- United States

- /

- Aerospace & Defense

- /

- NYSE:TDG

Will TransDigm Group’s (TDG) Leadership Transition Reinforce Its Acquisition-Driven Growth Ambitions?

Reviewed by Sasha Jovanovic

- TransDigm Group appointed Mike Lisman as President, effective October 1, 2025, following the retirement of long-serving CEO Kevin Stein and after Lisman's tenure as Co-Chief Operating Officer and Chief Financial Officer.

- Lisman's deep experience in TransDigm's M&A activities aligns with recent analyst focus on the company's acquisition capacity and growth prospects in the aerospace sector.

- We'll assess how Lisman's leadership and M&A background could influence TransDigm's investment narrative amid heightened analyst expectations.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

TransDigm Group Investment Narrative Recap

To invest in TransDigm Group, you need to believe in the durability of its high-margin aftermarket aerospace business and its proven ability to grow through targeted acquisitions. The recent appointment of Mike Lisman as President reinforces the company’s focus on M&A but does not materially alter the near-term catalyst, which remains the potential for deal-making to boost growth, or the core risk, which is the company’s heavy leverage and associated sensitivity to higher interest expenses.

Among recent company news, TransDigm’s September 2025 refinancing of $1,857 million in term loans stands out, directly relevant given the company’s ongoing acquisitive strategy and the market’s focus on its capital structure. This move is closely linked to analyst commentary that highlights both the catalyst of M&A-driven upside and the risk of constrained financial flexibility if borrowing costs rise.

Yet, against the prospect of further acquisitions, investors should be aware of the company’s existing debt load and how quickly...

Read the full narrative on TransDigm Group (it's free!)

TransDigm Group's narrative projects $10.8 billion in revenue and $2.5 billion in earnings by 2028. This assumes an 8.0% annual revenue growth rate and a $0.7 billion increase in earnings from the current $1.8 billion.

Uncover how TransDigm Group's forecasts yield a $1586 fair value, a 23% upside to its current price.

Exploring Other Perspectives

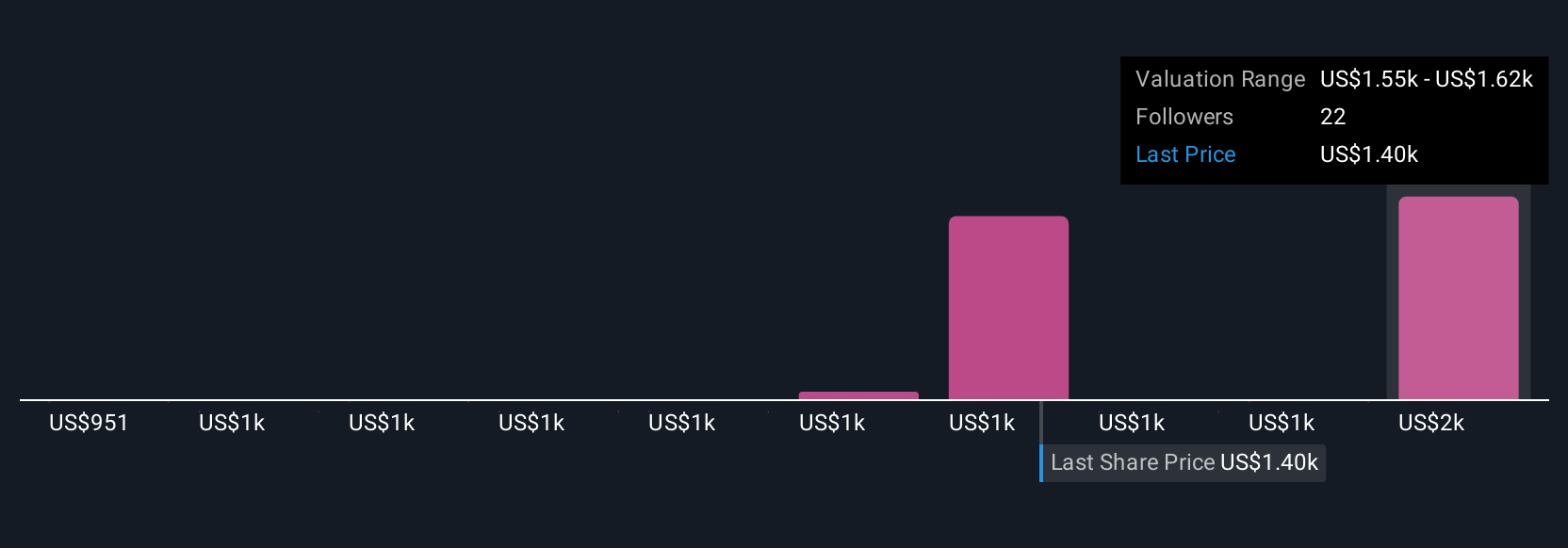

Seven individual fair value estimates from the Simply Wall St Community range from US$951 to US$1,586 per share, reflecting wide-ranging outlooks on growth and risk. While some see upside, the continued pressure of high leverage may affect earnings if rate conditions shift, so it pays to consider more than one viewpoint.

Explore 7 other fair value estimates on TransDigm Group - why the stock might be worth as much as 23% more than the current price!

Build Your Own TransDigm Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TransDigm Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TransDigm Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TransDigm Group's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransDigm Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDG

TransDigm Group

Designs, produces, and supplies aircraft components in the United States and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives