- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

Redwire (NYSE:RDW) Powers Lunar Gateway With Record-Breaking Solar Tech For Deep Space Exploration

Reviewed by Simply Wall St

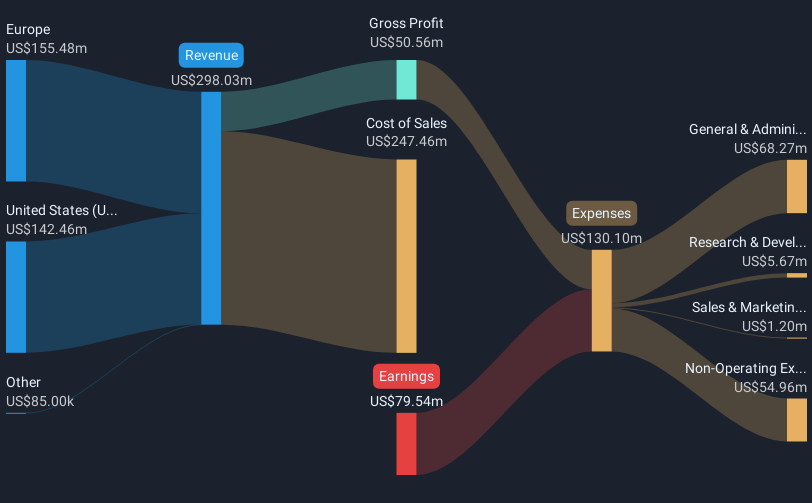

Redwire (NYSE:RDW) recently announced a successful deployment test of its Roll-Out Solar Arrays (ROSAs) for the lunar Gateway, marking a significant technological advancement with potential applications for lunar and Mars missions. This achievement, coupled with contracts like the NASA award for a biotechnology experiment and the ESA's ALTIUS mission integration, underscores the company's progress in the aerospace sector. Despite a challenging market backdrop where indexes like Nasdaq saw fluctuations, Redwire's 66% increase in shareholder returns over the last quarter aligns more closely with positive company-specific developments than broader market trends.

The recent news about Redwire's successful deployment test of its Roll-Out Solar Arrays (ROSAs) for the lunar Gateway, along with other significant contracts, highlights the company's technological advances. This development could potentially drive revenue and earnings growth, as the successful implementation of such cutting-edge space infrastructure advances outlines future expansion opportunities in lunar and Mars missions. As Redwire focuses on innovations like microgravity manufacturing, these advancements may unlock high-margin revenue streams, potentially enhancing the overall financial outlook.

Over a three-year period, Redwire's total shareholder return was very large, reflecting a substantial increase in investor confidence in the company's capabilities and market positioning. In contrast, its one-year performance surpassed the US Aerospace & Defense industry's return of 43.8%, further emphasizing its recent business-specific achievements.

Considering the broader market context, Redwire's share price fluctuation appears connected more closely to company-specific catalysts rather than general market trends. With a current share price of US$11.23, the increase remains below the analyst consensus price target of US$25.80, suggesting room for further appreciation pending successful execution of strategic plans and revenue goals. The consensus anticipates significant revenue growth, driven by Redwire’s pipeline of US$7.1 billion in opportunities and strategic acquisitions like Edge Autonomy, indicating potential positive impacts on future earnings forecasts.

Upon reviewing our latest valuation report, Redwire's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives