- United States

- /

- Aerospace & Defense

- /

- NYSE:TDG

A Look at TransDigm Group’s (TDG) Valuation After Leadership Transition to New President

Reviewed by Kshitija Bhandaru

TransDigm Group (TDG) has made headlines after announcing that Mike Lisman is stepping in as President, succeeding Kevin Stein following Stein’s retirement. Leadership transitions like this often spark investor curiosity about strategic direction.

See our latest analysis for TransDigm Group.

TransDigm Group has not only ushered in a new president, but also wrapped up a major $765 million acquisition of Simmonds Precision Products and returned cash to shareholders through a special $90 per share dividend and recent buybacks. Even with these milestones, momentum in the share price has softened. A 1-year total shareholder return of -3.2% contrasts with hefty three- and five-year total returns of over 190% and 210% respectively, signaling that long-term holders have been well rewarded even as recent sentiment cools.

If you’re curious where the next big story might come from, now’s the ideal moment to expand your search and discover fast growing stocks with high insider ownership

With the share price lagging despite bullish long-term returns and robust fundamentals, the key question is whether TransDigm’s stock is undervalued at current levels or if investors have already priced in the company’s future growth trajectory.

Most Popular Narrative: 19% Undervalued

TransDigm Group’s prevailing narrative prices in much more upside than the last close of $1,277.99. The fair value calculation implies significant room for the stock to run.

Air travel demand continues to increase globally, with airlines maintaining high aircraft utilization and OEMs (Boeing and Airbus) working through exceptionally long backlogs. This indicates a coming rebound in OEM build rates and sustained, recurring aftermarket demand, both set to drive top-line revenue growth as current supply chain challenges ease.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Interested in which bold financial projections support that price target? Dive deeper to see the surprising numbers that drive this fair value calculation.

Result: Fair Value of $1,586 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including TransDigm’s heavy reliance on legacy aftermarket revenues and high leverage. These factors could challenge future growth if market dynamics shift.

Find out about the key risks to this TransDigm Group narrative.

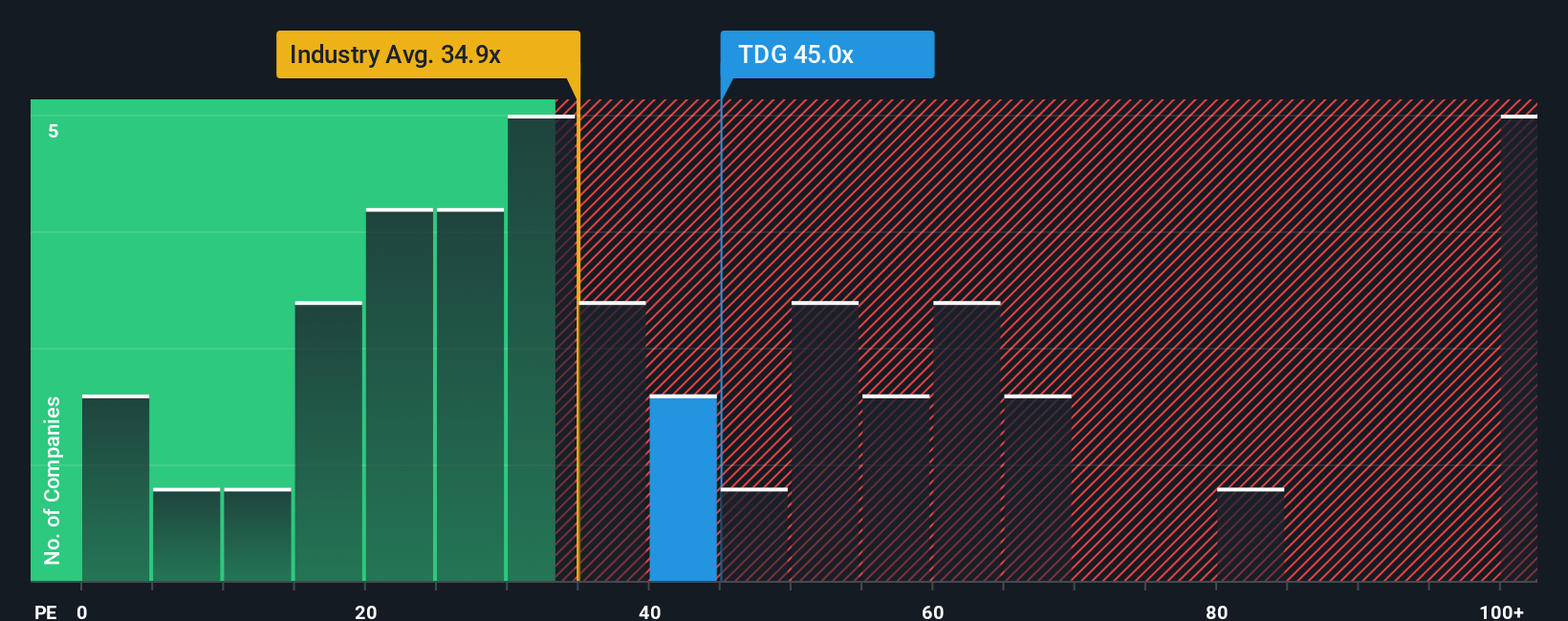

Another View: High Earnings Multiple Points to Lofty Expectations

Taking a look through the lens of earnings multiples, TransDigm Group’s stock appears pricey. Its current price-to-earnings ratio is 41.1x, well above the peer average of 32.5x and also higher than the fair ratio of 30.6x that the market could eventually rotate toward. This gap points to elevated expectations and potential valuation risk if growth falters. Could investors be betting on too much future upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransDigm Group Narrative

If you have your own perspective or want to dig into the numbers yourself, crafting your personal take on TransDigm’s outlook takes just a few minutes. Do it your way

A great starting point for your TransDigm Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your research further and stay ahead of the curve by checking out standout opportunities beyond TransDigm. The smartest investors keep an eye on what is working now.

- Boost your portfolio with steady income by checking out these 19 dividend stocks with yields > 3%, which offers attractive yields above 3% from resilient companies.

- Catch the momentum behind breakthrough tech by scouting these 24 AI penny stocks, which set new standards in artificial intelligence and automation.

- Start your search for tomorrow’s hidden gems by evaluating these 3581 penny stocks with strong financials, thriving on solid financials and rapid growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransDigm Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDG

TransDigm Group

Designs, produces, and supplies aircraft components in the United States and internationally.

Low risk with questionable track record.

Similar Companies

Market Insights

Community Narratives