- United States

- /

- Electrical

- /

- NYSE:ST

Could Analyst Optimism and Electrification Focus Shift Sensata Technologies (ST)'s Competitive Positioning?

Reviewed by Sasha Jovanovic

- Sensata Technologies recently presented at the Battery Show North America 2025 in Detroit, featuring Maxime Blin, Global Product Manager for High Voltage Solutions, as a key speaker.

- This presentation spotlighted Sensata’s engagement with high-growth electrification markets and helped reinforce industry awareness of its capabilities in advanced sensor and electrical protection technology.

- With Barclays initiating coverage and highlighting confidence in Sensata’s prospects, we’ll explore how this increased analyst support could influence the company’s investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sensata Technologies Holding Investment Narrative Recap

To own shares in Sensata Technologies, investors need to believe in the company’s ability to outpace sector headwinds by expanding its footprint in electrification, especially as automotive and industrial end-markets remain under pressure. While Barclays’ new coverage and improved analyst sentiment provide short-term visibility, neither this nor Sensata's Battery Show appearance are likely to drastically alter the main catalyst, winning new business with fast-growing EV makers, or mitigate the major risk of intensifying competition and margin pressure in China.

Sensata’s recent launch of the High Efficiency Contactor for electric vehicles is most relevant, signaling continued progress in the critical area of electrified powertrain solutions. These product rollouts support the company's strategy to raise content per vehicle and maintain a competitive edge as electrification accelerates, directly tying into the most important growth opportunities and market share gains anticipated over the next several quarters.

Yet, in contrast to these optimistic signals, investors should be aware of how risks like escalating price competition in China could...

Read the full narrative on Sensata Technologies Holding (it's free!)

Sensata Technologies Holding's narrative projects $4.2 billion in revenue and $495.4 million in earnings by 2028. This requires 3.6% yearly revenue growth and a $384.1 million increase in earnings from $111.3 million today.

Uncover how Sensata Technologies Holding's forecasts yield a $38.14 fair value, a 21% upside to its current price.

Exploring Other Perspectives

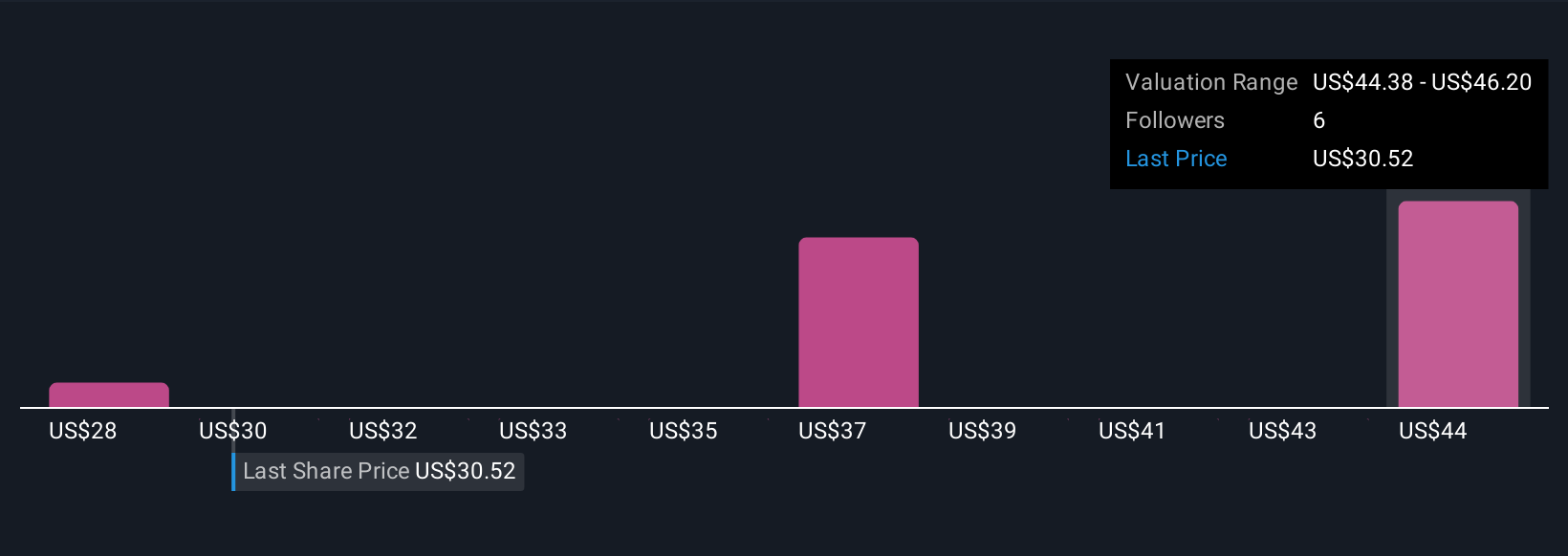

Three members of the Simply Wall St Community estimate Sensata’s fair value between US$27.98 and US$47.11. While many see opportunity in electrification, ongoing margin risk from aggressive Chinese competitors remains a central concern impacting long-term performance.

Explore 3 other fair value estimates on Sensata Technologies Holding - why the stock might be worth 11% less than the current price!

Build Your Own Sensata Technologies Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sensata Technologies Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sensata Technologies Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sensata Technologies Holding's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ST

Sensata Technologies Holding

Develops, manufactures, and sells sensors and sensor-rich solutions, electrical protection components and systems, and other products used in mission-critical systems and applications in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives