- United States

- /

- Aerospace & Defense

- /

- NYSE:SPCE

Virgin Galactic Holdings (NYSE:SPCE) Reports First-Quarter Earnings Decline With US$0.5 Million Sales

Reviewed by Simply Wall St

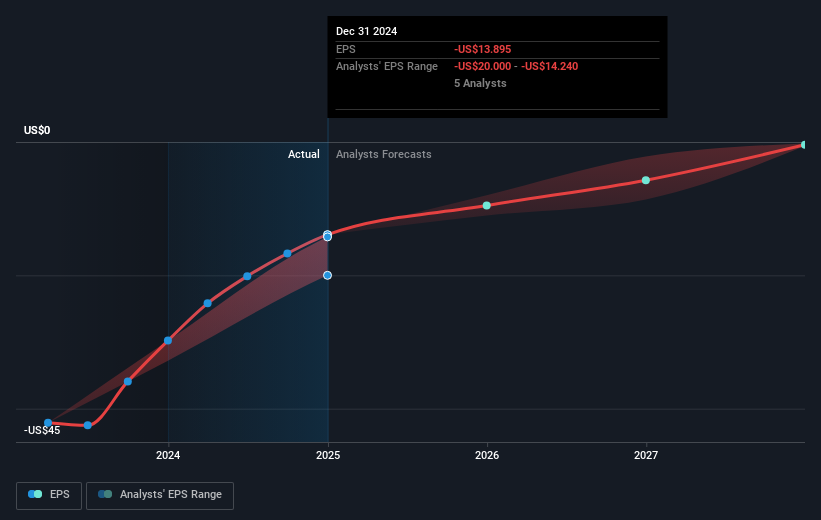

Virgin Galactic Holdings (NYSE:SPCE) recently reported a disappointing first-quarter earnings for 2025, with sales falling to USD 0.5 million from USD 2 million the previous year, yet they managed to narrow their net loss. Despite the wider market experiencing a 2.6% decline over the last 7 days, Virgin Galactic's share price moved upward by 30% over the past month. This increase suggests that investors might be optimistic about the company's efforts to improve financial management, as indicated by the reduced net loss and improved loss per share. These factors could have added weight to the broader positive move over the year.

Over the past year, Virgin Galactic Holdings has experienced a substantial decline in total shareholder return, with a notable 78.29% drop. When compared to the broader market performance, Virgin Galactic underperformed, as the US market returned 9.1%, and the US Aerospace & Defense industry returned 25% during the same 12-month period. This longer-term underperformance provides important context to the recent 30% share price uplift over the past month.

The factors discussed in the introduction, such as improving financial management and reduced net losses, could potentially influence the revenue and earnings forecasts positively. Analysts estimate Virgin Galactic's revenue to grow at a significant rate of 54.3% per year, despite the company's current unprofitability. The recent price movement towards the analyst consensus price target of US$8.11 per share indicates investor optimism, although the share currently trades at a discount of approximately 17.9% to this target. This suggests that the market may be expecting further improvements in Virgin Galactic's operational and financial performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPCE

Virgin Galactic Holdings

An aerospace and space travel company, focuses on the development, manufacture, and operation of spaceships and related technologies.

Excellent balance sheet low.

Market Insights

Community Narratives