- United States

- /

- Machinery

- /

- NYSE:OSK

Oshkosh's (NYSE:OSK) 11% CAGR outpaced the company's earnings growth over the same five-year period

It hasn't been the best quarter for Oshkosh Corporation (NYSE:OSK) shareholders, since the share price has fallen 12% in that time. On the bright side the share price is up over the last half decade. Unfortunately its return of 56% is below the market return of 80%.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

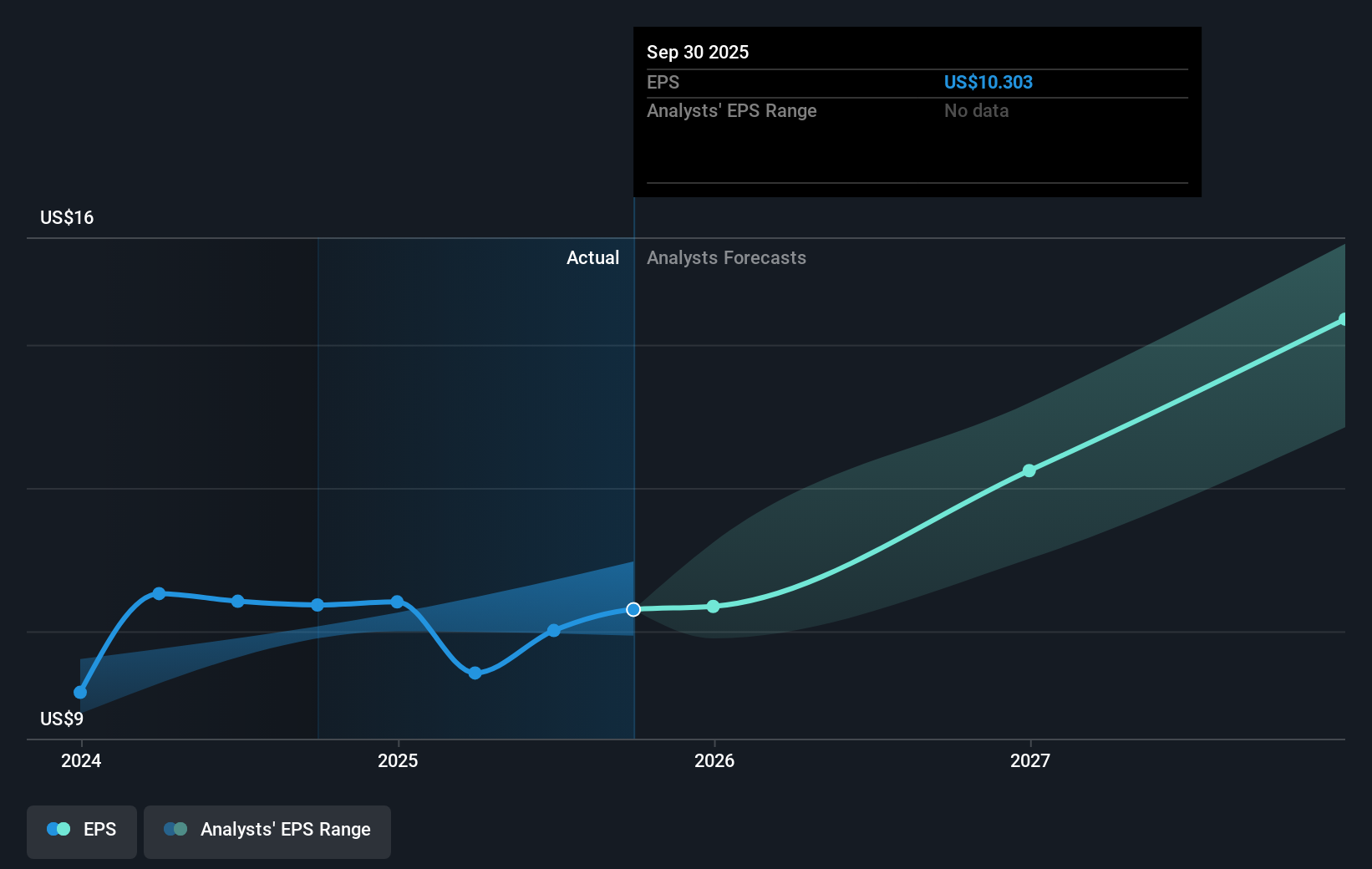

Over half a decade, Oshkosh managed to grow its earnings per share at 17% a year. The EPS growth is more impressive than the yearly share price gain of 9% over the same period. So one could conclude that the broader market has become more cautious towards the stock. This cautious sentiment is reflected in its (fairly low) P/E ratio of 11.89.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Oshkosh has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Oshkosh's financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Oshkosh, it has a TSR of 69% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Oshkosh's TSR for the year was broadly in line with the market average, at 12%. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 11%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. If you would like to research Oshkosh in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OSK

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.