- United States

- /

- Electrical

- /

- NYSE:TE

T1 Energy: Assessing Valuation After Major Solar Cell Partnership Announcement in Texas

Reviewed by Kshitija Bhandaru

T1 Energy (TE) has captured attention following its recent investment in Talon PV LLC, establishing a partnership to produce advanced solar cells in Texas. The collaboration aims to support growth for American solar manufacturing and create domestic job opportunities.

See our latest analysis for T1 Energy.

T1 Energy’s latest move clearly struck a chord with investors, as the stock’s 7-day share price return surged over 43%. This built on massive momentum with a 94.7% climb in the last month. Momentum really took off this year, with the 1-year total shareholder return topping 250%, even as longer-term returns are still catching up from past declines.

If you find these shifts in the renewables space compelling, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares riding a powerful wave of optimism, the key question for investors now is whether T1 Energy is still trading at a bargain or if the market has already factored in all its future potential.

Most Popular Narrative: 21% Overvalued

Despite ambitious expectations for rapid business expansion and strong tailwinds, the current market price of $3.64 sits noticeably above the $3.00 fair value suggested by the most widely tracked narrative. Here is the core fundamental argument behind that valuation outlook.

The expansion of U.S. electricity demand, driven by the AI infrastructure build-out, electrification of transportation, and onshoring of advanced manufacturing, positions T1 as a key provider of solar modules and storage solutions for a rapidly growing market, supporting sustained topline revenue growth. Robust government policy tailwinds, including stackable, transferable Section 45X tax credits and protectionist trade measures, are providing T1 with access to funding, margin-boosting incentives, and risk mitigation for its U.S. production pipeline. This should improve both earnings quality and net margins.

Earnings power, revenue takeoff, and government incentives all build a case for T1’s future valuation leap. Analysts are betting on exceptional growth prospects and big margin improvements, but only the full narrative breaks down the bold assumptions fueling this premium price tag.

Result: Fair Value of $3.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if government incentives weaken or T1 Energy fails to secure project financing, the company’s impressive growth outlook could encounter significant short-term hurdles.

Find out about the key risks to this T1 Energy narrative.

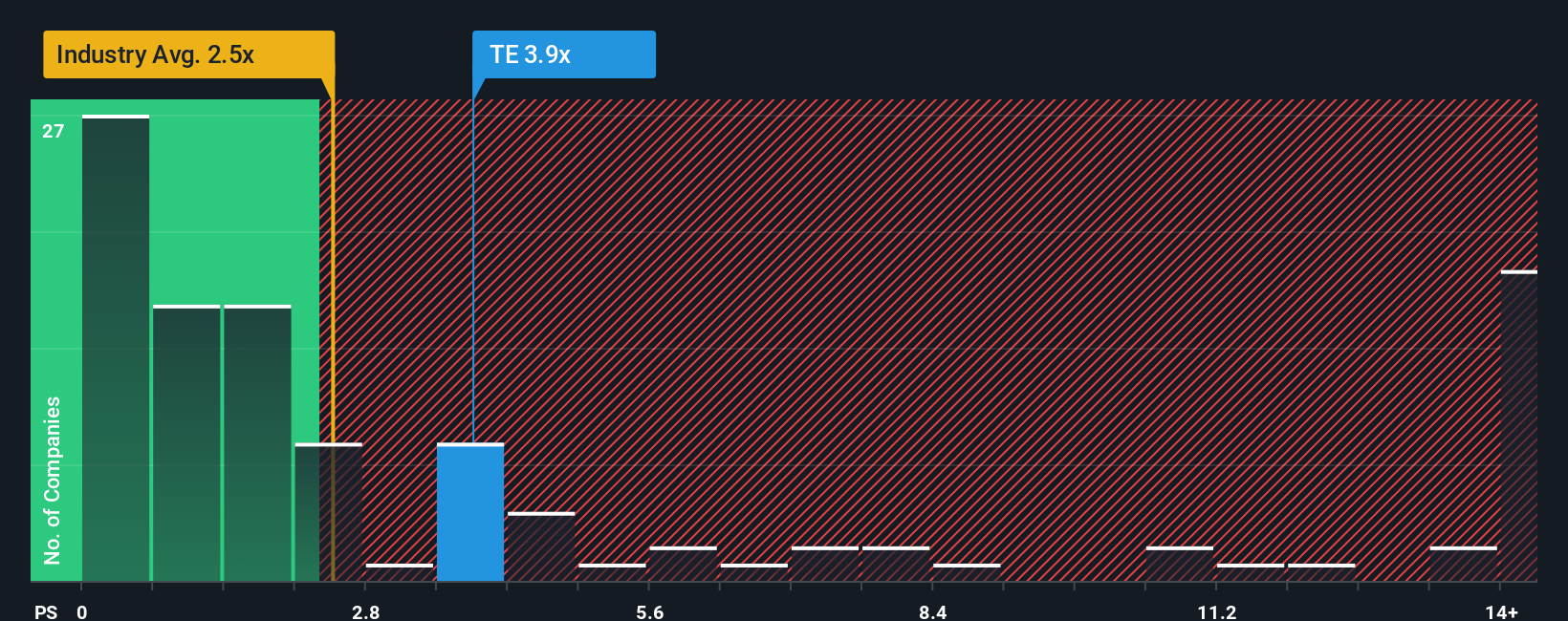

Another View: Market Ratios Send a Mixed Signal

Looking at the price-to-sales ratio, T1 Energy appears reasonably valued against its peers. It trades at 3x sales, well below the average peer multiple of 15.4x and the fair ratio of 36.7x. However, compared to the US Electrical industry’s average of 2.3x, it appears slightly more expensive. Does this gap mean hidden risks, or could the market re-rate the stock closer to those higher multiples?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own T1 Energy Narrative

If you'd rather draw your own conclusions or find this perspective unconvincing, you can check the numbers yourself and craft your own view in just a few minutes. Do it your way.

A great starting point for your T1 Energy research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that real opportunities come from looking beyond today’s headlines. Put yourself ahead by using the Simply Wall Street Screener to chart your own course with fresh investment ideas you might otherwise miss.

- Uncover companies benefiting from digital payments, network security, and blockchain tech by stepping into these 79 cryptocurrency and blockchain stocks leaders who are influencing the future of finance.

- Target cash-generating stocks that offer steady income and resilience in changing markets by tapping into these 19 dividend stocks with yields > 3% with yields over 3%.

- Spot growth stories and strong fundamentals where the market is still undervaluing potential, using these 899 undervalued stocks based on cash flows to get ahead before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T1 Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TE

T1 Energy

Provides energy solutions for solar and batteries in the United States and Norway.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives