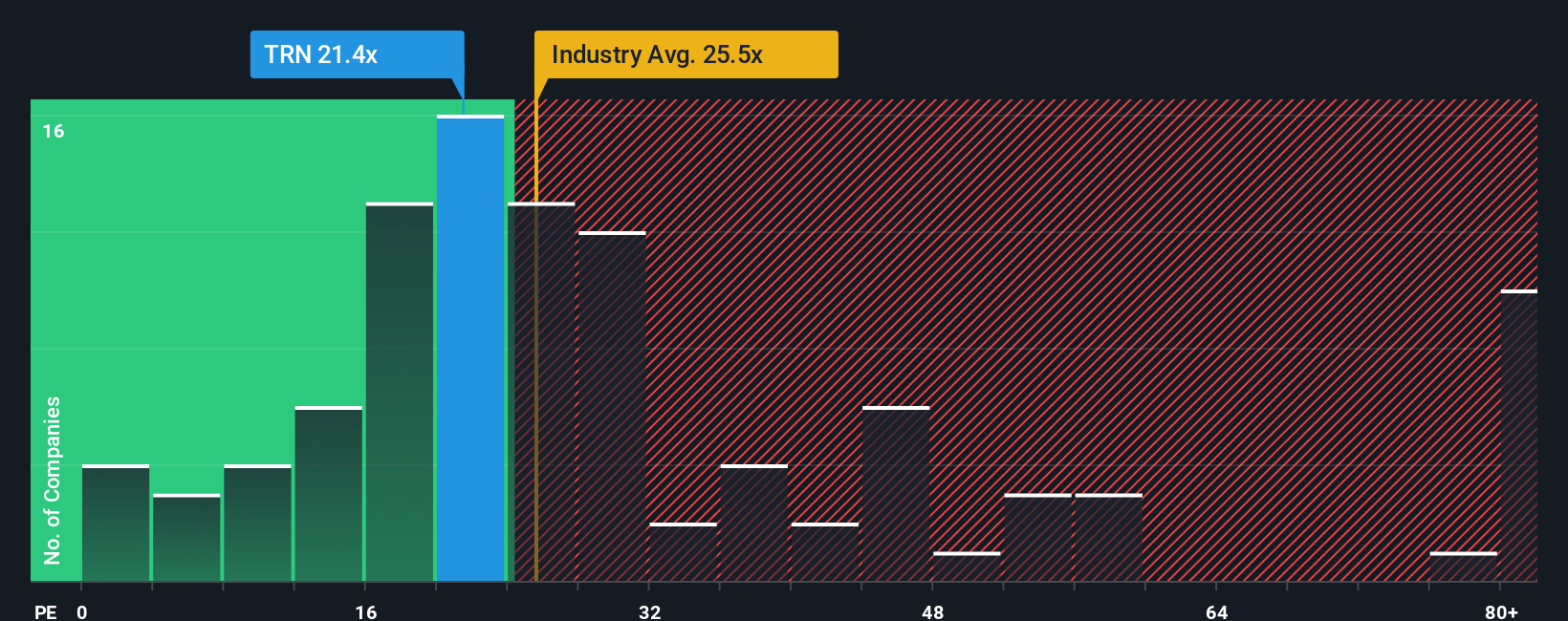

While the narrative points to Trinity being about 8.4 percent overvalued versus a 25.50 dollar fair value, its current price to earnings ratio of 21.4 times sits below the US Machinery industry at 25.3 times, but above both its peer average of 20.1 times and a fair ratio of 18.3 times.

That mix of slightly cheaper than the sector, richer than peers, and still above the fair ratio hints at limited upside if sentiment turns. This raises the question of whether investors are being paid enough for the valuation risk they are taking on.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trinity Industries Narrative

If you see Trinity’s story differently or would rather dig into the numbers yourself, you can build a personalized view in under three minutes: Do it your way.

A great starting point for your Trinity Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one railcar story when you can uncover fresh opportunities across sectors with the Simply Wall St Screener tailored to your strategy.

- Capture growth potential early by scanning these 3571 penny stocks with strong financials that pair smaller market caps with surprisingly solid fundamentals and room to run.

- Target future facing innovation by reviewing these 30 healthcare AI stocks where medicine, data, and automation collide to reshape long term earnings potential.

- Explore income opportunities by filtering for these 15 dividend stocks with yields > 3% that combine attractive yields with balance sheets built to support sustainable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trinity Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRN

Trinity Industries

Provides railcar products and services under the TrinityRail trade name in North America.

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026