- United States

- /

- Electrical

- /

- NYSE:SMR

NuScale Power (SMR): Valuation in Focus After Landmark 6GW SMR Partnership and Ownership Shift

Reviewed by Kshitija Bhandaru

NuScale Power (NYSE:SMR) is drawing investor interest after announcing a partnership with ENTRA1 Energy and the Tennessee Valley Authority to deploy up to 6 gigawatts of small modular reactor capacity. This is the largest project of its kind in the U.S.

See our latest analysis for NuScale Power.

NuScale Power’s latest headlines cap off a remarkable run, fueled not just by its 6-gigawatt partnership news but also by seismic shifts in its ownership structure as Fluor trimmed its holdings and the company advanced in regulatory milestones. This rapid-fire progress has helped build real momentum, with the 1-year total shareholder return now at an eye-catching 223 percent and the share price surging 154 percent since the start of the year. These are clear signs that sentiment is shifting toward growth potential and commercial viability.

If this SMR breakthrough has you curious about where else innovation is heating up, now’s the perfect moment to discover fast growing stocks with high insider ownership

Yet with excitement running high and shares up more than 150 percent year to date, the question is whether NuScale is still trading at a bargain, or if expectations for future growth have already been fully reflected in the stock price.

Most Popular Narrative: 8% Overvalued

NuScale Power’s most widely followed narrative places its fair value at $41.69, notably lower than the last close at $45.02. This gap highlights growing debate over whether the market’s optimism has outpaced fundamental progress.

Major upside potential highlighted from the landmark TVA and ENTRA1 Energy partnership to deploy up to 6GW of NuScale SMR capacity, signaling commercial traction and technology validation. Bullish analysts cite the growing global and domestic demand for always-on, carbon-free baseload power, backed by policy tailwinds and an increasing need from sectors like data centers and AI.

What exactly fuels this high narrative valuation? The answer starts with huge growth assumptions hiding in plain sight, and a future profit trajectory more ambitious than most realize. Want to decode the numbers behind this bold call and see where analyst beliefs might diverge from market reality? Get the full breakdown inside.

Result: Fair Value of $41.69 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in securing long-term customer contracts and navigating complex regulatory milestones could quickly temper these bullish growth predictions.

Find out about the key risks to this NuScale Power narrative.

Another View: Market Value Through a Different Lens

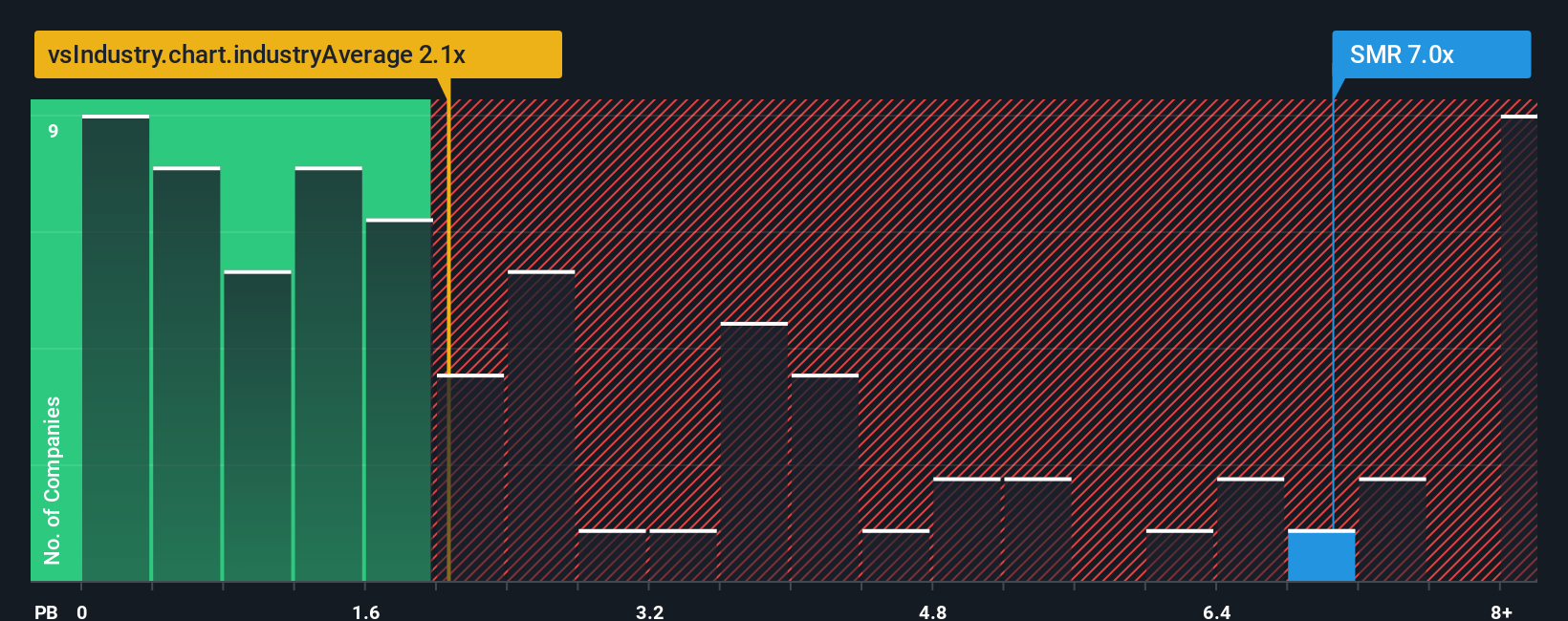

Taking a look through the lens of the price-to-book ratio, NuScale trades at 8.7 times its book value. This stands out as more expensive than the industry average of 2.4 times, yet it is considerably cheaper than its peer group’s lofty 22.3 times. For investors, this split suggests the market’s uncertainty about how to price NuScale’s potential versus its risks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NuScale Power Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your NuScale Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on the sidelines while other investors capture tomorrow’s winners. Use these specialized tools to spot trends early and build your edge now:

- Uncover high-potential tech disruptors by scanning through these 25 AI penny stocks, featuring companies with artificial intelligence leadership and breakthrough applications.

- Target long-term income by checking out these 18 dividend stocks with yields > 3%, which includes securities that consistently deliver yields above 3 percent and have strong track records.

- Catch the next leap in computing by browsing these 26 quantum computing stocks, highlighting innovators pushing boundaries in quantum technology and securing tomorrow’s digital landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives