- United States

- /

- Building

- /

- NYSE:REZI

Resideo Technologies, Inc.'s (NYSE:REZI) 30% Jump Shows Its Popularity With Investors

Despite an already strong run, Resideo Technologies, Inc. (NYSE:REZI) shares have been powering on, with a gain of 30% in the last thirty days. Looking further back, the 12% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

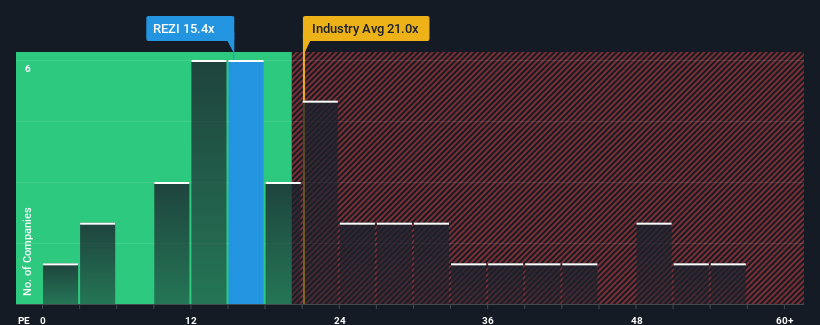

Although its price has surged higher, there still wouldn't be many who think Resideo Technologies' price-to-earnings (or "P/E") ratio of 15.4x is worth a mention when the median P/E in the United States is similar at about 16x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings that are retreating more than the market's of late, Resideo Technologies has been very sluggish. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Resideo Technologies

How Is Resideo Technologies' Growth Trending?

In order to justify its P/E ratio, Resideo Technologies would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 26%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 388% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 12% per year over the next three years. That's shaping up to be similar to the 10% each year growth forecast for the broader market.

In light of this, it's understandable that Resideo Technologies' P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Resideo Technologies appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Resideo Technologies maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 1 warning sign for Resideo Technologies that you need to take into consideration.

Of course, you might also be able to find a better stock than Resideo Technologies. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:REZI

Resideo Technologies

Develops, manufactures, and sells comfort, energy management, and safety and security solutions to the commercial and residential end markets in the United States, Europe, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives