- United States

- /

- Machinery

- /

- NYSE:TKR

What Timken (TKR)'s Earnings Beat and ESG Momentum Means For Shareholders

Reviewed by Sasha Jovanovic

- In early December 2025, The Timken Company reported third-quarter revenue of US$1.16 billion, with higher sales, operating earnings, and cash flow than a year earlier, and presented at Goldman Sachs Industrials & Autos Week in London.

- Timken’s strong quarterly beat on analyst expectations came alongside repeated recognition for corporate responsibility and ethics, underscoring a blend of operational and ESG strengths.

- We’ll now examine how Timken’s stronger-than-expected quarterly earnings performance might influence its existing investment narrative and future expectations.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Timken Investment Narrative Recap

To own Timken, you need to believe it can translate its engineered bearings and industrial motion footprint into steady cash generation despite softer industrial demand, margin pressure, and tariff uncertainty. The latest quarterly beat and higher sales offer some relief against those headwinds, but they do not yet change the key short term catalyst of cost savings and pricing actions, nor do they remove the risk from weaker volumes and lower margins.

The most relevant recent development is Timken’s third quarter update, where revenue reached US$1.16 billion, up 2.7% year on year, with stronger operating earnings and cash flow. That result supports the company’s plans to offset tariff costs and pursue US$75 million of cost savings in 2025, which many investors are watching closely as a potential bridge between today’s margin pressure and the longer term benefits of portfolio optimization and renewable energy exposure.

Yet for all the good news, investors should also be aware that weaker organic revenue and tariff related margin pressure could still...

Read the full narrative on Timken (it's free!)

Timken's narrative projects $4.9 billion revenue and $474.3 million earnings by 2028. This requires 2.7% yearly revenue growth and about a $164.5 million earnings increase from $309.8 million today.

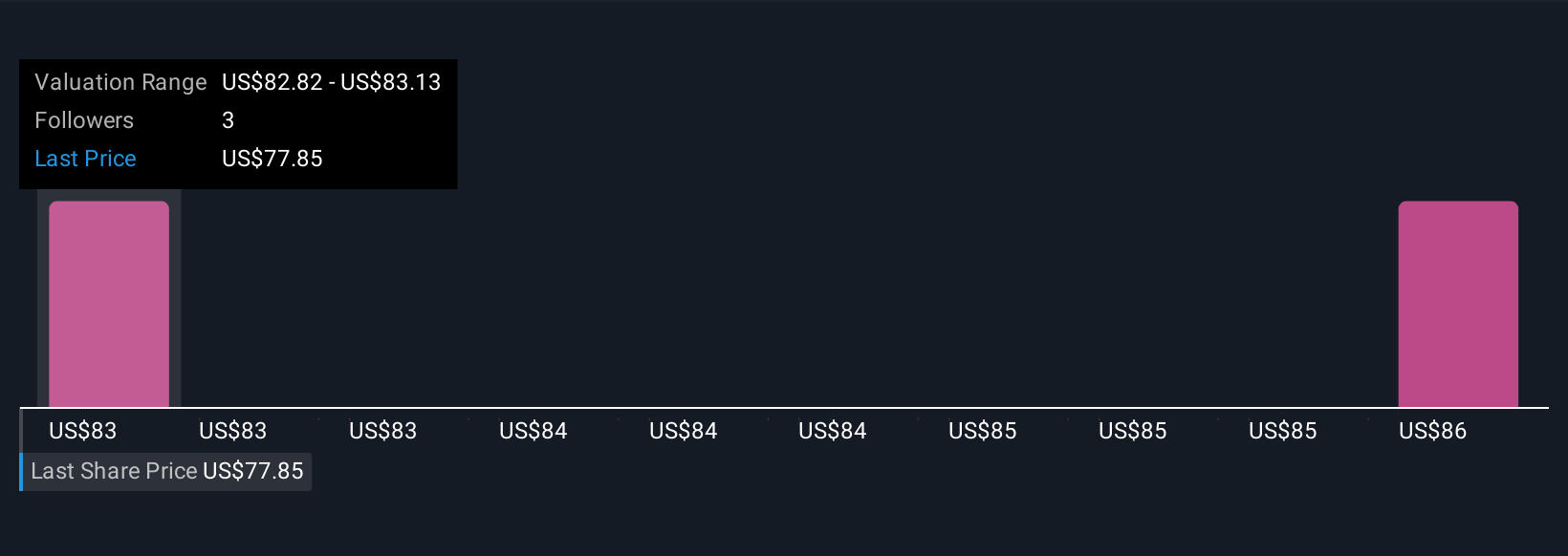

Uncover how Timken's forecasts yield a $87.85 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community currently span roughly US$50 to US$88 per share, showing how differently individual investors view Timken’s potential. As you weigh those views, keep in mind that recent margin pressure and softer industrial volumes may be just as important to future performance as the company’s cost savings and pricing initiatives.

Explore 2 other fair value estimates on Timken - why the stock might be worth as much as 6% more than the current price!

Build Your Own Timken Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Timken research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Timken research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Timken's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Timken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKR

Timken

Designs, manufactures, and sells engineered bearings and industrial motion products, and related services in the United States and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026