- United States

- /

- Machinery

- /

- NYSE:TNC

Undiscovered Gems in United States Stocks To Watch This August 2024

Reviewed by Simply Wall St

The market has been flat over the last week but has risen 22% in the past 12 months, with earnings forecast to grow by 15% annually. In this dynamic environment, identifying undiscovered gems can offer substantial growth potential for investors looking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.32% | 6.73% | ★★★★★★ |

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| United Bancorporation of Alabama | 13.34% | 18.86% | 25.45% | ★★★★★☆ |

| Planet Image International | 119.30% | 2.39% | 0.80% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Republic Bancorp (NasdaqGS:RBCA.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Republic Bancorp, Inc. is a bank holding company for Republic Bank & Trust Company, offering a range of banking products and services in the United States with a market cap of approximately $1.24 billion.

Operations: Republic Bancorp generates revenue primarily from Core Banking - Traditional Banking ($223.15 million), Republic Credit Solutions ($39.93 million), and Tax Refund Solutions ($22.68 million). The company also earns from Warehouse Lending ($9.91 million) and Republic Payment Solutions ($17.85 million).

Republic Bancorp, with total assets of US$6.6 billion and equity of US$955.4 million, has demonstrated robust performance metrics. Total deposits stand at US$5.1 billion while loans are at US$5.2 billion, earning a net interest margin of 4.9%. The company has a sufficient allowance for bad loans at 0.4% and repurchased 3,115,362 shares worth US$111.92 million this year alone. Earnings grew by 10.8% over the past year and are forecasted to grow revenue by 11% annually moving forward.

- Dive into the specifics of Republic Bancorp here with our thorough health report.

Evaluate Republic Bancorp's historical performance by accessing our past performance report.

Tennant (NYSE:TNC)

Simply Wall St Value Rating: ★★★★★★

Overview: Tennant Company, along with its subsidiaries, designs, manufactures, and markets floor cleaning equipment globally and has a market cap of approximately $1.81 billion.

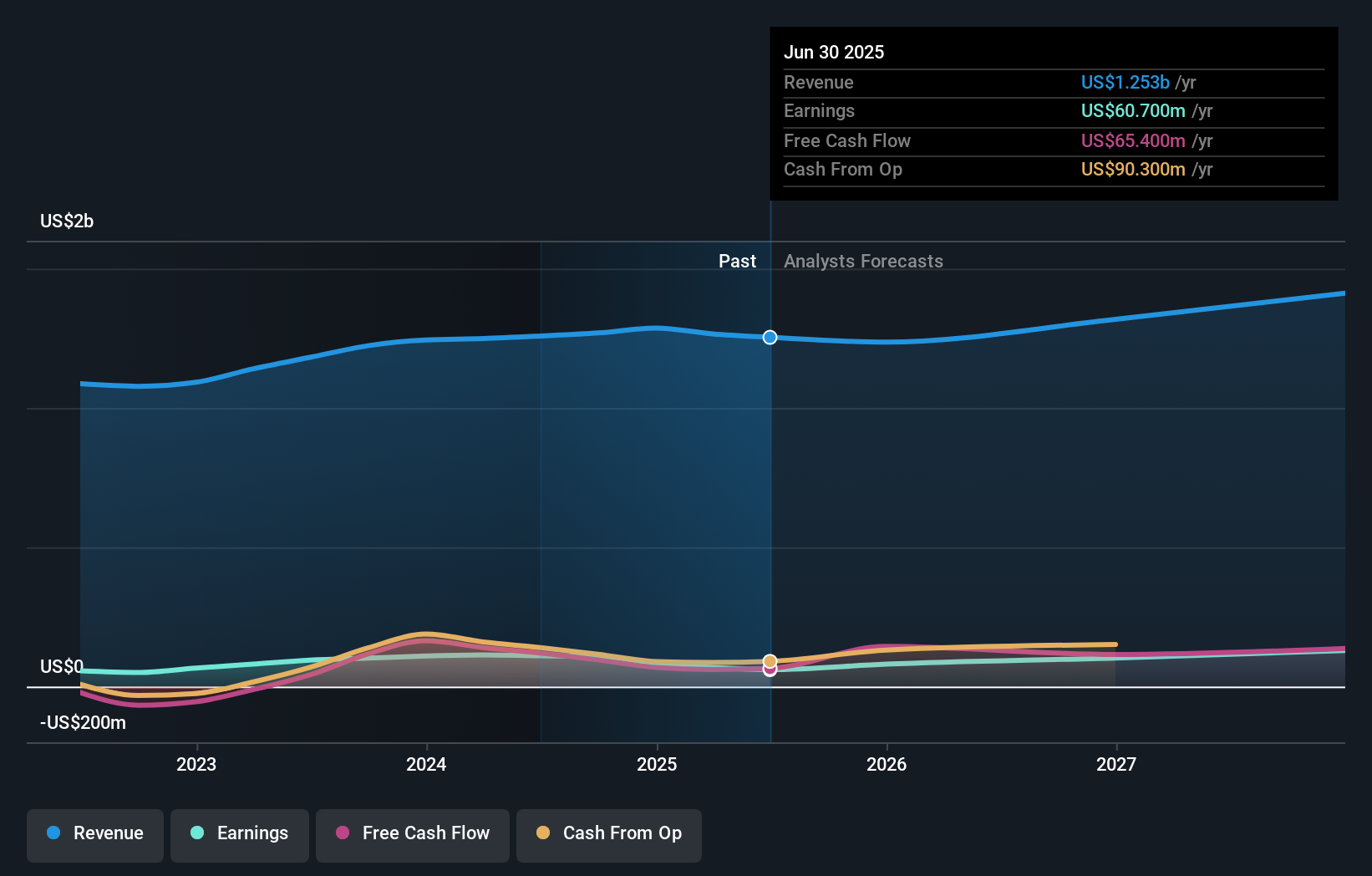

Operations: Tennant generates $1.26 billion from the design, manufacture, and sale of products used in the maintenance of nonresidential surfaces.

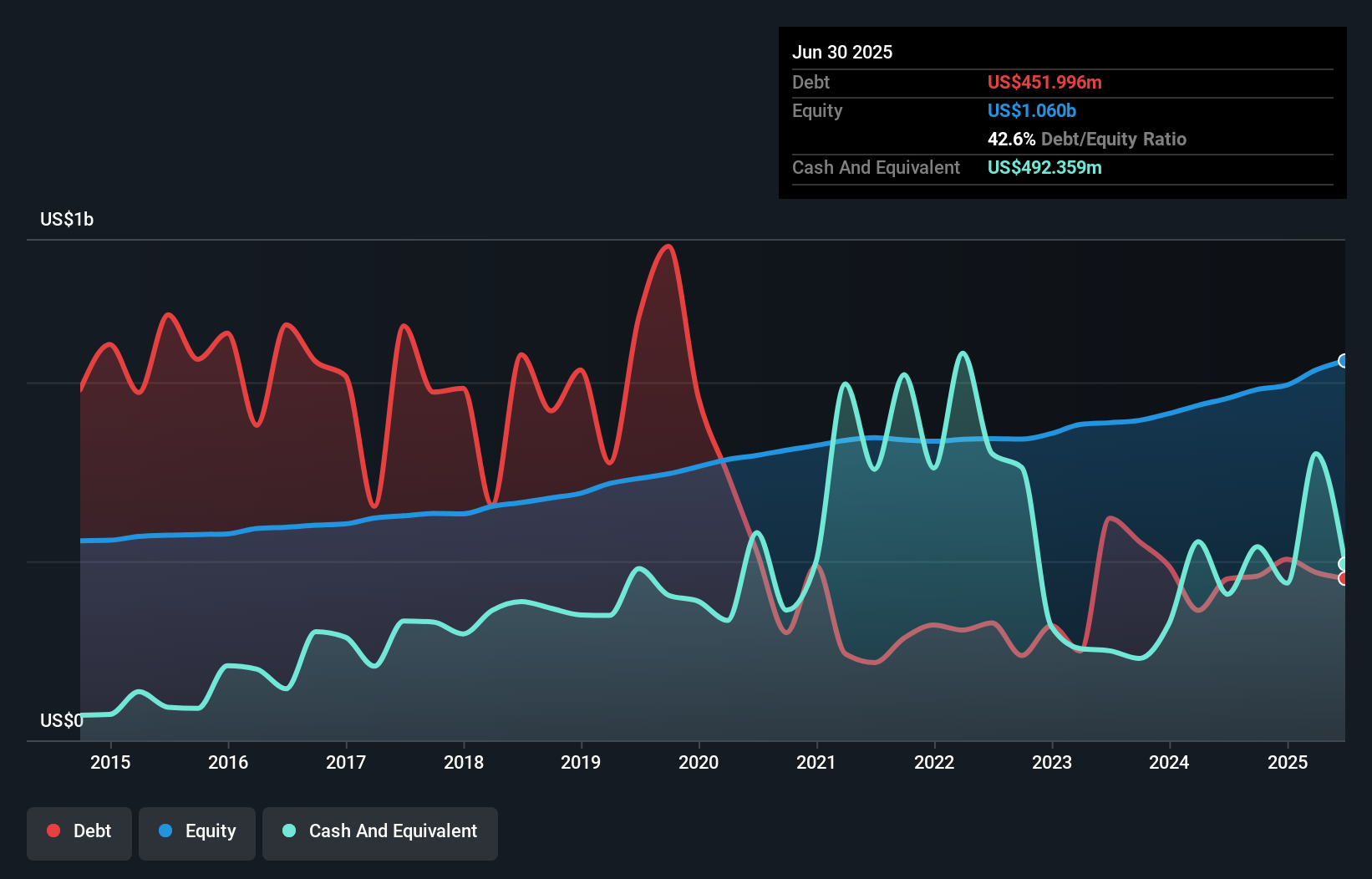

TNC has demonstrated solid performance with earnings growing 16% over the past year, outpacing the Machinery industry’s 9.4%. The debt to equity ratio has significantly improved from 105.6% to 34% over five years, reflecting prudent financial management. Despite a forecasted average annual earnings decline of 3.1% for the next three years, TNC's net debt to equity ratio stands at a satisfactory 20.3%, and its EBIT covers interest payments by a robust factor of 13x.

- Click here and access our complete health analysis report to understand the dynamics of Tennant.

Assess Tennant's past performance with our detailed historical performance reports.

Valhi (NYSE:VHI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Valhi, Inc. operates in the chemicals, component products, and real estate management and development sectors across Europe, North America, the Asia Pacific, and internationally with a market cap of $796.22 million.

Operations: Valhi, Inc. generates revenue primarily from its chemicals segment ($1.78 billion), followed by component products ($157.40 million) and real estate management and development ($78.50 million).

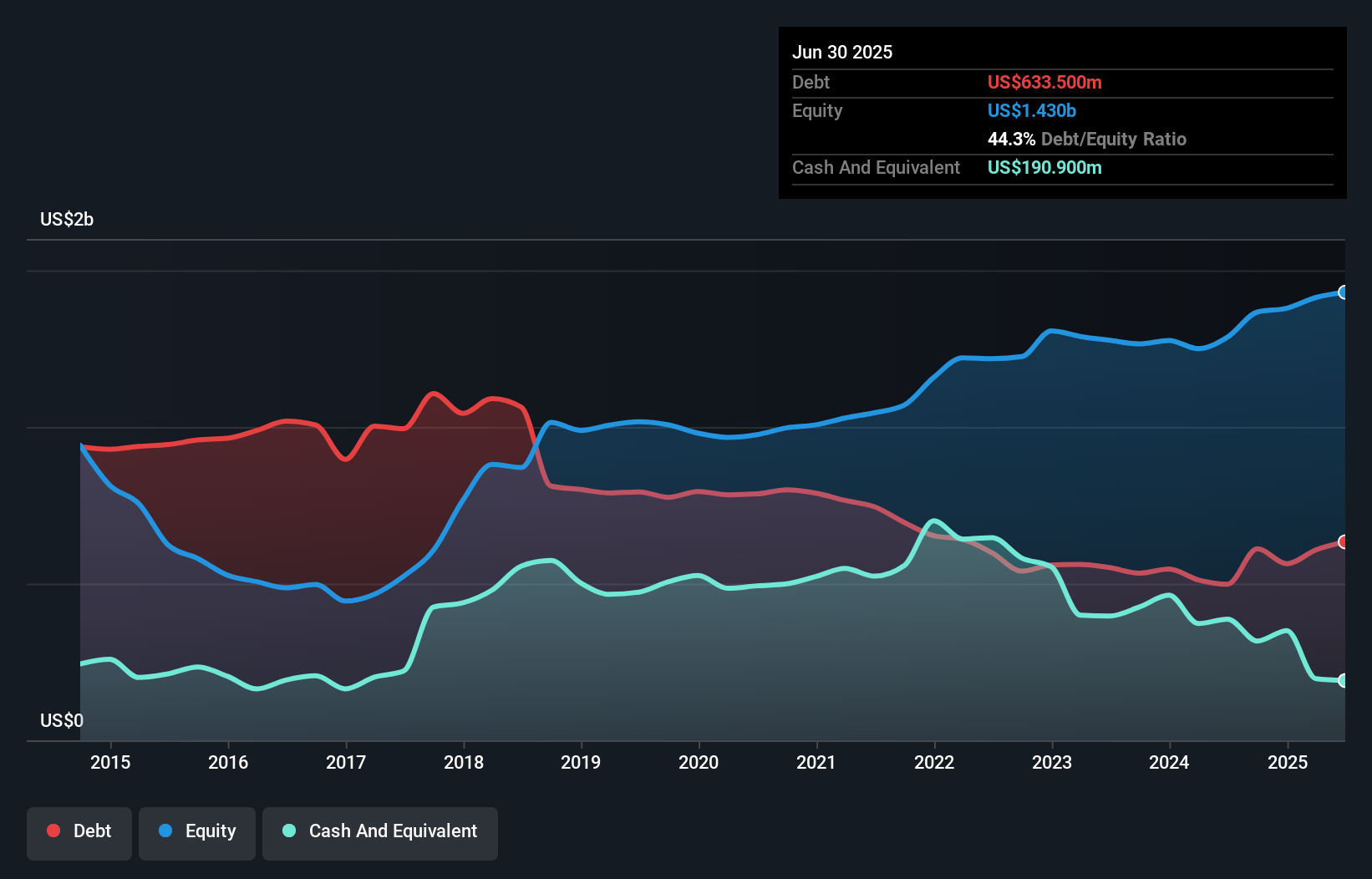

Valhi's earnings surged 215.4% over the past year, outpacing the Chemicals industry which saw a 4.8% drop. Its debt to equity ratio has improved from 78% to 38.7% in five years, and net debt to equity stands at a satisfactory 8.6%. The company reported Q2 sales of US$559.7 million, up from US$507.1 million last year, with net income hitting US$19.9 million compared to a previous loss of US$3.2 million

- Unlock comprehensive insights into our analysis of Valhi stock in this health report.

Review our historical performance report to gain insights into Valhi's's past performance.

Key Takeaways

- Reveal the 221 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tennant might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNC

Tennant

Designs, manufactures, and markets floor cleaning equipment in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with flawless balance sheet and pays a dividend.