- United States

- /

- Construction

- /

- NYSE:PWR

The Bull Case For Quanta Services (PWR) Could Change Following Backlog Growth Outpacing Supply Capacity - Learn Why

Reviewed by Sasha Jovanovic

- Quanta Services recently drew attention as commentary highlighted that its backlog growth is outpacing supply capacity, pointing to sustained revenue growth supported by strong earnings per share performance.

- This underlying business momentum reflects robust demand and improved visibility for long-term infrastructure projects across transmission, renewables, and utility markets.

- We'll now examine how Quanta's continued backlog expansion and supply-demand dynamics influence its broader investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Quanta Services Investment Narrative Recap

To be a shareholder in Quanta Services, you need confidence in the multiyear investment cycle driving grid modernization, renewable infrastructure, and heightened power demand from data centers and utilities. The recent market relief tied to US-China sentiment was not material to Quanta’s most important short-term catalyst, its ability to convert a record backlog into actual revenue, nor did it considerably change the main risk, which remains potential execution pitfalls in large, complex project ramps or M&A integration challenges.

Of all recent company developments, the announcement of nearly US$1.7 billion in contracts for the Grain Belt Express project stands out given Quanta’s backlog commentary. This award reinforces the strength of current project visibility, but also illustrates the rising complexity and potential regulatory obstacles associated with such marquee energy projects, which could impact both revenue timing and earnings predictability as projects progress.

However, investors should also stay conscious of the flip side, especially where regulatory delays or cancellations could …

Read the full narrative on Quanta Services (it's free!)

Quanta Services' narrative projects $37.5 billion revenue and $1.7 billion earnings by 2028. This requires 12.9% yearly revenue growth and a $728 million earnings increase from $971.8 million.

Uncover how Quanta Services' forecasts yield a $424.20 fair value, in line with its current price.

Exploring Other Perspectives

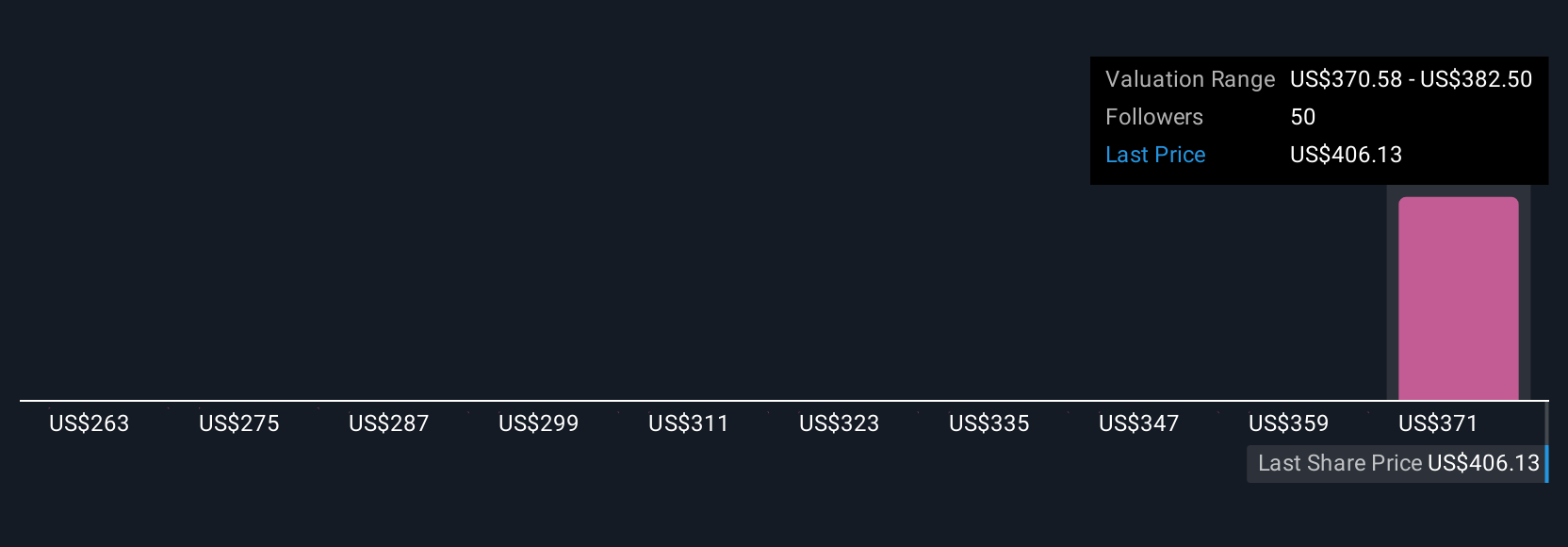

Four Simply Wall St Community members estimate Quanta’s fair value from US$263 to US$424 per share. These diverse views meet an environment where strong backlog growth brings potential for revenue expansion but underscores the need to review regulatory and execution risks before forming your own outlook.

Explore 4 other fair value estimates on Quanta Services - why the stock might be worth as much as $424.20!

Build Your Own Quanta Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quanta Services research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Quanta Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quanta Services' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PWR

Quanta Services

Offers infrastructure solutions for the electric and gas utility, renewable energy, communications, pipeline, and energy industries in the United States, Canada, Australia, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives