- United States

- /

- Building

- /

- NYSE:REZI

Resideo Technologies (REZI): Exploring Valuation After Strong Shareholder Returns and Recent Price Rally

Reviewed by Kshitija Bhandaru

See our latest analysis for Resideo Technologies.

Resideo Technologies has seen its share price climb impressively lately, with a 16.8% jump over the past month and year-to-date gains of 86.3%. While the recent momentum has been strong, the real standout is the company’s 112.5% total shareholder return over the past year. This signals that investor sentiment has firmly shifted in a positive direction.

If this surge has you wondering what other dynamic opportunities might be out there, consider broadening your search and check out fast growing stocks with high insider ownership.

With shares trading just above analyst price targets despite strong gains, the question now is whether Resideo remains undervalued or if the recent rally already reflects all the company’s future growth potential and leaves little room for upside.

Most Popular Narrative: 2% Overvalued

Given Resideo Technologies' last close at $42.44 and the narrative’s fair value estimate of $41.50, the stock is now trading slightly above what analysts consider justified. This sets the stage for a deeper look at the assumptions shaping current market expectations versus underlying fundamentals.

The planned separation of the ADI segment and portfolio optimization are set to sharpen strategic focus and resource allocation, enabling both entities to better address evolving industry needs and unlocking potential value. These changes could have positive implications for operating leverage, margin profile, and long-term earnings power.

Want to know what’s fueling these new expectations? The core of this narrative is a transformation plan built around strategic moves and bold profitability targets. The full story reveals the ambitious forecasts and critical financial levers behind the price target. Find out if these projections will shake up the smart home space next.

Result: Fair Value of $41.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensified competition from Big Tech and reliance on legacy products could quickly challenge Resideo’s growth outlook if market dynamics shift unexpectedly.

Find out about the key risks to this Resideo Technologies narrative.

Another View: SWS DCF Model Suggests Upside

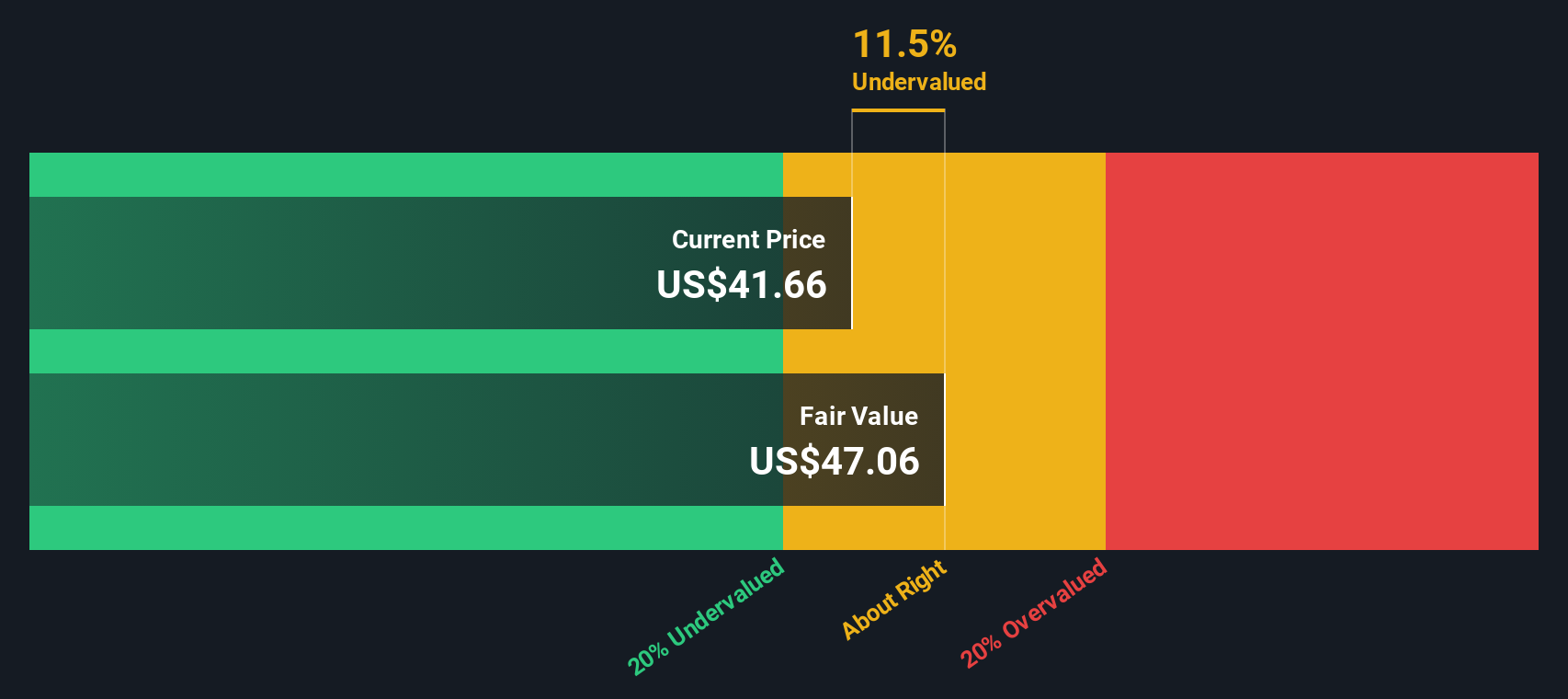

While analysts see Resideo as slightly overvalued using traditional price targets, the SWS DCF model provides a more optimistic perspective. It estimates fair value at $47.22, about 10.1% above the current share price. This suggests there might be room for further gains. Could this more comprehensive approach capture value that multiples miss?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Resideo Technologies Narrative

If you see things differently or want to dig into the details on your own terms, you can build a personalized narrative in just minutes. Do it your way.

A great starting point for your Resideo Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Set yourself apart from the crowd by pursuing stocks with high potential in fast-moving, untapped markets. Don’t let these unique opportunities pass you by. Let the data guide you.

- Power up your portfolio with reliable income streams by tapping into these 19 dividend stocks with yields > 3% offering yields above 3% and robust fundamentals.

- Get a head start on innovation leaders by checking out these 25 AI penny stocks driving advancements in artificial intelligence across every sector.

- Turn volatility into opportunity and uncover growth gems through these 892 undervalued stocks based on cash flows that are trading below their intrinsic value, before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REZI

Resideo Technologies

Develops, manufactures, sells, and distributes comfort, energy management, and safety and security solutions in the United States, Europe, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026