- United States

- /

- Aerospace & Defense

- /

- NYSE:SARO

Is StandardAero’s (SARO) Augusta Expansion a Signal of Evolving Competitive Strength in Aviation Services?

Reviewed by Simply Wall St

- StandardAero recently celebrated the grand opening of its expanded business aviation facility at Augusta Regional Airport, adding 80,500 square feet of new space and roughly 100 skilled jobs to serve operators across North America and abroad.

- This 60% facility expansion specifically increases maintenance capacity for Honeywell HTF7000 engines, for which StandardAero is the exclusive independent heavy overhaul provider.

- We'll explore how the expanded Augusta operations strengthen StandardAero's position in the business aviation maintenance market.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is StandardAero's Investment Narrative?

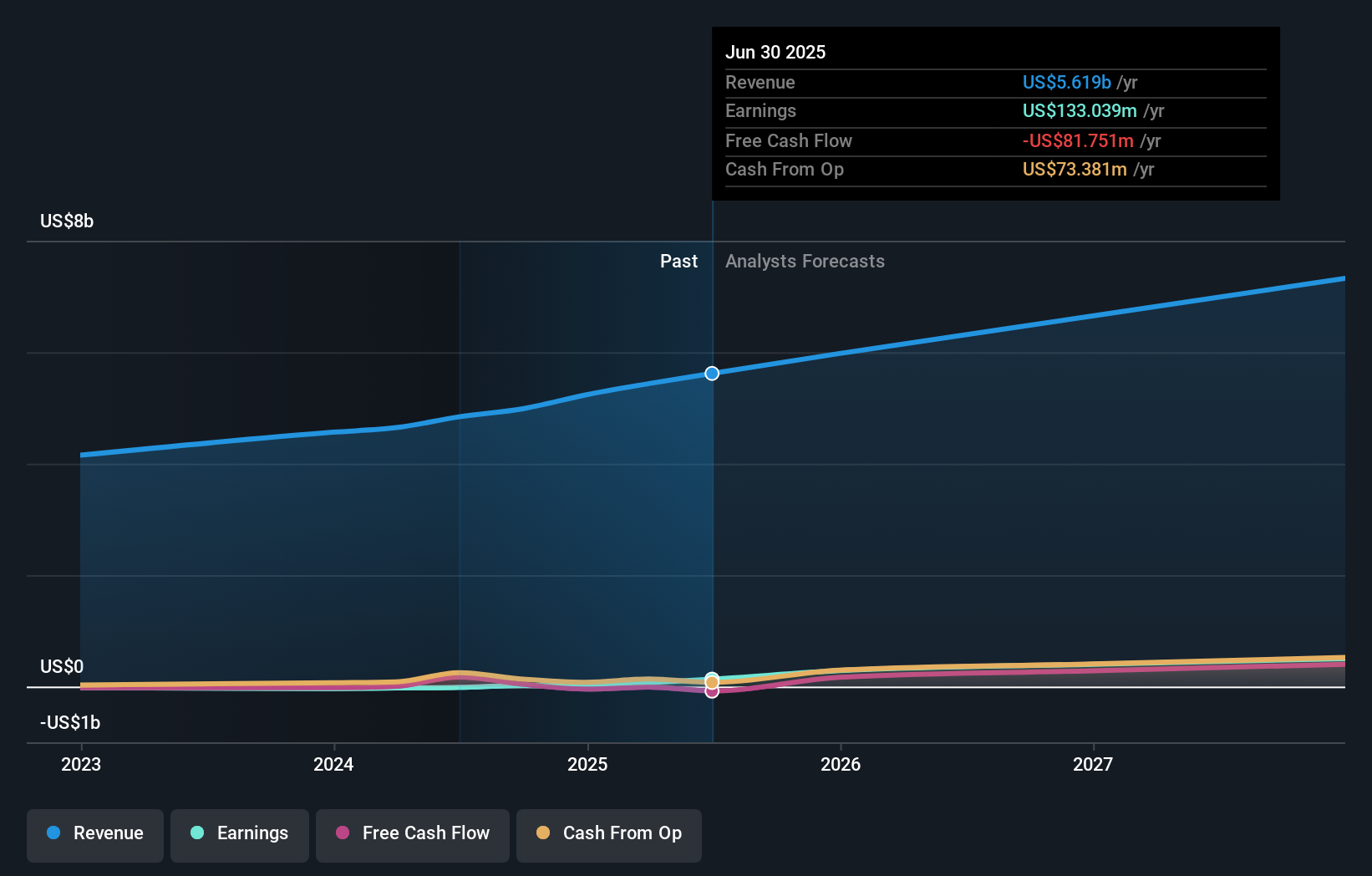

Owning a piece of StandardAero is all about believing in the expanding global demand for business aviation maintenance, repair, and overhaul (MRO) services, especially where the company holds exclusive provider status, like with Honeywell HTF7000 engines. The recent Augusta facility expansion comes at a time when StandardAero had already reported rising revenue and earnings, raised its 2025 guidance, and cited a robust M&A pipeline. This move should provide an immediate increase in service capacity and operational flexibility, potentially sharpening StandardAero’s competitive edge in high-value MRO segments. Short-term catalysts now include increased throughput from the Augusta site and continued growth in engine partnerships, but integration risks or delays from large expansions could temper margin gains if not executed as planned. It’s worth watching how these new investments flow through to earnings amid a premium valuation relative to peers. Yet, it’s important to keep an eye on how quickly the added capacity translates into meaningful profitability improvements for shareholders.

Despite retreating, StandardAero's shares might still be trading 9% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on StandardAero - why the stock might be worth 14% less than the current price!

Build Your Own StandardAero Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StandardAero research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free StandardAero research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StandardAero's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SARO

StandardAero

Provides aerospace engine aftermarket services for fixed and rotary wing aircraft in the United States, Canada, the United Kingdom, Rest of Europe, Asia, and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives