- United States

- /

- Electrical

- /

- NYSE:SMR

NuScale Power (NYSE:SMR) Boosts Sales to US$37M Despite US$137M Net Loss in 2024

Reviewed by Simply Wall St

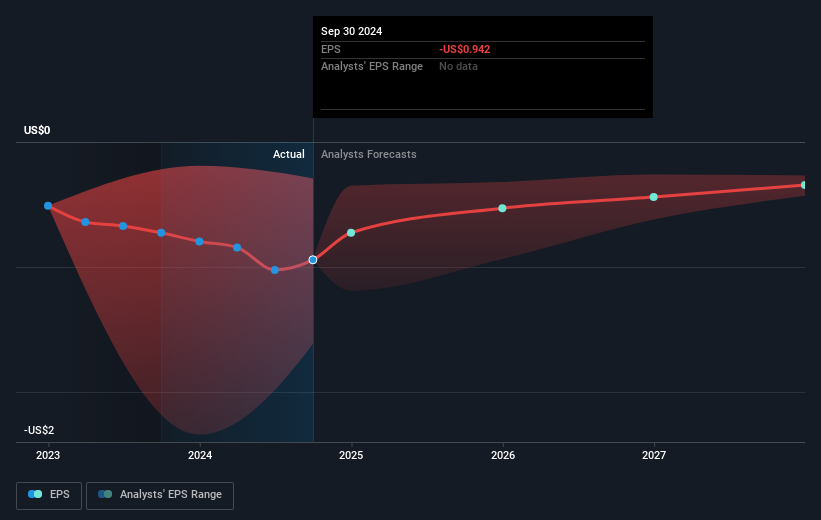

NuScale Power (NYSE:SMR) reported a significant year-over-year increase in sales for 2024 to USD 37 million, up from USD 23 million in 2023. However, the company's financial health was overshadowed by a substantial rise in net losses, jumping from USD 58 million to USD 137 million, along with a basic loss per share increasing to USD 1.47 from USD 0.80. This worsening financial position comes amid a broader market downturn, with the Dow Jones and S&P 500 experiencing a decline of 1.8% as investors assess tariff impacts. As bank shares led the S&P 500 sell-off and the tech-heavy Nasdaq Composite dropped 1.5%, NuScale's market performance became part of the broader narrative of volatility and economic uncertainty. Such conditions likely played a role in the company's recent share price decline of 16%, reflecting investor concerns about the company's operational challenges within a fluctuating market environment.

Take a closer look at NuScale Power's potential here.

Over the last year, NuScale Power's total shareholder return surged by 296.15%, far surpassing the US market's 15.3% return and the 1.3% return of the US Electrical industry. Several key developments contributed to this performance. Prominently, in December 2024, NuScale opened the Energy Exploration Center at The Ohio State University, aiming to advance nuclear workforce development—an initiative supported by the U.S. Department of Energy. Also, in November 2024, the company filed for a US$200 million equity offering. Despite high volatility in recent months, these strategic efforts possibly bolstered investor confidence.

Additionally, executive changes at NuScale could have played a role. At the start of 2025, Alan Boeckmann was appointed Non-Executive Chairman, which may have been viewed positively by the market due to his experience. Financially, NuScale's ongoing revenue growth forecasts, despite current unprofitability, may have reinforced long-term optimism among investors, supporting its impressive share return over the past year.

- See how NuScale Power measures up with our analysis of its intrinsic value versus market price.

- Assess the potential risks impacting NuScale Power's growth trajectory—explore our risk evaluation report.

- Is NuScale Power part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

NuScale Power

Engages in the development and sale of modular light water reactor nuclear power plants to supply energy for electrical generation, district heating, desalination, hydrogen production, and other process heat applications.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives