- United States

- /

- Electrical

- /

- NYSE:STEM

Can Stem’s (STEM) Berlin Expansion Reveal Its Strategy for Scaling Renewables Across EMEA?

Reviewed by Sasha Jovanovic

- Stem, Inc. recently expanded its Berlin operations by relocating to centralized and collaborative facilities, emphasizing its focus on utility-scale solar, storage, and hybrid projects across the EMEA region.

- This move signals Stem's intent to deepen its presence in international renewable energy markets and support large-scale clean energy initiatives in Europe, the Middle East, and Africa.

- We'll explore how Stem's commitment to utility-scale project growth in EMEA could influence its investment trajectory and long-term outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Stem Investment Narrative Recap

To own shares in Stem, I believe you ultimately have to trust in its transition from hardware to software, its ability to expand internationally, and that it can balance growth with profitability despite ongoing volatility. While the Berlin expansion highlights international ambitions and recognition of utility-scale opportunities in EMEA, it does not materially change the company’s most important short-term catalyst: accelerating software and recurring revenue growth. The biggest risk, continued margin pressure from cost competition, remains unchanged and just as relevant in the wake of this news.

The September launch of Stem’s PowerTrack Energy Management System (EMS) offers more direct context for the Berlin move, as the solution is designed for scalable deployment across new international markets. PowerTrack’s flexible, AI-enabled platform is positioned to underpin revenue and margin expansion, which directly connects to the company’s pivot toward higher-margin, recurring software revenue, the catalyst closely watched by investors right now.

Yet in contrast to these growth prospects, investors should be aware that ongoing margin pressure from new entrants and pricing competition remains a risk that could ...

Read the full narrative on Stem (it's free!)

Stem's narrative projects $217.2 million revenue and $22.3 million earnings by 2028. This requires 11.7% yearly revenue growth and a $44.2 million earnings increase from -$21.9 million.

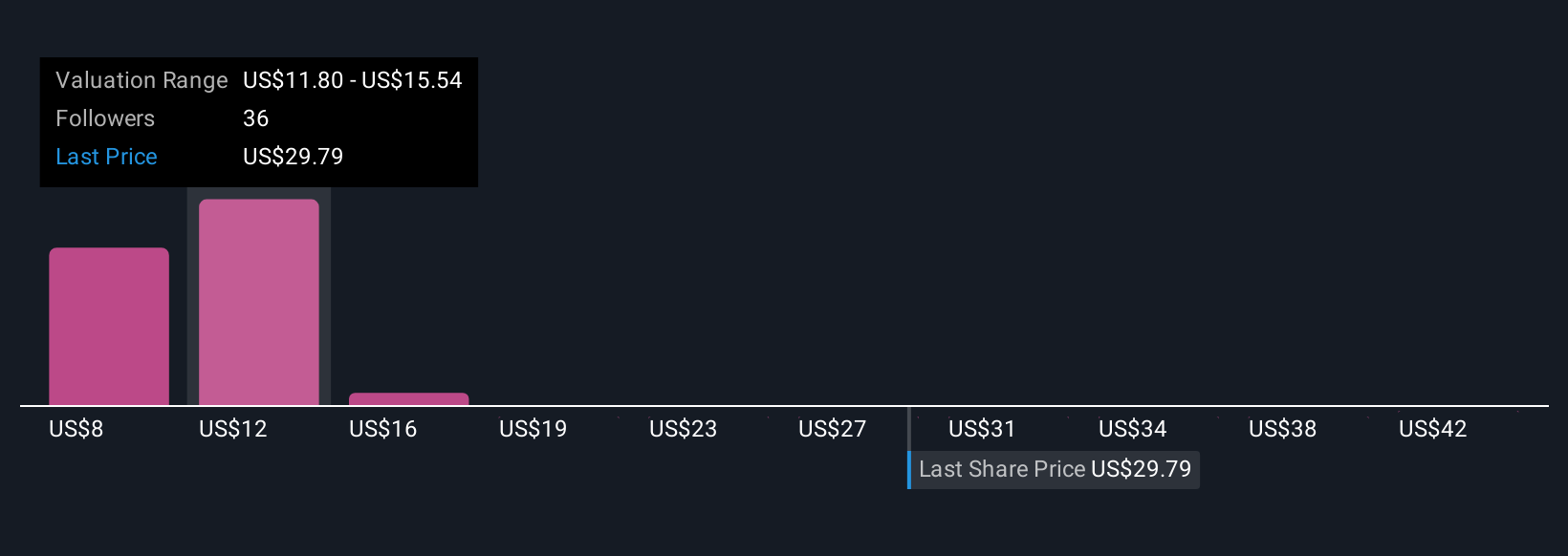

Uncover how Stem's forecasts yield a $14.67 fair value, a 47% downside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community members estimate fair values for Stem between US$11.01 and US$45.46 per share, showing a wide spectrum of conviction. While recurring revenue growth is a focus, be mindful that market participants see outcomes for Stem’s future performance quite differently, explore several perspectives before making up your mind.

Explore 4 other fair value estimates on Stem - why the stock might be worth less than half the current price!

Build Your Own Stem Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stem research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Stem research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stem's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 39 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STEM

Stem

Provides artificial intelligence driven software and services that enable its customers to plan, deploy, and operate clean energy assets in the United States and internationally.

Slight risk with moderate growth potential.

Market Insights

Community Narratives