- United States

- /

- Aerospace & Defense

- /

- NYSE:RTX

RTX (RTX): Valuation Check After New F135 Sustainment and Iron Dome Contracts

Reviewed by Simply Wall St

RTX has caught investors attention after its Pratt and Whitney unit landed a $1.6 billion F135 sustainment contract and its Iron Dome joint venture signed a separate $1.25 billion missile supply deal with Israel.

See our latest analysis for RTX.

These contracts land at a time when RTX is already back in favor, with the share price at $168.8 and a strong year to date share price return of 45.5 percent helping drive a 5 year total shareholder return of 157.44 percent. This suggests momentum is rebuilding after last year’s wobble.

If RTX’s recent wins have you rethinking the whole defense space, it could be worth exploring other aerospace and defense names through aerospace and defense stocks as potential additions to your watchlist.

With RTX trading just under 15 percent below consensus targets after a powerful rally, the key question now is whether investors are still underestimating its long term cash generation or whether the market is already factoring in future growth.

Most Popular Narrative Narrative: 12.9% Undervalued

RTX's most followed narrative sees fair value at $193.79 per share versus the recent $168.80 close, framing the potential upside through defense and aerospace tailwinds.

Robust and growing backlog, highlighted by a 1.86 quarter book-to-bill ratio, $236 billion backlog (up 15% year-over-year), and major new international contracts (e.g., EU, MENA, Asia-Pacific) indicate RTX is well-positioned to benefit from sustained increases in global defense spending and heightened geopolitical tensions, setting up strong visibility for future revenue growth.

Curious how steady mid single digit growth, rising margins and a rich future earnings multiple can still add up to double digit upside? The narrative breaks down which segment mix, backlog conversion and profitability gains need to align to support that price tag.

Result: Fair Value of $193.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors still need to watch jet engine reliability costs and any pullback in defense budgets, as both could quickly undermine the bullish outlook.

Find out about the key risks to this RTX narrative.

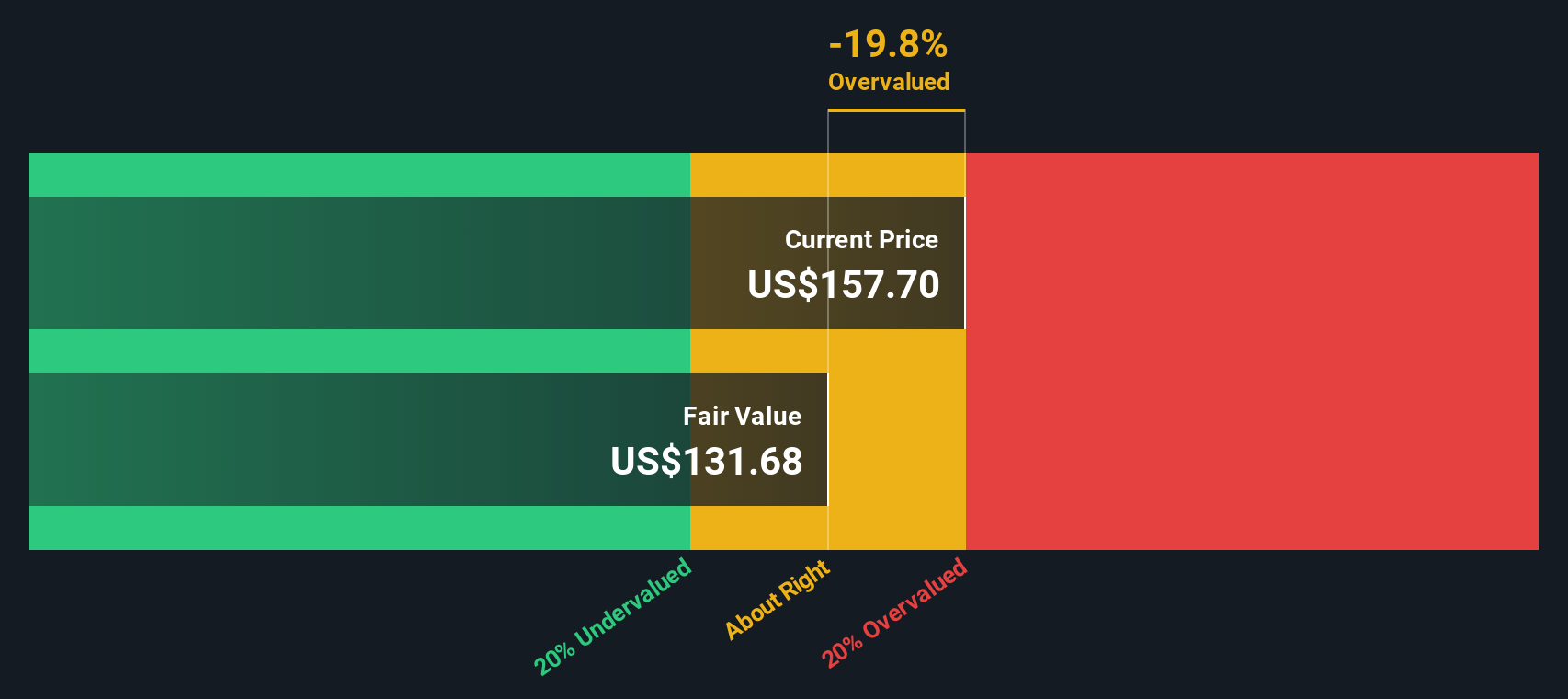

Another View: What The SWS DCF Model Says

Our DCF model paints a cooler picture, putting RTX’s fair value at $144.78 versus today’s $168.80. That implies the stock is now trading above intrinsic value and raises the question of whether recent contract wins are already fully priced in.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RTX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RTX Narrative

If you are not fully convinced or you prefer to dig into the numbers yourself, you can build a personalized RTX narrative in just minutes: Do it your way.

A great starting point for your RTX research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, give yourself an edge and tap into fresh stock ideas ranked by fundamentals, growth, and income potential using the Simply Wall Street Screener.

- Capture income opportunities by scanning these 14 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow without stretching your risk tolerance.

- Position for the next secular trend as you review these 25 AI penny stocks pushing the boundaries of automation, data, and intelligent software.

- Sharpen your value strategy by targeting these 927 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RTX

RTX

An aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026