- United States

- /

- Machinery

- /

- NYSE:TEX

Terex (TEX): Assessing Valuation After Analyst Upgrades and MAGNA’s European Launch

Reviewed by Simply Wall St

Terex (TEX) caught investors attention after the stock climbed about 7% following upbeat analyst sentiment and the European debut of its MAGNA brand, a move that underscores managements push into new markets.

See our latest analysis for Terex.

That upbeat reaction fits a broader pattern, with an 8.3% 1 month share price return and an 11.9% year to date share price gain suggesting momentum is rebuilding even though the 1 year total shareholder return is still slightly negative.

If MAGNA’s expansion has put Terex back on your radar, it could also be a smart time to explore aerospace and defense stocks as potential complementary opportunities in the industrial and defense supply chain.

With analysts seeing nearly 20% upside to their price targets and valuation models implying an even deeper discount, investors now face a key question: Is Terex genuinely undervalued, or is the market already baking in future growth?

Most Popular Narrative: 15.2% Undervalued

With Terex last closing at $49.83 versus a narrative fair value near $58.73, the spread implies the market is still discounting its long term earnings power.

The sustained increase in global infrastructure and manufacturing investment, supported by recent policy incentives such as enhanced bonus depreciation and significant federal construction allocations, is driving multi year demand for Terex's construction, utility, and materials processing equipment, positioning the company for steady revenue growth as both U.S. and international markets upgrade infrastructure and manufacturing capacity.

Curious how steady growth, richer margins, and a lower future earnings multiple can still justify a higher price than today? Explore the narrative math behind this gap.

Result: Fair Value of $58.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates and tariff driven cost inflation could delay equipment purchases and compress margins, which could undermine the upbeat growth narrative.

Find out about the key risks to this Terex narrative.

Another Angle on Valuation

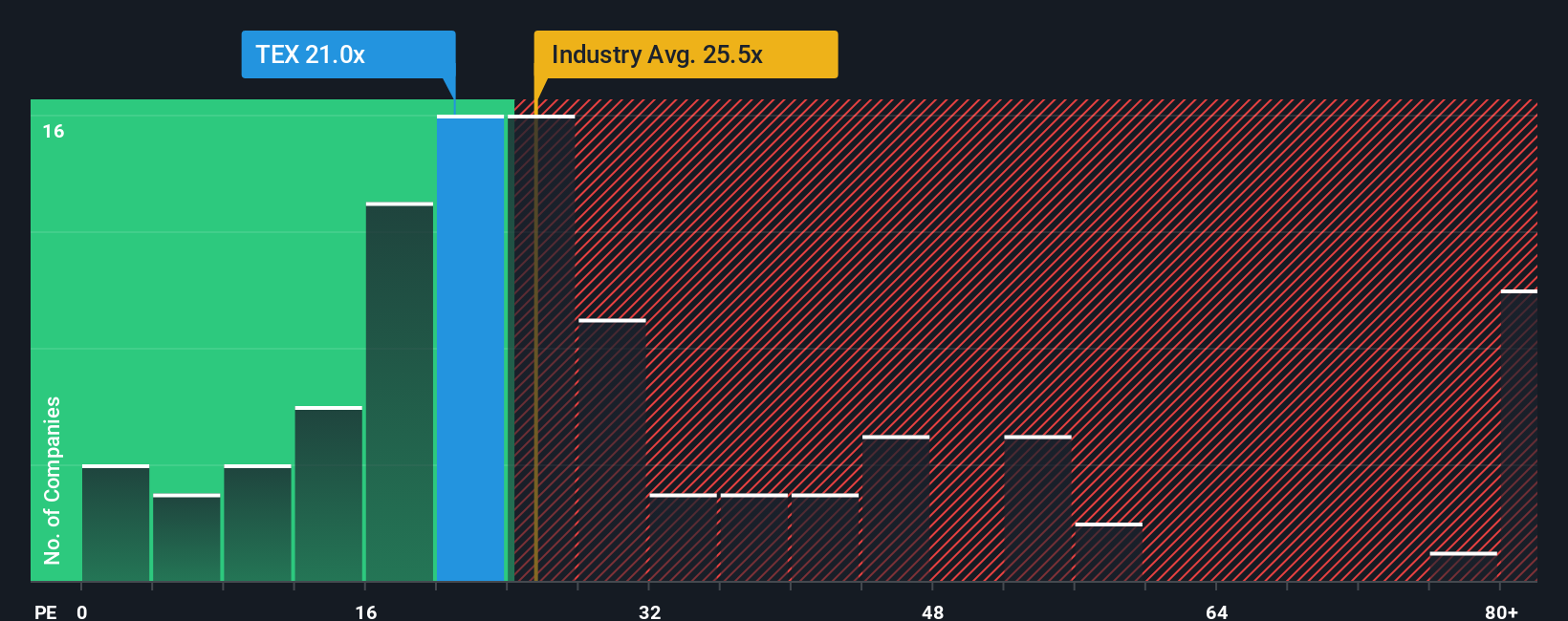

On earnings, Terex trades at 21 times profits, cheaper than the US Machinery industry at 25.5 times but well below its own fair ratio of 32.7 times. That gap looks like upside optionality, yet it also begs the question: what if earnings keep disappointing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Terex Narrative

If you see the story differently, or simply want to dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Terex research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, use the Simply Wall St Screener to uncover fresh opportunities that fit your strategy instead of chasing headlines.

- Capture early growth potential by reviewing these 3573 penny stocks with strong financials that already show financial strength instead of relying on pure speculation.

- Position your portfolio for tomorrow’s technologies by targeting these 26 AI penny stocks that combine innovation with real business traction.

- Focus on these 15 dividend stocks with yields > 3% that aim to provide income and stability, which may help support returns when sentiment is volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEX

Terex

Provides materials processing machinery and mobile elevating work platform worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026