- United States

- /

- Machinery

- /

- NYSE:TEX

Is Terex’s (TEX) MAGNA Europe Launch Reframing Its Global Expansion and Profitability Narrative?

Reviewed by Sasha Jovanovic

- Terex recently introduced its MAGNA brand to European customers, using a launch event to highlight the brand’s position and product lineup across the region.

- This move, combined with upbeat analyst coverage, points to how brand expansion in Europe is becoming a meaningful part of Terex’s broader growth story.

- Next, we’ll explore how the MAGNA launch in Europe may influence Terex’s existing investment narrative around global expansion and profitability.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Terex Investment Narrative Recap

To own Terex, you generally need to believe the company can translate its global footprint and equipment brands into improving profitability despite cyclical end markets and tariff pressures. The MAGNA launch in Europe, alongside upbeat analyst coverage, reinforces the global expansion angle, but does not change that the most immediate catalyst is restoring earnings power, while the biggest near term risk remains weak construction demand and cautious capital spending that could limit equipment orders.

Among recent announcements, Terex’s reiterated 2025 guidance for net sales of US$5,300 million to US$5,500 million and EPS of US$4.70 to US$5.10 is especially relevant. It frames how management currently sees demand and margins holding up as MAGNA expands in Europe, while tariff related cost inflation and softer European construction activity sit in the background as key swing factors for both revenue and earnings.

Yet investors should be aware that prolonged hesitation on equipment purchases and rental fleet decisions could...

Read the full narrative on Terex (it's free!)

Terex's narrative projects $6.1 billion revenue and $525.7 million earnings by 2028. This requires 6.0% yearly revenue growth and a roughly $346.7 million earnings increase from $179.0 million today.

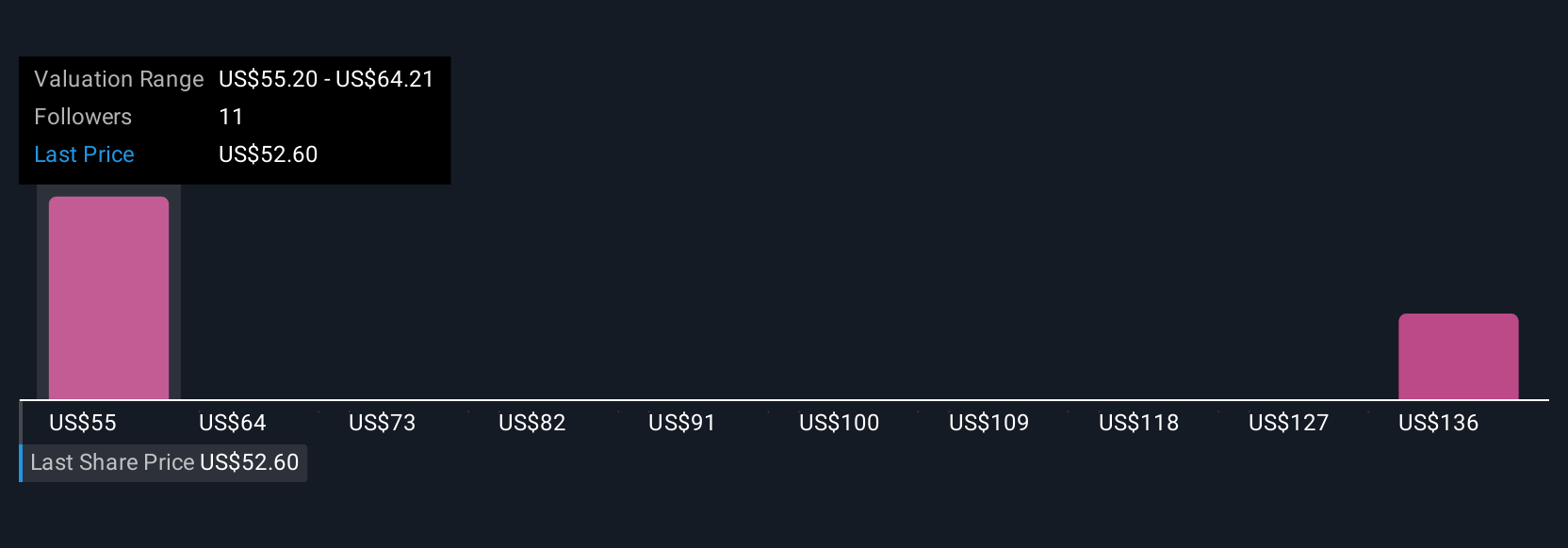

Uncover how Terex's forecasts yield a $58.73 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently see Terex’s fair value between US$51.89 and US$93.06, highlighting very different expectations. When you set those views against risks like persistently weak European construction demand, it underlines why examining several perspectives can be so important to understanding Terex’s future performance.

Explore 4 other fair value estimates on Terex - why the stock might be worth just $51.89!

Build Your Own Terex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Terex research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Terex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Terex's overall financial health at a glance.

No Opportunity In Terex?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEX

Terex

Provides materials processing machinery and mobile elevating work platform worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026