- United States

- /

- Machinery

- /

- NYSE:REVG

REV Group (REVG): Valuation Check After Short Interest Drops and the Stock Rallies

Reviewed by Simply Wall St

REV Group (REVG) just caught traders attention after a sharp drop in short interest. This shift helped push the stock higher as bearish positions were reduced and some investors moved to cover.

See our latest analysis for REV Group.

That short-covering pop comes on top of a powerful backdrop, with a year to date share price return of 77.1 percent and a five year total shareholder return of 625.08 percent. This suggests momentum is still very much on the front foot.

If this kind of rerating has you curious about what else is out there, it could be a good moment to explore fast growing stocks with high insider ownership for other high potential names.

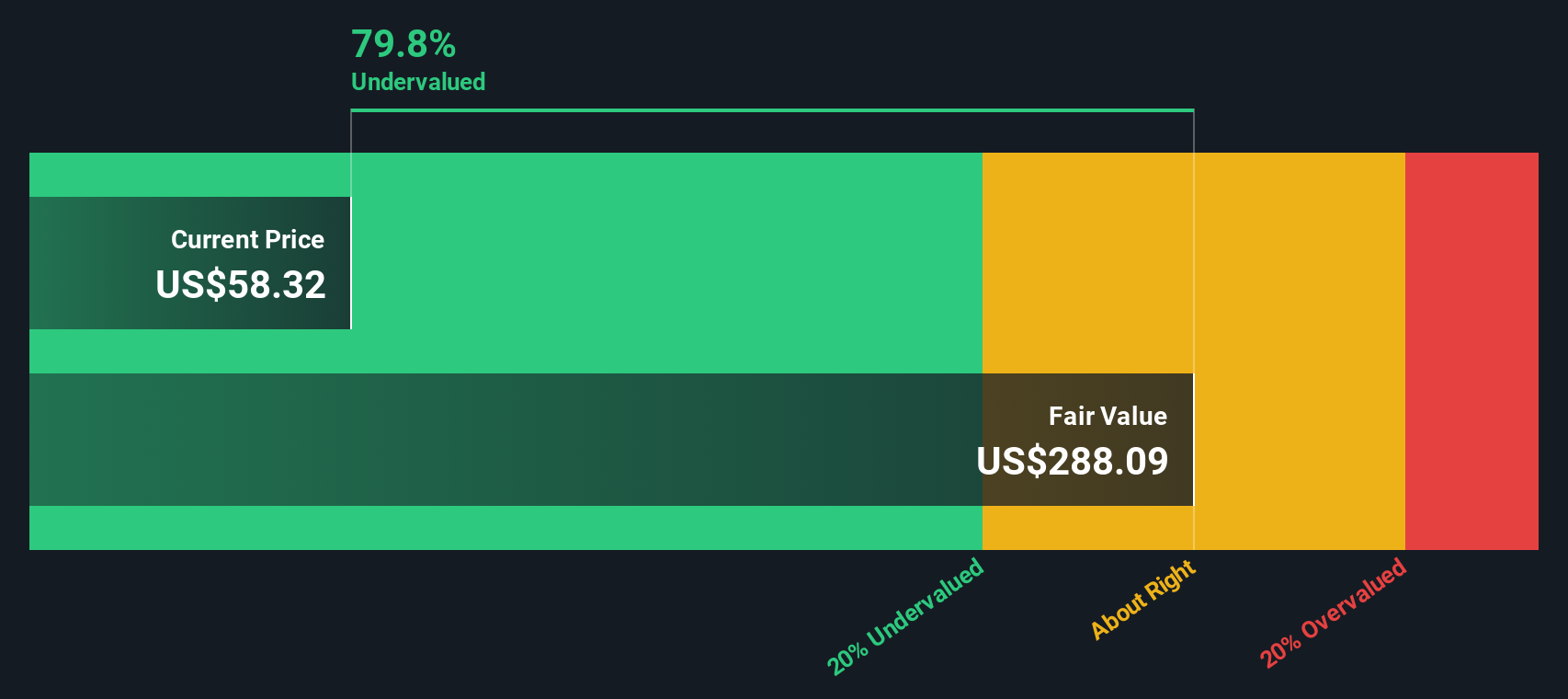

With earnings growing, a premium valuation versus intrinsic estimates, and only a modest gap to Wall Street targets, investors now face a key question: is REV Group still mispriced or is the market already baking in future growth?

Most Popular Narrative: 6.3% Undervalued

Compared with REV Group's last close at $56.39, the most followed narrative sees fair value modestly higher, suggesting the current rally still has room.

A strategically large, multi-year backlog in the fire and ambulance divisions provides earnings protection while allowing pricing actions and favorable product mix to be realized over time, buffering against near-term economic uncertainty and driving steady earnings and margin expansion.

Want to see how a steady revenue build, rising margins, and a leaner portfolio combine into that value gap? The full narrative explains the calculations that support this view.

Result: Fair Value of $60.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated deal risk around the Terex merger and persistent inflationary cost pressures could squeeze margins and weaken the case for further upside.

Find out about the key risks to this REV Group narrative.

Another Take on Value

While the consensus narrative sees REV Group about 6 percent undervalued, our DCF model paints a cooler picture, with fair value closer to $42.77. This implies the shares look overvalued today. Which lens makes more sense if earnings or merger assumptions do not fully play out?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own REV Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes, starting with Do it your way.

A great starting point for your REV Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Do not stop with one opportunity. Use the Simply Wall Street Screener to uncover fresh ideas before the crowd and keep your portfolio working smarter for you.

- Capture mispriced potential by scanning these 907 undervalued stocks based on cash flows that may offer strong upside as the market corrects.

- Tap into transformative innovation with these 26 AI penny stocks positioned to benefit from accelerating demand for intelligent automation.

- Lock in reliable income streams by reviewing these 15 dividend stocks with yields > 3% that can support long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REVG

REV Group

Designs, manufactures, and distributes specialty vehicles, and related aftermarket parts and services in North America and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026