Stock Analysis

- United States

- /

- Aerospace & Defense

- /

- NYSE:TGI

Further weakness as Triumph Group (NYSE:TGI) drops 10% this week, taking five-year losses to 34%

Ideally, your overall portfolio should beat the market average. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Triumph Group, Inc. (NYSE:TGI) shareholders for doubting their decision to hold, with the stock down 34% over a half decade. On top of that, the share price is down 10% in the last week.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Triumph Group

Because Triumph Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

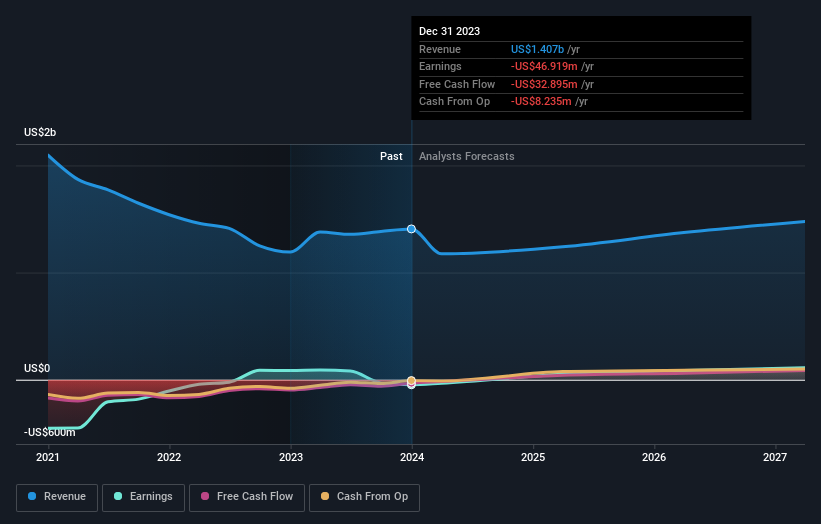

In the last five years Triumph Group saw its revenue shrink by 23% per year. That's definitely a weaker result than most pre-profit companies report. It seems pretty reasonable to us that the share price dipped 6% per year in that time. We doubt many shareholders are delighted with this share price performance. Risk averse investors probably wouldn't like this one much.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Triumph Group will earn in the future (free profit forecasts).

A Different Perspective

Triumph Group shareholders gained a total return of 14% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 6% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Triumph Group better, we need to consider many other factors. Take risks, for example - Triumph Group has 2 warning signs (and 1 which is significant) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Triumph Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TGI

Triumph Group

Designs, engineers, manufactures, repairs, overhauls, and distributes aircraft, aircraft components, accessories, subassemblies, and systems worldwide.

Undervalued with reasonable growth potential.