- United States

- /

- Machinery

- /

- NYSE:SWK

Can Stanley (SWK) Sustain Momentum by Turning Trendy Tumblers Into Lasting Brand Strength?

Reviewed by Sasha Jovanovic

- In recent days, Stanley Black & Decker experienced heightened consumer attention following the rapid sell-out of its new Quencher Luxe Tumblers and major promotional activity through Amazon’s Prime Big Deal Days. This surge in demand has spotlighted the company's success in merging functional performance with high-end design to capture changing consumer tastes.

- We’ll examine how this strong reception of new lifestyle products and promotional wins may influence Stanley Black & Decker’s investment case.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Stanley Black & Decker Investment Narrative Recap

To be a Stanley Black & Decker shareholder today, you need to believe the company can convert strong consumer demand for premium products, like the recent sell-out of its Quencher Luxe Tumblers, into sustainable revenue and margin growth. While this product excitement demonstrates potential for trend-driven sales, it does not appear to materially shift the most important short-term catalyst, progress on cost-out and supply chain transformation, or offset the main risk of continued flat demand in core DIY and outdoor markets.

Of the company's recent announcements, the upcoming Q3 2025 earnings report is especially relevant. Investors looking for confirmation that lifestyle product launches are translating into improved sales or profitability will be focused on whether these one-off wins help reverse the trend of declining revenues seen in recent quarters, as management targets better margins and earnings through efficiency gains.

However, while product sell-outs are positive, investors should also be aware that persistently sluggish demand in core channels could still limit Stanley Black & Decker’s ability to...

Read the full narrative on Stanley Black & Decker (it's free!)

Stanley Black & Decker's outlook anticipates revenue of $16.8 billion and earnings of $1.3 billion by 2028. This is based on a projected annual revenue growth rate of 3.5% and an earnings increase of $821.7 million from current earnings of $478.3 million.

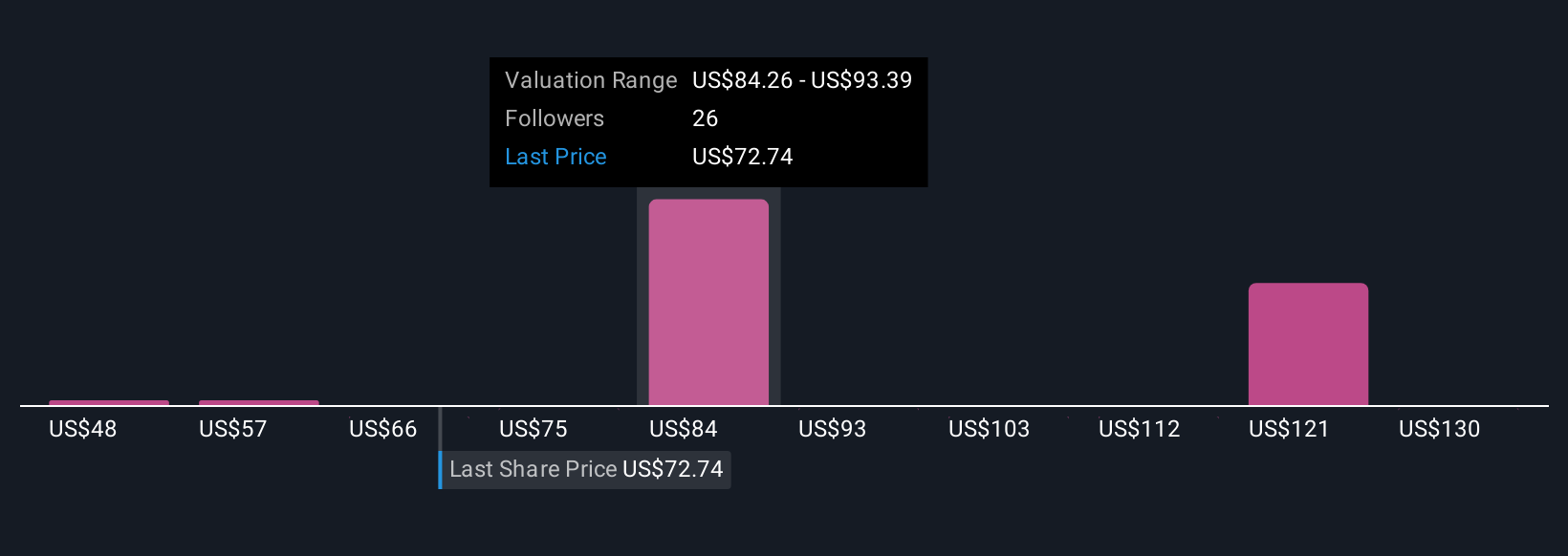

Uncover how Stanley Black & Decker's forecasts yield a $87.82 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members gave 10 separate fair value estimates for the stock ranging from US$47.77 to US$139, reflecting a broad spectrum of investor outlooks. While many anticipate margin improvement from ongoing supply chain changes, shifting DIY demand remains an open question for future company performance and could have wide-reaching implications, review several viewpoints to inform your position.

Explore 10 other fair value estimates on Stanley Black & Decker - why the stock might be worth 26% less than the current price!

Build Your Own Stanley Black & Decker Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stanley Black & Decker research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Stanley Black & Decker research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stanley Black & Decker's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SWK

Stanley Black & Decker

Provides hand tools, power tools, outdoor products, and related accessories in the United States, Canada, Other Americas, Europe, and Asia.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives