- United States

- /

- Electrical

- /

- NYSE:SMR

How Investors Are Reacting To NuScale Power (SMR) Securing Largest U.S. SMR Deal With TVA

Reviewed by Sasha Jovanovic

- Earlier in October 2025, Fluor Corporation announced the sale of 15 million Class A shares in NuScale Power, with plans to use most proceeds for its share repurchase program while maintaining a 39% equity interest.

- This move coincided with NuScale's partnership milestone to supply up to 6 gigawatts of small modular reactor capacity alongside ENTRA1 Energy and the Tennessee Valley Authority, marking the largest SMR project in U.S. history.

- We will explore how the largest SMR deployment agreement with TVA could influence NuScale's commercialization trajectory and investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

NuScale Power Investment Narrative Recap

To be a NuScale Power shareholder, you need confidence in the company's ability to scale up its commercial SMR deployments amid heightened industry competition and a challenging customer acquisition process. The recent sale of shares by Fluor and the historic 6-gigawatt TVA agreement mark meaningful progress, but they do not remove the immediate risks around project execution and customer negotiations, which remain central to NuScale’s short-term prospects.

The September 2025 agreement with ENTRA1 Energy and TVA stands out as the most relevant announcement, representing a significant catalyst for NuScale by underpinning its commercialization efforts with the largest SMR capacity commitment in U.S. history. However, this momentum is balanced by ongoing concerns around the timing and finalization of customer agreements, which are critical for transforming projects into realized contracts and revenue.

Yet, despite this progress, investors should be aware of the ongoing challenges NuScale faces in converting interest from potential customers into binding power purchase agreements, and...

Read the full narrative on NuScale Power (it's free!)

NuScale Power's narrative projects $402.3 million revenue and $42.2 million earnings by 2028. This requires 121.5% yearly revenue growth and a $178.8 million earnings increase from -$136.6 million.

Uncover how NuScale Power's forecasts yield a $41.69 fair value, a 6% upside to its current price.

Exploring Other Perspectives

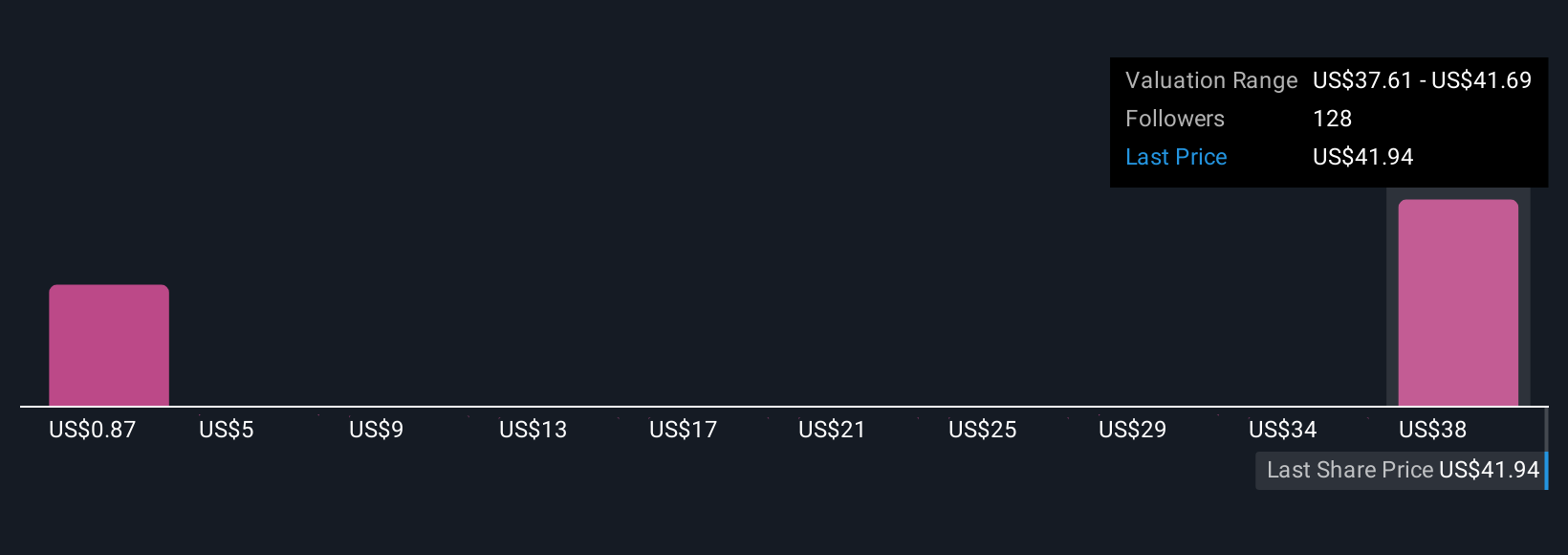

With 14 individual fair value estimates from the Simply Wall St Community ranging from US$0.87 to US$41.69, market participants see NuScale’s outlook very differently. While many expect accelerated revenue growth, customer contract finalization will be the key driver to watch for sustained performance.

Explore 14 other fair value estimates on NuScale Power - why the stock might be worth less than half the current price!

Build Your Own NuScale Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NuScale Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free NuScale Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NuScale Power's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives