- United States

- /

- Electrical

- /

- NYSE:ST

Sensata Technologies (ST): Assessing Valuation as Earnings Set to Double, Investor Interest Grows

Reviewed by Kshitija Bhandaru

If you’ve been following Sensata Technologies Holding (ST), you might have noticed some chatter around the stock lately. The latest analysis points out that Sensata is trading below its intrinsic value, even as new forecasts suggest the company’s earnings could double in the next few years. This dynamic has put Sensata on the radar for those looking for value with a side of growth potential, especially after a stretch of steady price gains for the company.

In context, the stock’s performance has been a bit of a mixed bag. Over the past year, Sensata shares have declined by 11%, pulled lower by broader market volatility and shifting investor sentiment. However, there has been renewed momentum lately, as the stock has climbed about 15% since the start of the year and nearly 8% in the past three months. This trend hints that the market may be warming up to its improving outlook. Sensata’s recent financial results underscore this, with annual net income growth outpacing revenue gains. This signals stronger underlying profitability compared to previous periods.

But is this recent uptick just the beginning of a bigger run, or has the market already factored in all of Sensata’s expected growth? Let’s dig into the numbers to see if there’s genuine value left on the table.

Most Popular Narrative: 17.9% Undervalued

According to the most widely followed narrative, Sensata Technologies Holding appears undervalued, trading below its estimated fair value despite robust growth expectations and recent positive momentum.

New business wins and market share gains with leading Chinese new energy vehicle (NEV) OEMs position Sensata to benefit from rapid electrification in China and internationally. This is expected to drive higher revenue growth as revenue from these customers ramps up in late 2025 and 2026. The scaling of gas leak detection and specialty sensing products, supported by increasingly stringent safety and environmental regulations, is delivering outgrowth in industrials and is expected to expand further into Europe and Asia. This creates recurring high-margin revenue streams and supports margin expansion.

Curious how analysts justify such a bullish target for Sensata? Dive into the narrative shaping this valuation. There are bold growth forecasts for both sales and profits, and the path to higher margins is well established. The details powering these assumptions might surprise you.

Result: Fair Value of $38.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, mounting price competition in China and evolving technology trends could both test Sensata’s ability to sustain its projected profit margins in the coming years.

Find out about the key risks to this Sensata Technologies Holding narrative.Another View: What Does the Market Say?

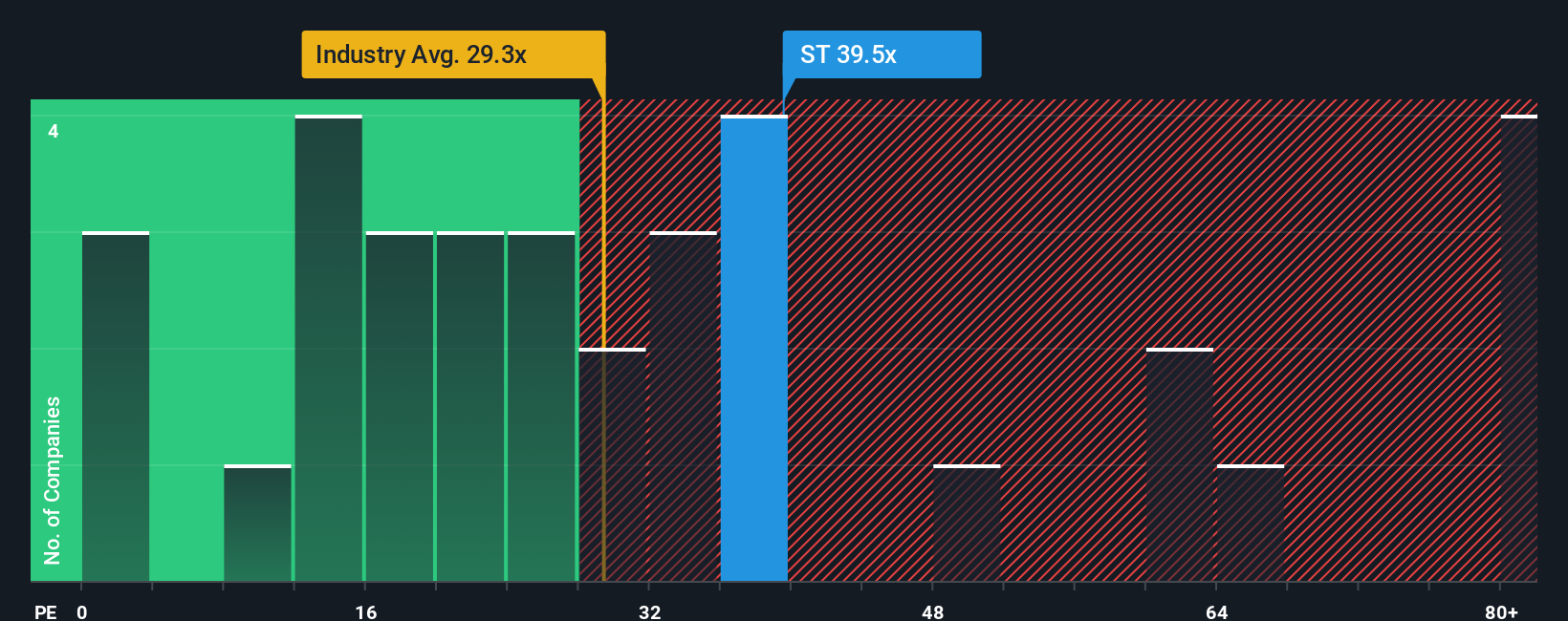

Looking at another angle, based on its price relative to earnings, Sensata appears more expensive than most of its industry peers. While one approach points to upside, this creates a different story. Which perspective do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sensata Technologies Holding Narrative

If this outlook doesn’t quite fit your view or you’d rather dig into the numbers yourself, it’s quick and easy to craft your own take on Sensata’s story. Do it your way.

A great starting point for your Sensata Technologies Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Miss out on these investment trends and you could leave serious upside on the table. If you want your next move to count, check out some of the market's strongest opportunities below.

- Uncover hidden gems in the market by tracking penny stocks with strong financials using penny stocks with strong financials. This can help you identify potential breakout winners.

- Tap into a wave of innovation by researching cutting-edge AI companies with AI penny stocks. This is ideal for those looking to participate in the artificial intelligence surge.

- Boost your portfolio’s income potential and stability by following dividend stocks with yields above 3 percent through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ST

Sensata Technologies Holding

Develops, manufactures, and sells sensors and sensor-rich solutions, electrical protection components and systems, and other products used in mission-critical systems and applications in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives