- United States

- /

- Capital Markets

- /

- NYSE:VRTS

3 Dividend Stocks To Consider With Yields Up To 6.4%

Reviewed by Simply Wall St

The United States market has shown a positive trend, rising 1.5% over the past week and 12% over the last year, with earnings projected to grow by 14% annually in the coming years. In this environment, dividend stocks with attractive yields can offer investors a way to potentially benefit from both income and capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.92% | ★★★★★☆ |

| Universal (UVV) | 5.39% | ★★★★★★ |

| Southside Bancshares (SBSI) | 5.05% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.75% | ★★★★★★ |

| Ennis (EBF) | 5.36% | ★★★★★★ |

| Dillard's (DDS) | 6.45% | ★★★★★★ |

| CompX International (CIX) | 5.01% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.00% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.97% | ★★★★★☆ |

| Chevron (CVX) | 4.86% | ★★★★★★ |

Click here to see the full list of 143 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

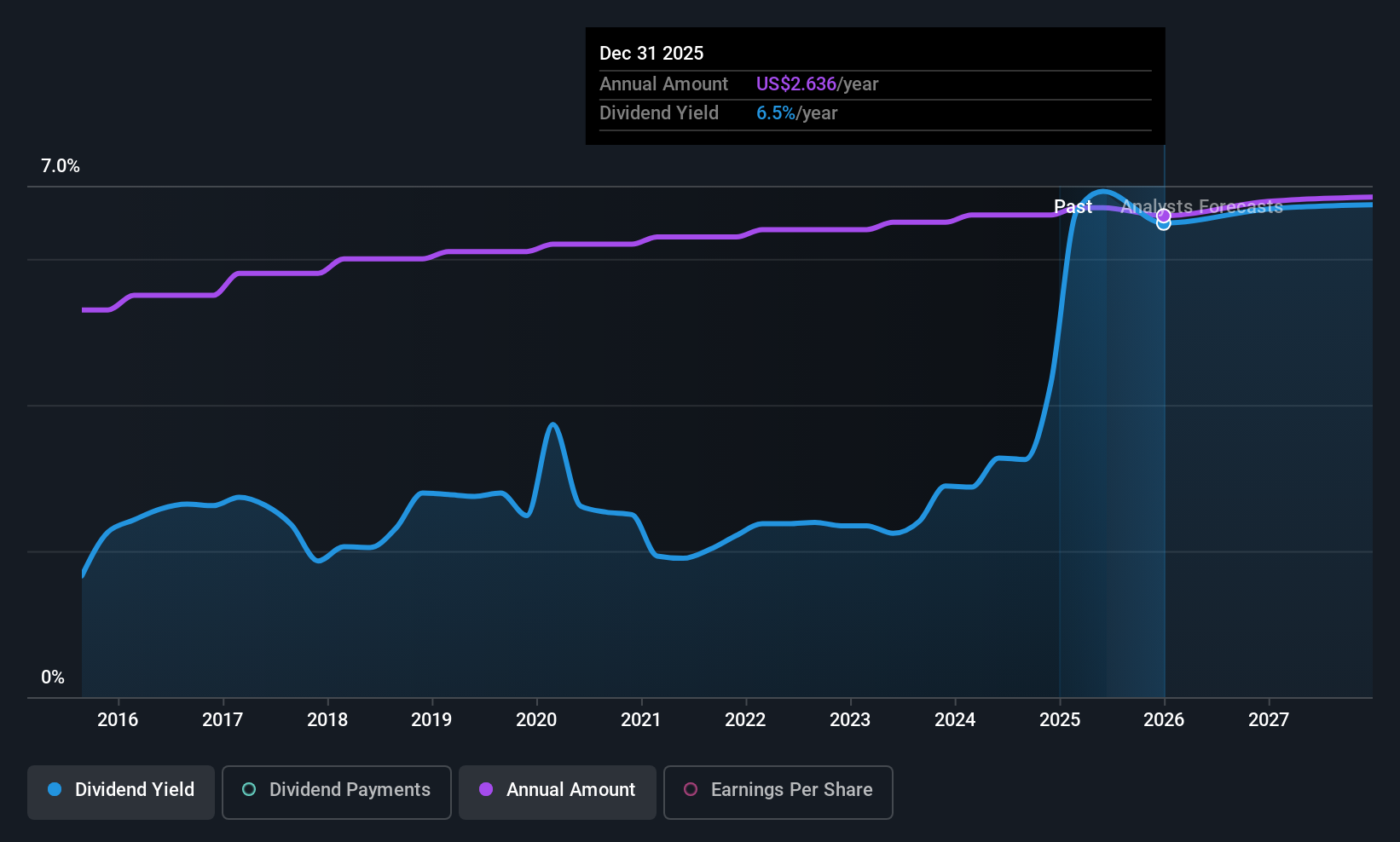

Polaris (PII)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Polaris Inc. designs, engineers, manufactures, and markets powersports vehicles across the United States, Canada, and internationally with a market cap of approximately $2.31 billion.

Operations: Polaris Inc.'s revenue is derived from its Marine segment at $472.80 million, On-Road segment at $932.40 million, and Off-Road segment at approximately $5.57 billion.

Dividend Yield: 6.4%

Polaris Inc. declared a quarterly dividend of $0.67 per share, reflecting its stable and reliable 10-year dividend history, although the high payout ratio of 372.5% suggests dividends are not well covered by earnings. Despite a top-tier yield of 6.44%, financial challenges include interest payments not being well-covered by earnings and declining profit margins from last year, raising concerns about long-term sustainability despite positive cash flow coverage at an 89.2% payout ratio.

- Click to explore a detailed breakdown of our findings in Polaris' dividend report.

- Upon reviewing our latest valuation report, Polaris' share price might be too optimistic.

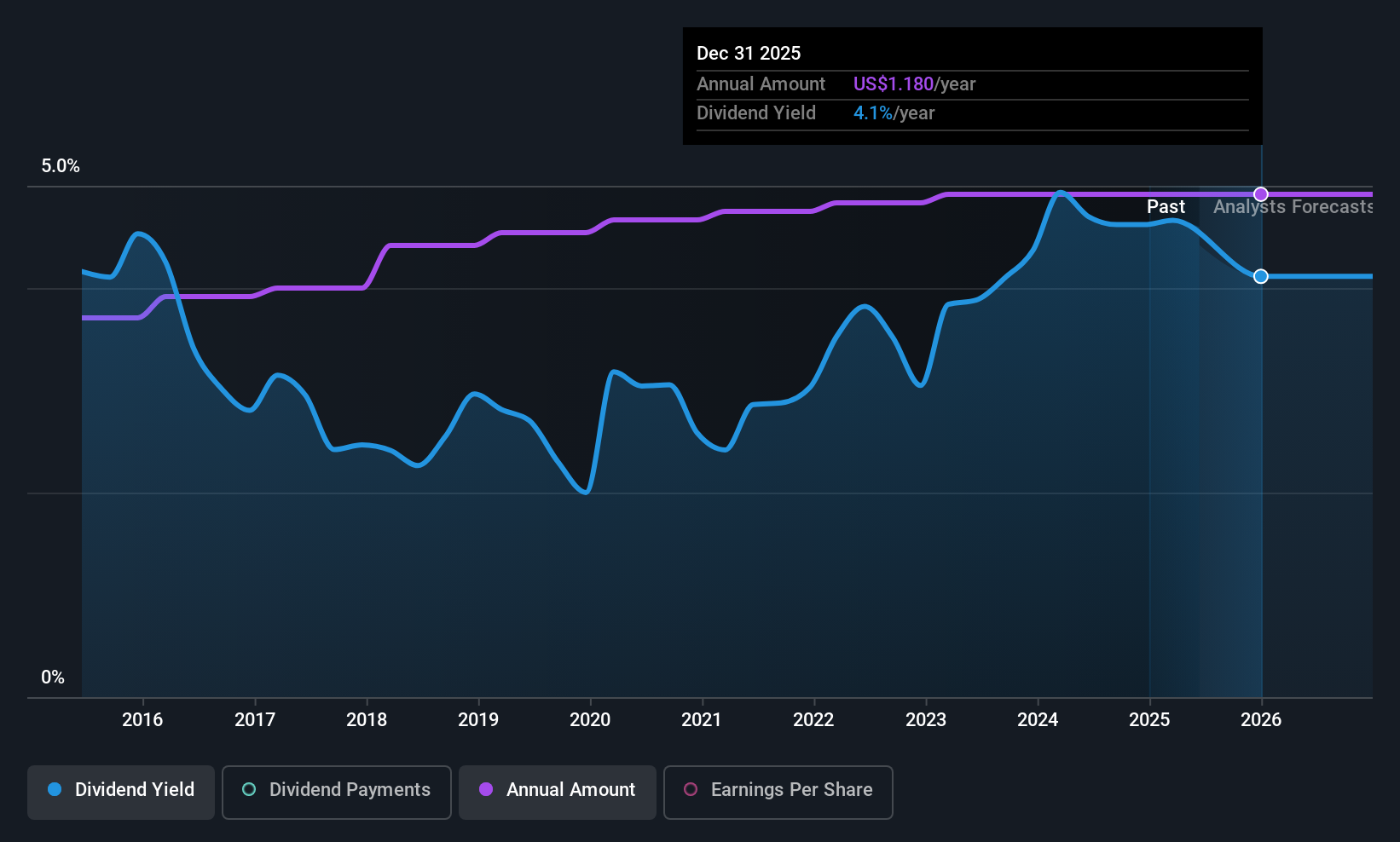

Douglas Dynamics (PLOW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Douglas Dynamics, Inc. is a North American manufacturer and upfitter of commercial work truck attachments and equipment with a market cap of $645.45 million.

Operations: Douglas Dynamics generates its revenue from two primary segments: Work Truck Solutions, contributing $319.29 million, and Work Truck Attachments, adding $268.63 million.

Dividend Yield: 4.1%

Douglas Dynamics declared a quarterly dividend of $0.295 per share, maintaining its stable 10-year dividend history. Despite a high debt level, dividends are well-covered by earnings and cash flows with payout ratios of 42.7% and 51.9%, respectively. Earnings grew significantly over the past year, but future declines are expected. The company trades below fair value estimates; however, its dividend yield of 4.14% is lower than the top quartile in the US market at 4.7%.

- Dive into the specifics of Douglas Dynamics here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Douglas Dynamics is trading behind its estimated value.

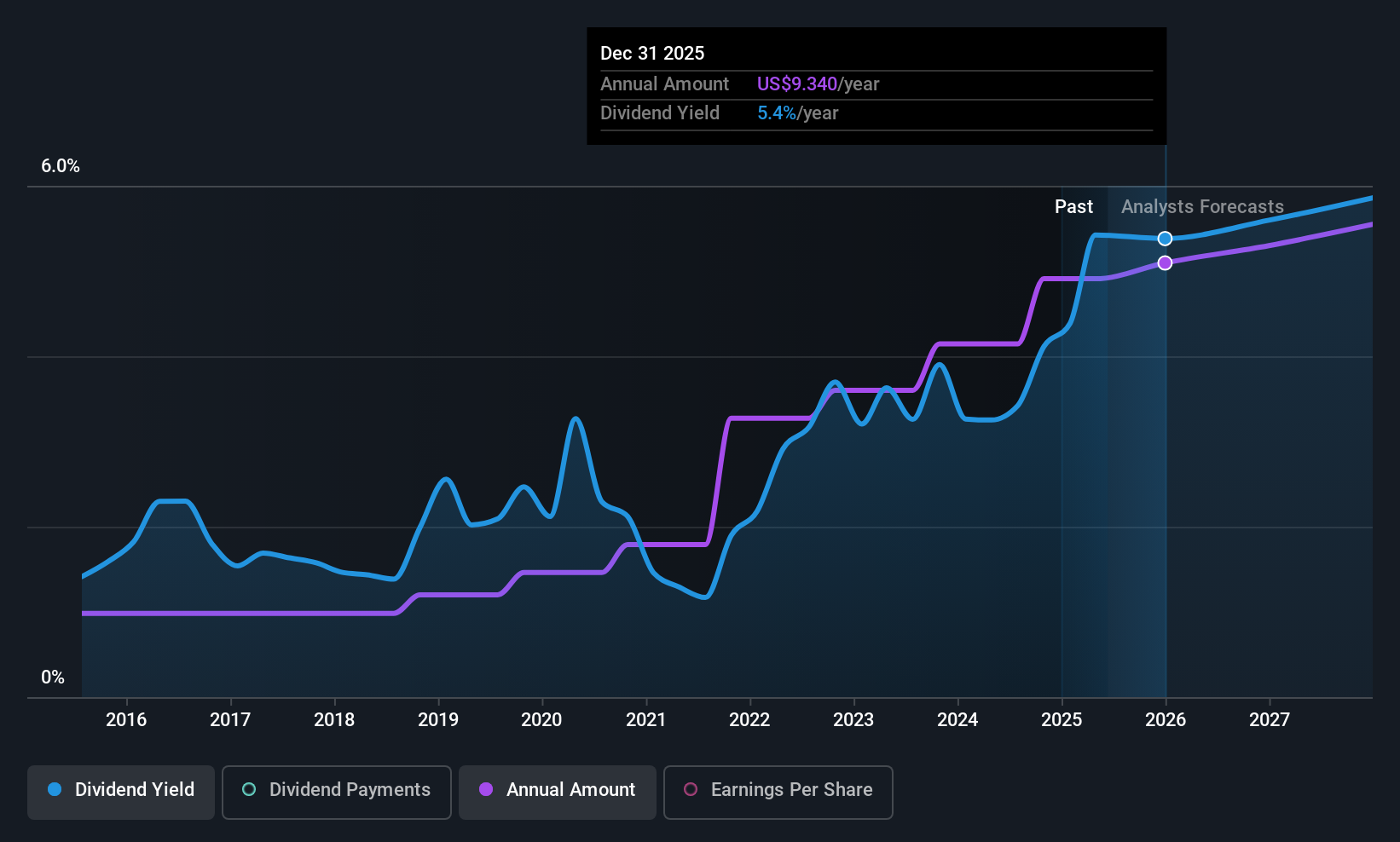

Virtus Investment Partners (VRTS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Virtus Investment Partners, Inc. is a publicly owned investment manager with a market cap of $1.18 billion.

Operations: Virtus Investment Partners generates revenue primarily from its asset management services, amounting to $902.84 million.

Dividend Yield: 5.1%

Virtus Investment Partners offers a dividend yield of 5.14%, ranking in the top 25% of US payers, but its sustainability is questionable due to a high cash payout ratio of 240.6%. Despite stable and growing dividends over the past decade, they are not well covered by free cash flows. The company recently declared a quarterly dividend of $2.25 per share and trades at a discount to estimated fair value, though revenue and net income have slightly declined year-over-year.

- Unlock comprehensive insights into our analysis of Virtus Investment Partners stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Virtus Investment Partners shares in the market.

Seize The Opportunity

- Access the full spectrum of 143 Top US Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRTS

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives