- United States

- /

- Electrical

- /

- NYSE:RRX

Unpleasant Surprises Could Be In Store For Regal Rexnord Corporation's (NYSE:RRX) Shares

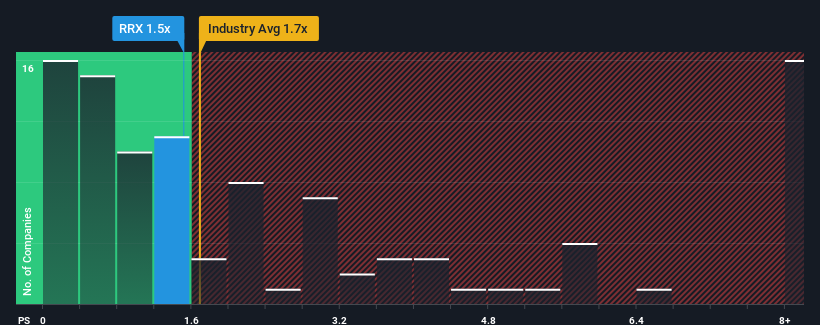

With a median price-to-sales (or "P/S") ratio of close to 1.7x in the Electrical industry in the United States, you could be forgiven for feeling indifferent about Regal Rexnord Corporation's (NYSE:RRX) P/S ratio of 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Regal Rexnord

What Does Regal Rexnord's P/S Mean For Shareholders?

Recent times haven't been great for Regal Rexnord as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Regal Rexnord will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Regal Rexnord's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. The latest three year period has also seen an excellent 120% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 5.0% as estimated by the eight analysts watching the company. With the industry predicted to deliver 13% growth, that's a disappointing outcome.

In light of this, it's somewhat alarming that Regal Rexnord's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It appears that Regal Rexnord currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Before you take the next step, you should know about the 1 warning sign for Regal Rexnord that we have uncovered.

If you're unsure about the strength of Regal Rexnord's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RRX

Regal Rexnord

Provides sustainable solutions for power, transmit, and control motion products in the North America, Asia, Europe, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives