- United States

- /

- Construction

- /

- NYSE:PRIM

A Look at Primoris Services’s Valuation Following Koti Vadlamudi’s Appointment as CEO

Reviewed by Kshitija Bhandaru

Primoris Services (PRIM) just announced that Koti Vadlamudi will step in as President and CEO this November. Investors are watching closely, since new leadership can bring a fresh vision and possible shifts in strategy.

See our latest analysis for Primoris Services.

Primoris Services has been on a tear lately, with its share price gaining nearly 12% in the past month and a remarkable 59% over the last 90 days. Momentum has built throughout the year, with a year-to-date share price return of 77% and a one-year total shareholder return soaring to 123%. These figures suggest that investors see real growth potential under new leadership.

If news of the CEO transition has you thinking about what else could be on the move, it's a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares already rocketing higher this year, is Primoris Services still trading at a bargain, or have investor expectations for new leadership and growth already been priced in? Is there real upside left for buyers?

Most Popular Narrative: 4.9% Overvalued

Primoris Services’ most widely followed narrative sees the current share price outpacing fair value by a narrow margin, with the consensus calculation anchored on robust growth assumptions. With the stock sitting above consensus fair value, investors seem excited about the company’s earnings outlook, at least for now.

Surging demand from data center development, including $1.7 billion of potential contracts being pursued, is creating incremental, higher-margin project opportunities across site prep, power generation, utility, and fiber network services. This is likely to lift future revenues and segment profitability. Operational execution, improved productivity, and a favorable project mix in core segments (especially Utilities) are driving company-wide gross margin improvement and improved cash conversion, structurally enhancing Primoris's earnings and free cash flow profile.

Want to know the blueprint fueling this valuation? The future value leans on bold assumptions about margins, explosive revenue drivers, and multi-year booking tailwinds. Ready to see which profit metrics justify the bold price target? Unlock the full narrative to see what sets this story apart.

Result: Fair Value of $130.11 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Intense competition for data center and renewables projects, as well as delays in utility sector awards, could challenge the bullish outlook.

Find out about the key risks to this Primoris Services narrative.

Another View: What Do the Multiples Say?

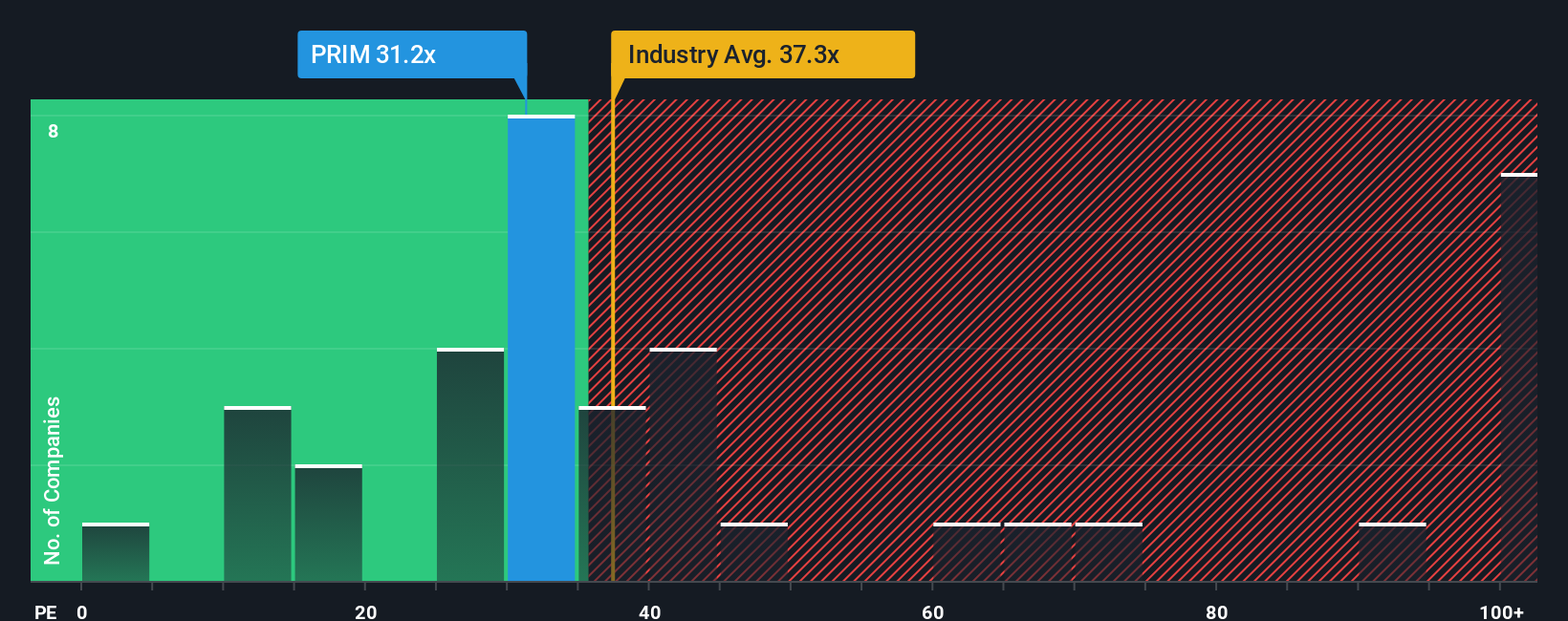

Looking at it from another angle, Primoris Services trades at a price-to-earnings ratio of 30.6x. That is cheaper than both the US Construction industry average (35.6x) and its peer group (39.1x), and close to its fair ratio of 31.1x. This suggests that, even after the recent surge, the shares are not especially stretched compared to the wider market. Could this imply there is limited risk left, or just not much more room to run?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Primoris Services Narrative

If you think the consensus misses the mark, or want to dig deeper into the numbers yourself, you can craft a fresh narrative in just minutes, your way. Do it your way.

A great starting point for your Primoris Services research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Don't wait for the next headline to take action. Level up your watchlist with fresh investment themes and companies poised for their next big move using the Simply Wall Street Screener.

- Uncover early movers with explosive growth trajectories among these 3578 penny stocks with strong financials, giving you a head start before the crowd catches up.

- Tap into tomorrow’s breakthroughs and turbocharge your portfolio by investigating these 25 AI penny stocks focused on artificial intelligence innovation.

- Capture hidden value and robust cash flow potential by reviewing these 893 undervalued stocks based on cash flows, where solid fundamentals meet attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRIM

Primoris Services

Provides infrastructure services primarily in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives