- United States

- /

- Trade Distributors

- /

- NYSE:QXO

Is QXO's (QXO) M&A Focus Resilient Amid Shifting Roofing and Construction Trends?

Reviewed by Sasha Jovanovic

- QXO recently presented at DPW 2025 in Amsterdam, with Chief Procurement Officer Michael DeWitt sharing insights into the company's latest initiatives.

- Analyst commentary is drawing attention to QXO's Acquire-and-Optimize strategy, while also highlighting near-term headwinds in roofing volumes and construction trends.

- We'll explore how concerns about roofing demand and construction activity are shaping QXO's investment narrative amid the company's ongoing M&A emphasis.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

What Is QXO's Investment Narrative?

For anyone weighing up QXO as a potential investment, the story hinges on whether you believe in the company’s ability to extract meaningful value from its Acquire-and-Optimize strategy despite near-term sector softness. The recent DPW 2025 conference in Amsterdam showcased QXO’s executive vision, but didn’t materially shift the catalysts or risks; the critical short-term levers remain M&A execution and improving construction demand. Analysts’ attention on weaker roofing volumes and construction trends, backed by price target cuts, underscores the real-world pressures QXO faces, particularly with winter inventory adjustments on the horizon. The broader investment thesis is still rooted in faith that QXO’s aggressive expansion and new executive hires can drive the company toward profitability and outpace market growth, but near-term risks like unsteady demand and integration challenges have only grown more prominent in light of recent events.

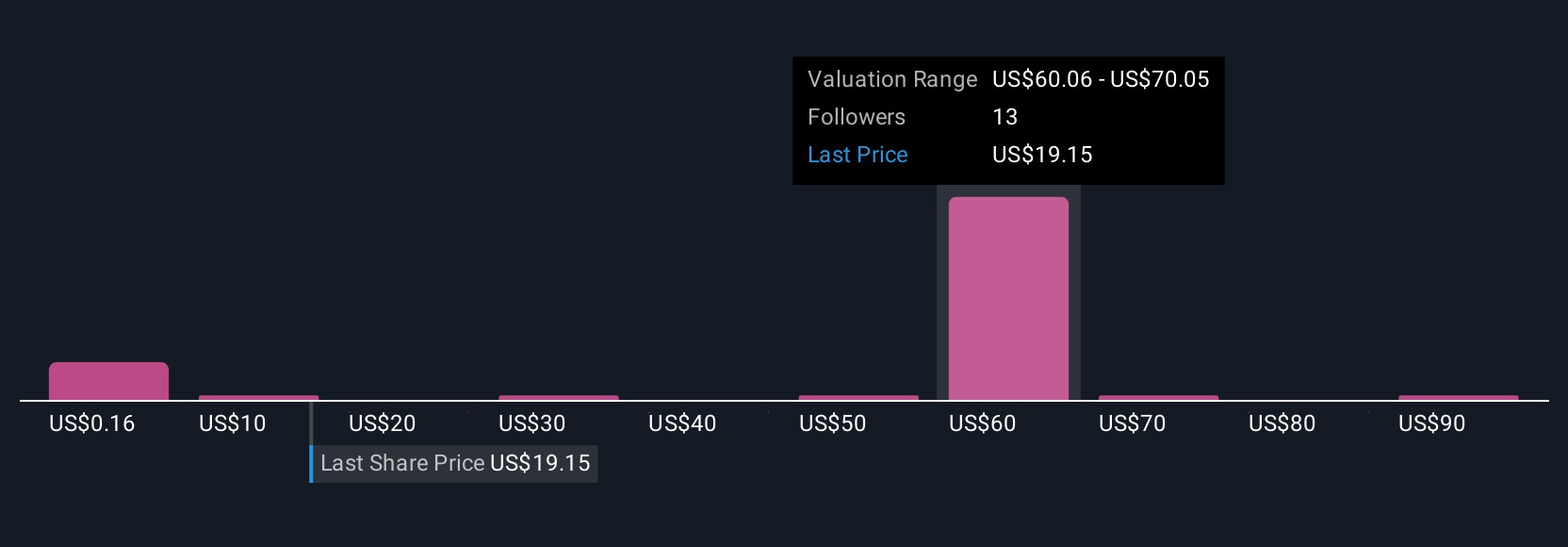

But while many focus on growth, inventory headwinds are a real risk investors should be aware of. Despite retreating, QXO's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 14 other fair value estimates on QXO - why the stock might be worth less than half the current price!

Build Your Own QXO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QXO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free QXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QXO's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QXO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QXO

QXO

Distributes roofing, waterproofing, and other building products in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives