- United States

- /

- Electrical

- /

- NYSE:RRX

Regal Rexnord Corporation (NYSE:RRX) Investors Are Less Pessimistic Than Expected

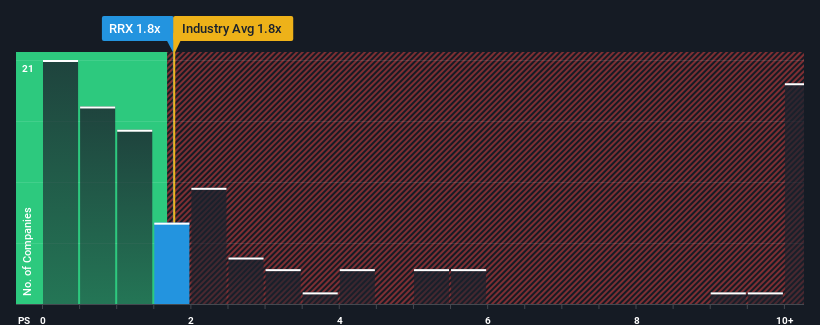

With a median price-to-sales (or "P/S") ratio of close to 1.8x in the Electrical industry in the United States, you could be forgiven for feeling indifferent about Regal Rexnord Corporation's (NYSE:RRX) P/S ratio, which comes in at about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Regal Rexnord

How Regal Rexnord Has Been Performing

Recent revenue growth for Regal Rexnord has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Keen to find out how analysts think Regal Rexnord's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Regal Rexnord?

The only time you'd be comfortable seeing a P/S like Regal Rexnord's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. Pleasingly, revenue has also lifted 96% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 2.2% each year over the next three years. That's shaping up to be materially lower than the 24% per annum growth forecast for the broader industry.

With this in mind, we find it intriguing that Regal Rexnord's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Regal Rexnord's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that Regal Rexnord's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Regal Rexnord, and understanding should be part of your investment process.

If you're unsure about the strength of Regal Rexnord's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RRX

Regal Rexnord

Manufactures and sells industrial powertrain solutions, power transmission components, electric motors and electronic controls, air moving products, and specialty electrical components and systems worldwide.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives