- United States

- /

- Machinery

- /

- NYSE:SWK

Potential Upside For Stanley Black & Decker, Inc. (NYSE:SWK) Not Without Risk

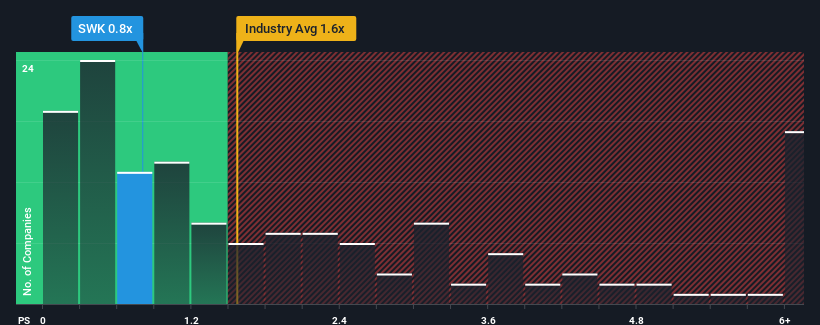

You may think that with a price-to-sales (or "P/S") ratio of 0.8x Stanley Black & Decker, Inc. (NYSE:SWK) is a stock worth checking out, seeing as almost half of all the Machinery companies in the United States have P/S ratios greater than 1.6x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Stanley Black & Decker

What Does Stanley Black & Decker's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Stanley Black & Decker's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Stanley Black & Decker will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Stanley Black & Decker would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 4.1% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 8.1% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 2.7% per year during the coming three years according to the analysts following the company. That's shaping up to be similar to the 3.3% per annum growth forecast for the broader industry.

In light of this, it's peculiar that Stanley Black & Decker's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Stanley Black & Decker currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware Stanley Black & Decker is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SWK

Stanley Black & Decker

Provides hand tools, power tools, outdoor products, and related accessories in the United States, Canada, Other Americas, Europe, and Asia.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives