- United States

- /

- Construction

- /

- NYSE:PWR

Where Does Quanta Services Stand After Its 616% Five Year Surge?

Reviewed by Bailey Pemberton

If you’ve been keeping an eye on Quanta Services lately, you’re probably wondering what’s next for this high-flyer. Whether you already own shares or are thinking of jumping in, the stock’s performance practically demands your attention. In just the past five years, Quanta Services has soared by a staggering 616.4%. Even over the past year, it’s up 40.1%, easily outpacing the wider market. While there was a slight dip of 1.5% in the past week, the stock still delivered a 13.3% gain over the last month and has climbed 38.5% since the start of the year. These numbers are hard to ignore, highlighting both recent momentum and a history of robust growth.

What’s driving all this? Investors have grown increasingly optimistic thanks to the company’s key role in vital infrastructure projects, especially as markets adapt to major trends like the energy transition and grid modernization. This growing appetite for companies supporting the backbone of tomorrow’s economy has been a major force behind the stock’s long-term climb.

Before you rush to hit the “buy” button, let’s talk value. Based on hard numbers, Quanta Services currently holds a valuation score of 0 out of 6 using our standard checklist. This indicates it does not come up as undervalued on any of the major metrics. However, simply looking at a checklist may not tell the whole story. Next, we’ll walk through the most common valuation approaches, and at the end, I’ll share a perspective that could offer an even better read on Quanta’s true worth.

Quanta Services scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Quanta Services Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and then discounting them back to their value today. This approach helps investors determine whether a stock’s price reflects its underlying financial performance and growth prospects.

For Quanta Services, current Free Cash Flow stands at $1.4 Billion. Analyst estimates suggest cash flows will grow steadily, reaching $2.8 Billion by 2029. Beyond that, projections continue to build, with Simply Wall St extrapolating values out to 2035. These forward-looking figures show the company’s underlying business is expected to generate increasingly strong cash returns as far out as estimates are available.

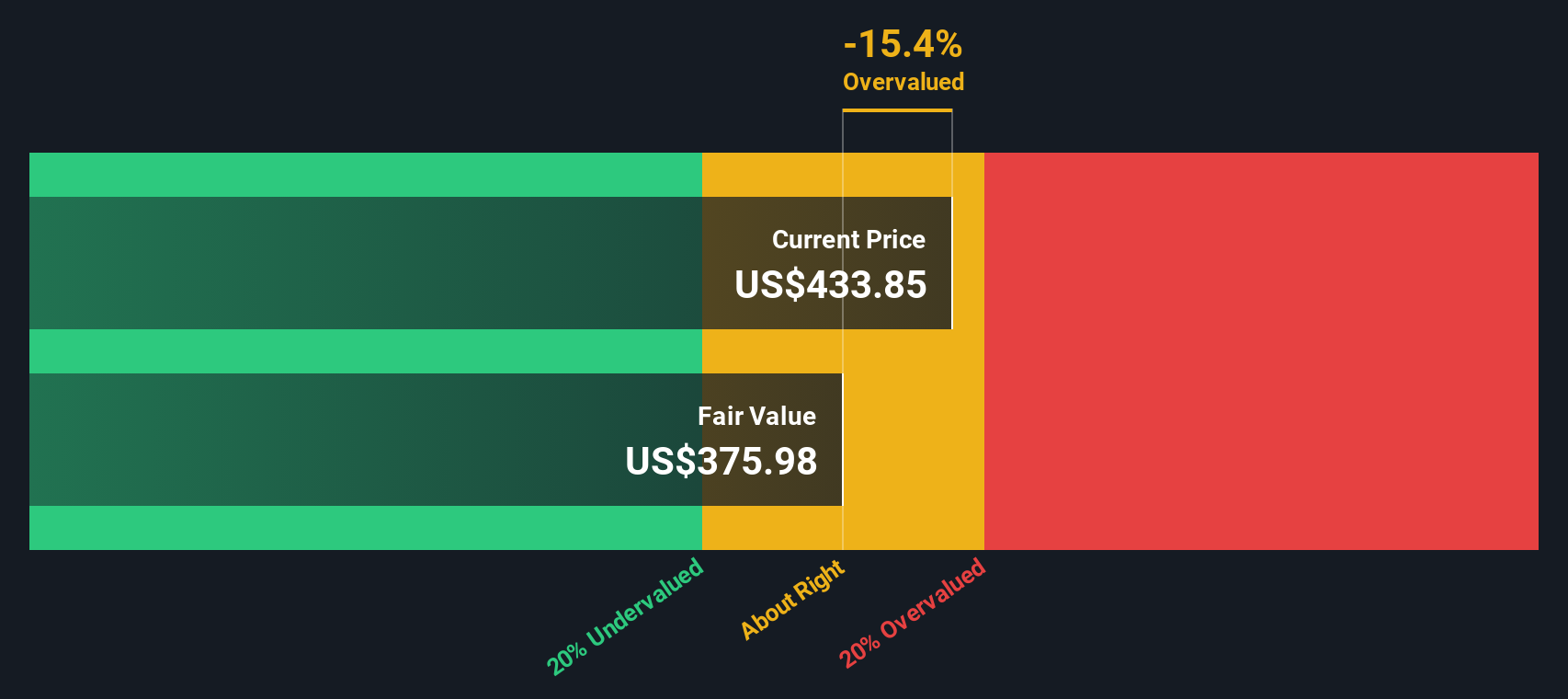

Based on this model, Quanta Services’ fair intrinsic value comes out to $376 per share. When compared with the current share price, the DCF model implies the stock is about 16.2% overvalued. In plain terms, the market is pricing in more optimism than the current cash flow trajectory justifies at this point.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Quanta Services may be overvalued by 16.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Quanta Services Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies, as it reflects how much investors are willing to pay for each dollar of a company’s earnings. For companies like Quanta Services that generate consistent profits, the PE ratio offers a clear window into how the market views future growth, stability, and risk.

Growth expectations and the company’s risk profile both influence what a “normal” or “fair” PE ratio should look like. High-growth companies often warrant higher PE multiples, while those facing more uncertainty or industry pressures usually trade at lower multiples.

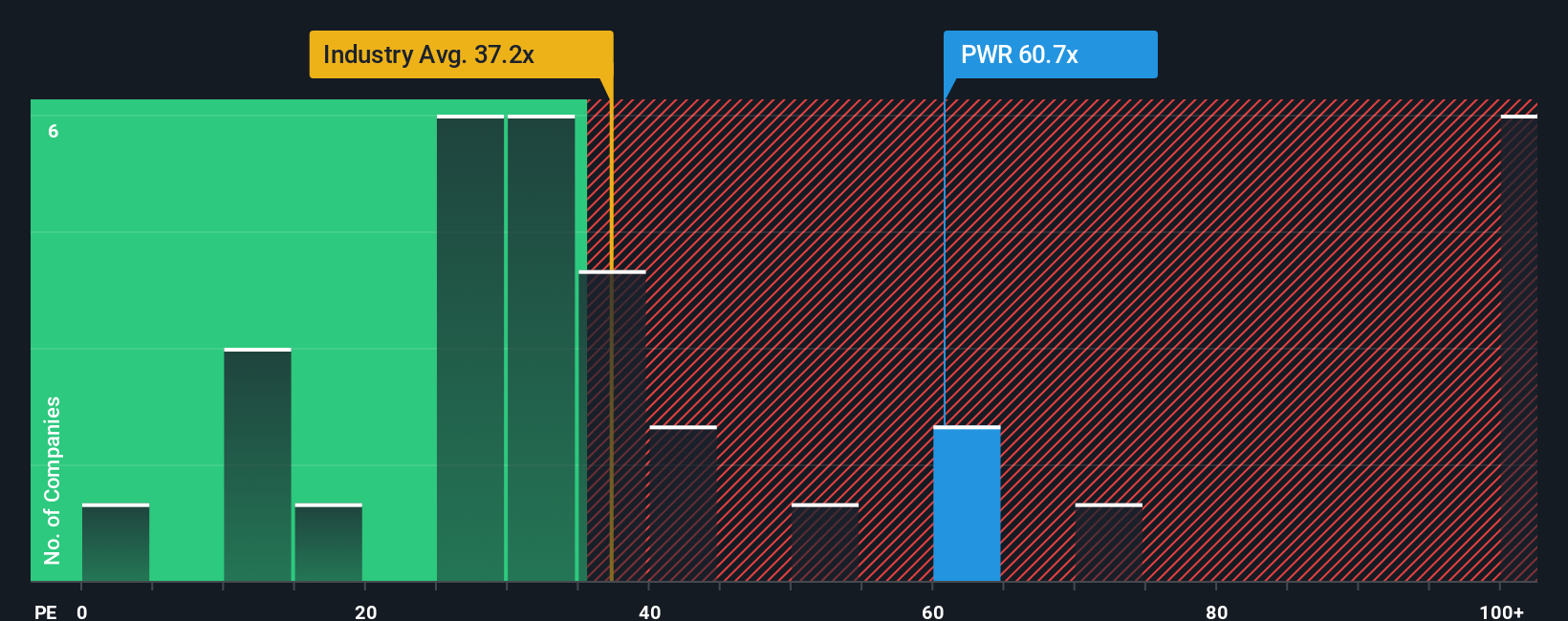

Currently, Quanta Services trades at a PE ratio of 67x. This stands out compared to the construction industry average of 37x and the peer group average of 39x. At first glance, this suggests the stock is priced at a significant premium relative to the sector.

Simply Wall St’s proprietary “Fair Ratio” estimates the most reasonable PE ratio for Quanta Services based on factors such as earnings growth prospects, profit margins, industry dynamics, size, and any flagged risks. Unlike a simple comparison with peers, the Fair Ratio is tailored to the company’s unique circumstances and provides a more grounded benchmark for what the PE multiple should be.

With a Fair Ratio of 39x and a current PE of 67x, Quanta Services is trading well above what our model considers justified by fundamentals. This points to the possibility that the market is building in very optimistic expectations for future earnings growth.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Quanta Services Narrative

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective on a company, expressed through your own expectations for its future, such as where you think revenue, earnings, and margins are heading, and what you believe is a fair value for the stock.

Narratives connect the dots between a company’s outlook, a realistic financial forecast, and a resulting fair value, providing a clear, customizable way to weigh whether to buy, hold, or sell. On Simply Wall St’s Community page, millions of investors use Narratives to set out their reasoning and automatically see how their view compares to the current market price, making good decision-making easier and more transparent than ever.

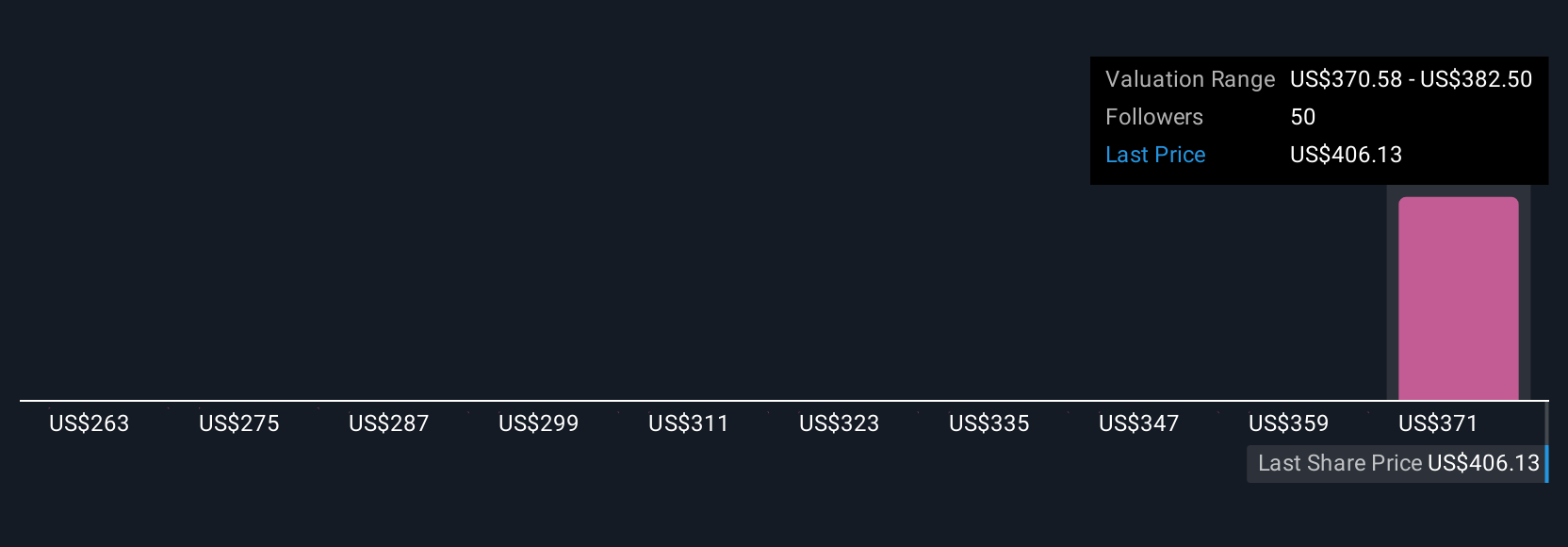

Because Narratives are dynamically updated when new announcements, news, or earnings drop, you can always check whether your investment “story” still holds up as conditions change. For example, some investors see Quanta Services growing rapidly thanks to power grid investments and assign a bullish fair value as high as $490 per share, while more cautious peers flag risks and set a value closer to $248. This demonstrates that each Narrative translates the same facts into a different investment decision.

Do you think there's more to the story for Quanta Services? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PWR

Quanta Services

Offers infrastructure solutions for the electric and gas utility, renewable energy, communications, pipeline, and energy industries in the United States, Canada, Australia, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives