- United States

- /

- Trade Distributors

- /

- NYSE:QXO

Can Wall Street’s Newfound Optimism on QXO (QXO) Validate Its Aggressive Consolidation Strategy?

Reviewed by Sasha Jovanovic

- In recent days, multiple major Wall Street firms, including KeyBanc, Raymond James, and Morgan Stanley, initiated positive analyst coverage on QXO, highlighting its growth prospects and consolidation strategy in building products distribution under CEO Brad Jacobs.

- This coordinated analyst attention has drawn strong interest from investors, underscoring confidence in QXO’s leadership and its positioning within the building materials supply chain.

- We’ll look at how this wave of favorable analyst coverage, centered on QXO’s consolidation approach, shapes its evolving investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is QXO's Investment Narrative?

For investors considering QXO, the core thesis rests on faith in the company's consolidation strategy within building products distribution, the leadership of CEO Brad Jacobs, and the potential for rapid revenue growth as acquisitions are integrated. The recent wave of bullish analyst coverage from KeyBanc, Raymond James, and Morgan Stanley has elevated attention and confidence in QXO, signaling possible short-term momentum as institutional interest increases. While this positive sentiment has helped drive a 5% rebound over the past week, shares still trade well below consensus price targets, leaving room for optimism. However, the company remains unprofitable and has a relatively inexperienced management and board, adding execution risk at a crucial phase of integration and expansion. If coverage translates to improved access to capital or supports future M&A pipeline, it could become a bigger catalyst. Otherwise, risks around valuation, losses, and board turnover remain largely unchanged for now. Yet even after this surge in confidence, management inexperience is still a key factor investors should watch.

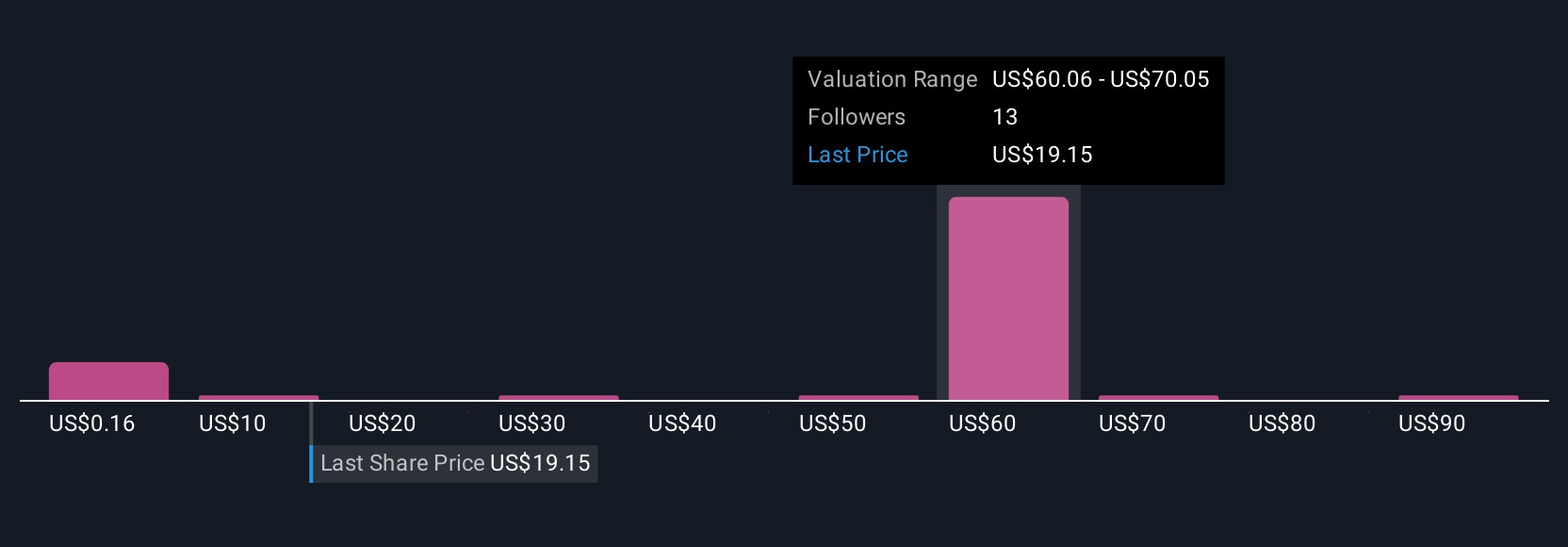

QXO's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 13 other fair value estimates on QXO - why the stock might be worth over 5x more than the current price!

Build Your Own QXO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QXO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free QXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QXO's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QXO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QXO

QXO

Distributes roofing, waterproofing, and other building products in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives