- United States

- /

- Construction

- /

- NYSE:PRIM

Insider Confidence and Strong EPS Growth Could Be A Game Changer For Primoris Services (PRIM)

Reviewed by Simply Wall St

- In recent days, Primoris Services received attention for its 24% annual earnings per share growth over three years and substantial insider ownership.

- Insiders continuing to hold significant stakes may signal management's confidence and alignment with longer-term shareholder interests.

- We'll explore how insider confidence highlighted in the news could shape the outlook within Primoris Services' investment story.

Primoris Services Investment Narrative Recap

Being a Primoris Services shareholder means believing in the company's ability to capitalize on North American infrastructure expansion and power delivery demand, while managing margin stability and project execution risks. The recent news centered on strong insider ownership and rapid earnings per share growth highlights positive momentum, but does not materially alter the main short-term catalyst, successful project wins and backlog execution, or the key risk, which remains uncertainty around renewables market volatility and margin pressure. A recent announcement that stands out in this context is the US$1.2 billion in new Energy Segment projects, focused on utility-scale solar and combustion gas turbine builds. This aligns with the company's catalyst of expanding into fast-growing sectors like solar and power delivery, potentially elevating future revenue and underpinning current insider confidence. Yet, investors should also keep in mind that, in contrast to these positives, ongoing uncertainty in the renewables market due to tariffs and supply chain pressures is something that...

Read the full narrative on Primoris Services (it's free!)

Primoris Services' outlook projects $7.9 billion in revenue and $309.1 million in earnings by 2028. This is based on forecasted annual revenue growth of 6.3% and an earnings increase of $102.9 million from current earnings of $206.2 million.

Exploring Other Perspectives

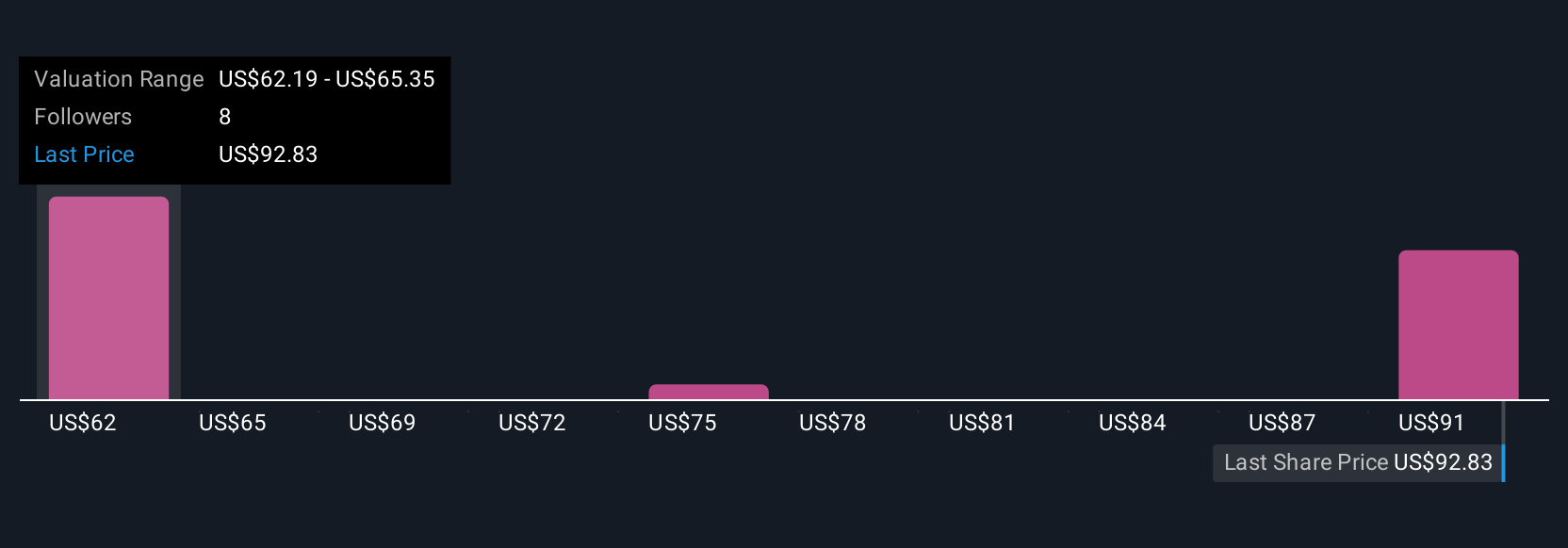

Fair value estimates from the Simply Wall St Community range from US$62.31 to US$93.80 across three viewpoints. While these investors bring varied perspectives, the company’s exposure to the unpredictable renewables sector may weigh on future results and warrants a closer look.

Build Your Own Primoris Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Primoris Services research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Primoris Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Primoris Services' overall financial health at a glance.

No Opportunity In Primoris Services?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRIM

Primoris Services

Provides infrastructure services primarily in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives