- United States

- /

- Aerospace & Defense

- /

- NYSE:RTX

The Bull Case For RTX (RTX) Could Change Following New AWS Space Deal And Defense Awards – Learn Why

Reviewed by Sasha Jovanovic

- Recently, Raytheon announced a collaboration with Amazon Web Services to advance cloud-based satellite data processing, AI-enabled mission control, and flexible space operations for national security customers.

- Together with fresh F135 engine sustainment funding and new Iron Dome missile orders, this deepens RTX’s role in long-term, high-tech defense infrastructure.

- Next, we’ll explore how the F135 sustainment award and related missile deals interact with RTX’s existing investment narrative and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

RTX Investment Narrative Recap

To own RTX, you need to believe in durable demand for advanced defense and aerospace systems, supported by long-term government programs and high-tech infrastructure. The AWS collaboration, F135 sustainment award, and Iron Dome missile orders collectively reinforce the near term catalyst around contract backlog and execution, while the biggest risk remains RTX’s dependence on defense budgets and program priorities. The latest news slightly tilts the balance toward stronger near term visibility rather than changing that risk outright.

Among the announcements, the US$1.6 billion F135 sustainment contract stands out as most relevant, because it ties directly into RTX’s core engine franchise and existing infrastructure. It supports the investment narrative around recurring, long-cycle defense revenue, while sitting alongside the Iron Dome missile order as another example of how program wins can offset concerns about tariff exposure and commercial aviation cyclicality.

Yet, even with these new contracts, investors still need to be aware of the risk that defense budgets could shift away from...

Read the full narrative on RTX (it's free!)

RTX's narrative projects $97.7 billion revenue and $8.9 billion earnings by 2028.

Uncover how RTX's forecasts yield a $193.79 fair value, a 13% upside to its current price.

Exploring Other Perspectives

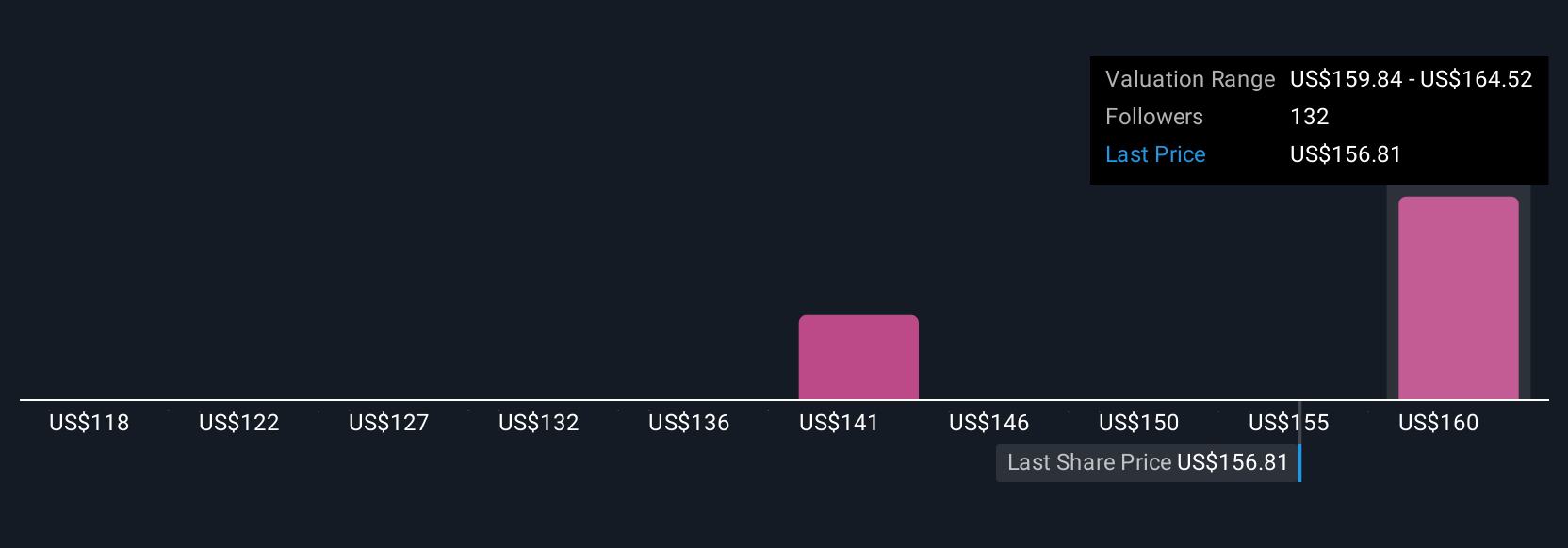

Eight members of the Simply Wall St Community see RTX’s fair value between US$131.81 and US$193.79, with estimates spread across that full range. As you weigh those views, remember that RTX’s reliance on large government defense contracts can cut both ways for future performance, so it is worth comparing several perspectives before forming your own stance.

Explore 8 other fair value estimates on RTX - why the stock might be worth 23% less than the current price!

Build Your Own RTX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RTX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free RTX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RTX's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RTX

RTX

An aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026